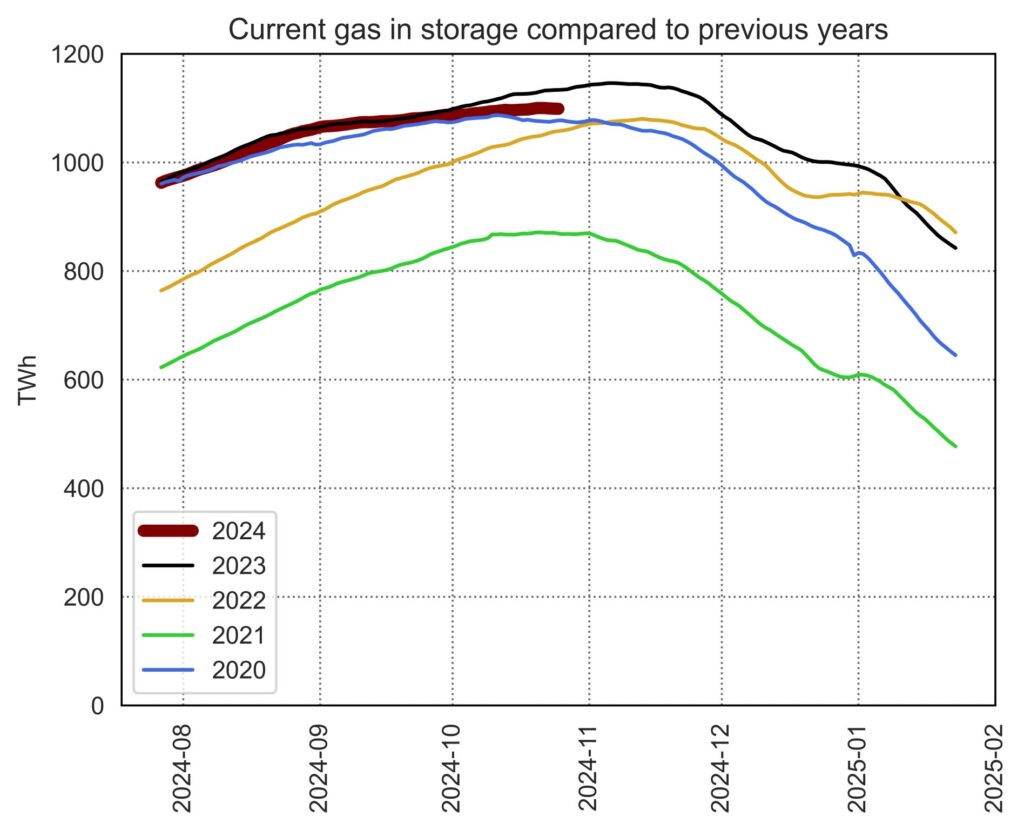

Europe is entering the winter season with volume in storage equal to ca. 96% of total capacity. To this must be added the lower volumes injected into Ukrainian storage facilities, which adds another ca. 40TWh to the total shortfall (equivalent to 4% of total EU storage capacity).

While this is below the record-high levels seen last year, this is mostly due to October not having seen demand as low as it was in 2023 and is overall unlikely to significantly affect the market’s ability to meet winter demand.

Price volatility at this time of the year has become the norm over the past three years, as this is the point of highest uncertainty on the outcome for winter demand.

While nervousness is to be expected in the market, it is however important to remember that overall the European gas market is not approaching the winter in a materially worse position compared to last year. This is despite significantly lower LNG imports in the year to date, which were in part enabled by a continued reduction in total demand.

While some reports indicate a potentially colder November, it is also useful to point out that last year also saw unseasonably high demand between November and December and then again in January, without materially affecting the overall balance of the market over the winter season.

Source: Giovanni Bettinelli