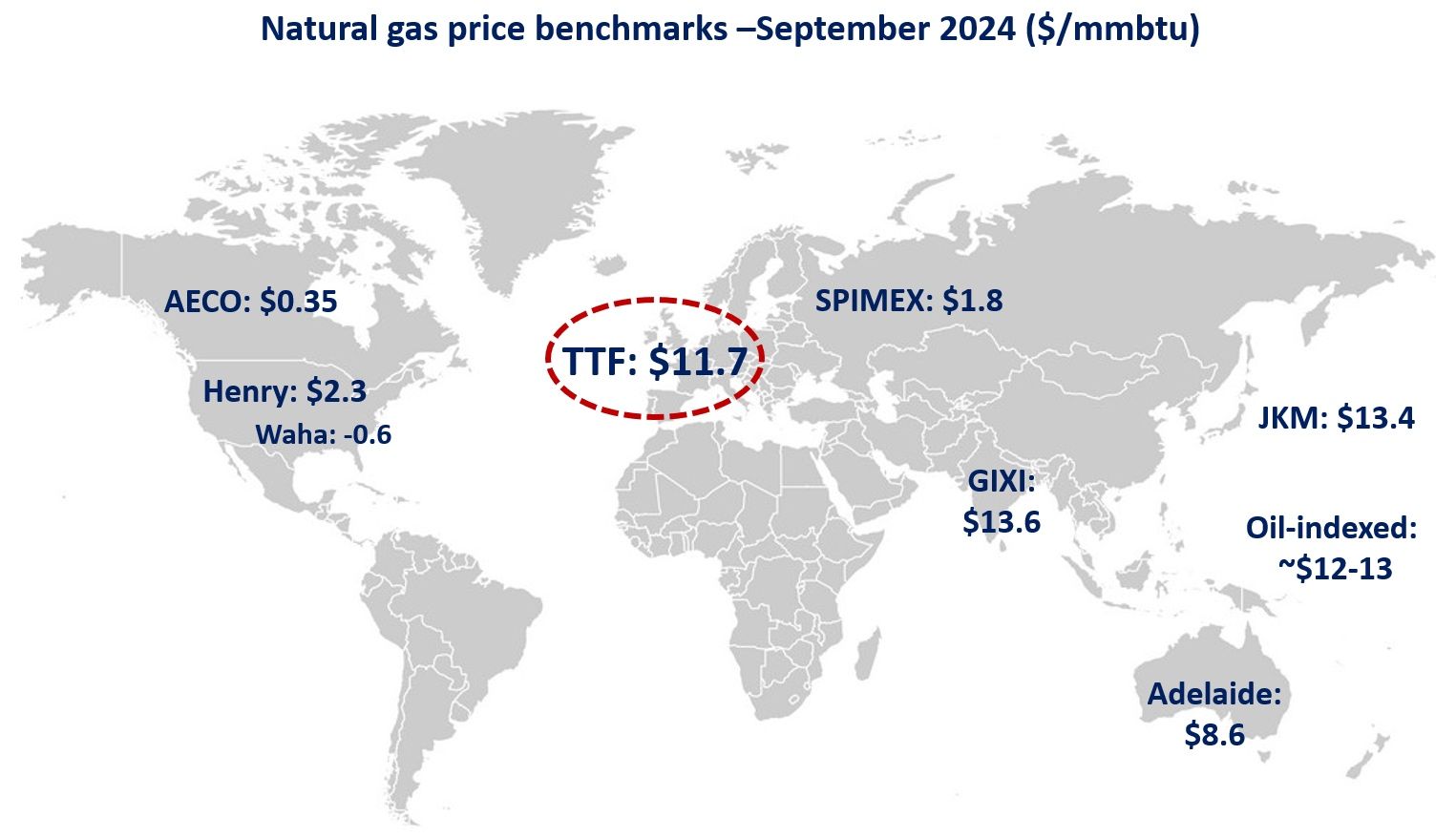

Gimme more: European gas prices averaged at a record high of $50/mmbtu in July, amidst further supply cuts via Nord Stream and growing market uncertainty.

Europe’s TTF jumped by over 55% month-on-month, with prices hitting over $60/mmbtu by the end of July.

This coincides with Russian pipeline flows plummeting down to just 3.5 bcm -their lowest level in the last two decades.

Gazprom’s renewed cuts via Nord Stream, to just 20% of the pipeline capacity, drives further market uncertainty and volatility.

$50/mmbtu is in many ways symbolic and it is also the threshold for synthetic methane production, i.e. when effectively it makes more sense to convert electricity to gas than the other way around…

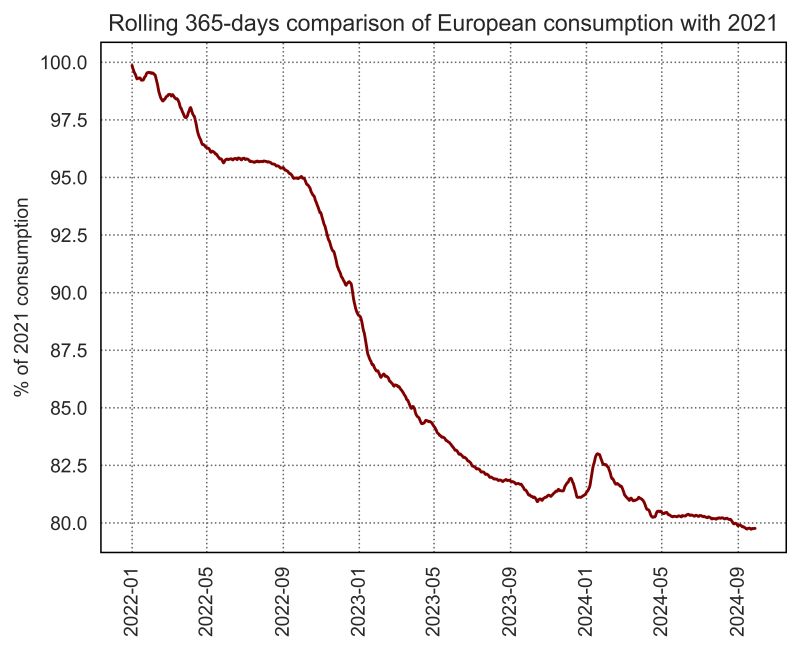

European demand meanwhile was down by just 8%, as gas burn received some push in the power sector, with July heatwaves weighing on nuclear and hydro output while driving up cooling demand.

In Asia, JKM prices followed TTF’s lead, up by 37% to $39/mmbtu.

This means that TTF’s premium averaged at a record of $10/mmbtu, on Europe’s growing thirst for every drop of LNG.

In Australia’s East Coast, gas prices remain at their record levels of $31/mmbtu.

The Market Operator has recently enacted the domestic gas supply guarantee mechanism, to be effective until the end of September.

In the US, Henry Hub prices averaged at $7.2/mmbtu -their highest July levels since 2008.

Heatwaves, strong cooling demand, low stocks (both gas and coal) continue to provide strong upward pressure on US gas prices -although many other regions would wish to have a gas price at just below $8/mmbtu…

What is your view? What is the summer outlook for gas prices? How will the current high gas price environment impact on the perception of gas and its future role in the energy system?

Source: Greg MOLNAR