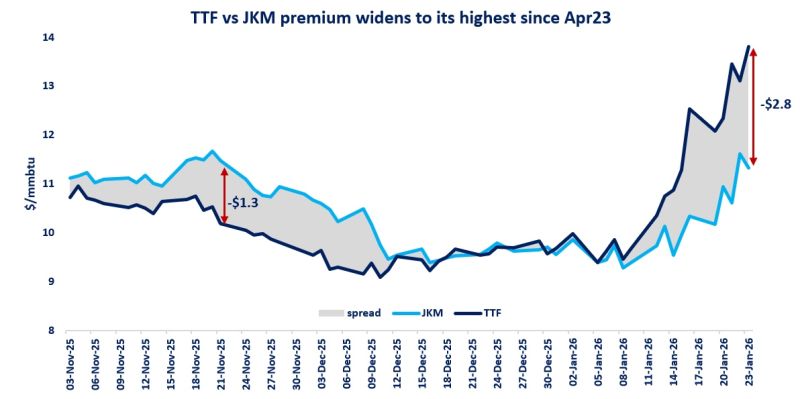

European gas prices were up overall yesterday as the weakness in Russian supply (stable yesterday at 104 mm cm/day on average, with Nord Stream 1 flows stabilizing at 68 mm cm/day) continued to dominate market sentiment. On their side, Norwegian flows increased slightly, averaging 329 mm cm/day on average, compared to 326 mm cm/day on Friday.

The rise in coal prices (+6.36% for API2 1st nearby prices, +4.42% for Cal 2023 prices), supported by the news that Germany looked to bring back idled coal plants, also provided support.

Note also that the Netherlands triggered yesterday the country’s gas crisis plan, the so-called “Gas Protection and Recovery Plan”, with the issuing of a first early warning notice due to the threat of reduced gas supplies after the drop in Russian deliveries. The early warning is the first of three crisis levels.

Moreover, the country announced that no wells at the giant Groningen gas field would be permanently closed in 2022 as originally planned. Instead, the field will be allowed to operate with a minimum production level of 2.8 Bcm for the new gas year that starts on 1 October (compared to 4.5 Bcm for the current gas year).

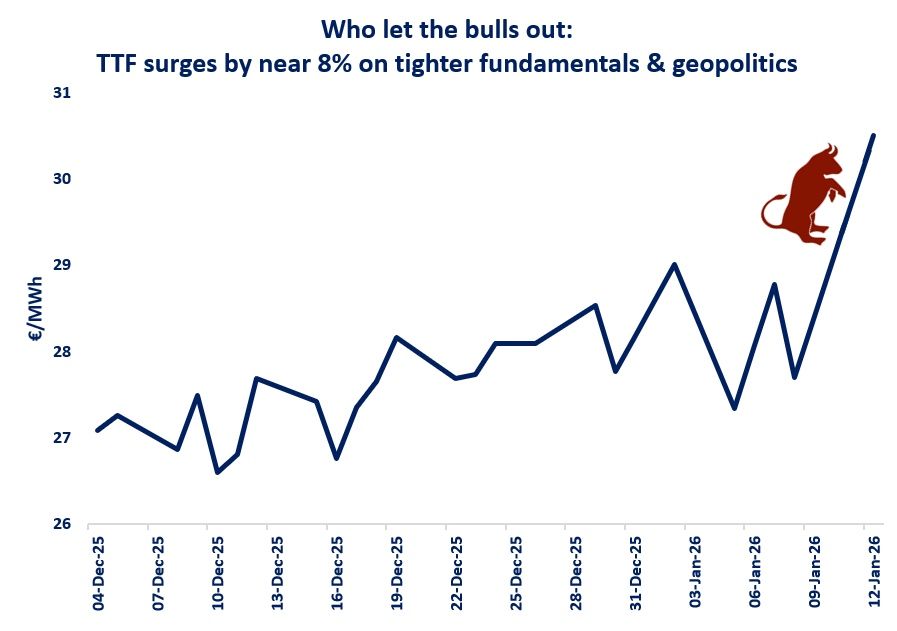

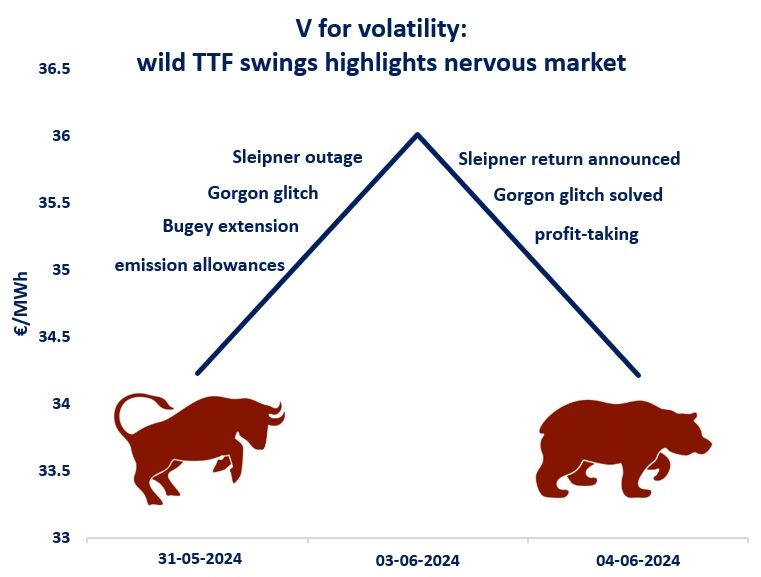

At the close, NBP ICE July 2022 prices dropped by 0.960 p/th (-0.48%), to 200.840 p/th, equivalent to €79.881/MWh. TTF ICE July 2022 prices were up by €2.889 (+2.45%), closing at €120.627/MWh. On the far curve, TTF ICE Cal 2023 prices increased by €2.242 (+2.60%), closing at €88.324/MWh.

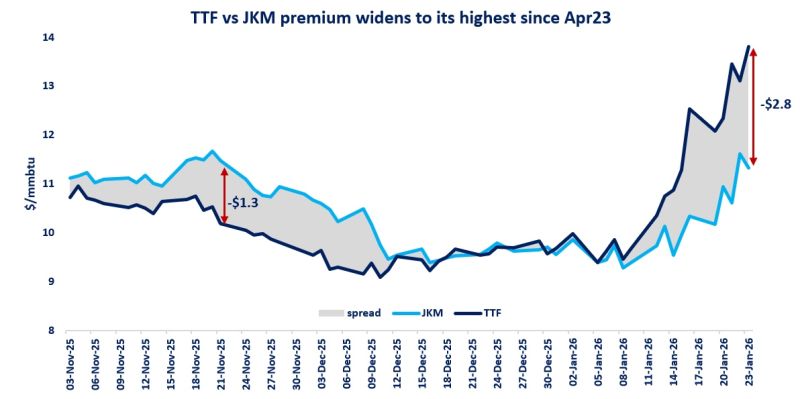

In Asia, JKM spot prices dropped by 4.86%, to €117.047/MWh.

TTF 1st nearby prices closed yesterday below the 5-day High. As a reminder, the “normal” price trajectory requires the 5-day range to lay inside the 20-day range. This means that the 5-day High is currently too high and the 20-day High too low. Prices should therefore be within these two levels.

That’s exactly what they are doing this morning. In the absence of additional decisive fundamental event, the “normalization” process could continue gradually.

Source: EnergyScan