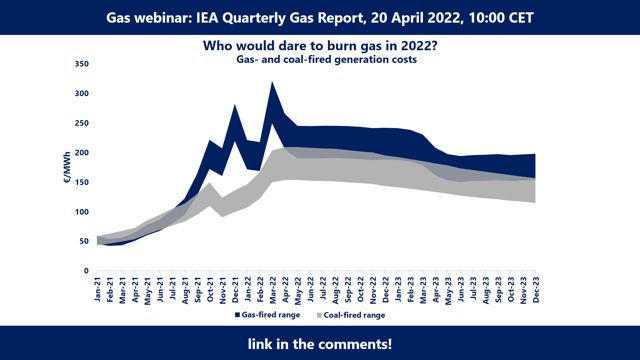

Who would dare to burn gas this year? despite the record high prices, gas-fired power generation in Europe remained resilient during the heating season, even increasing by a mere 1% yoy.

Several factors contributed to this:

(1) gas-fired generation is less flexible during the winter due to must-run CHP plants;

(2) the steep drop in hydro generation (-20%) occurred in southern European markets (Italy, Spain) with limited remaining coal-fired generation, leading to higher gas burn;

(3) low nuclear output in France during Q1 provided additional market space both to coal- and gas-fired generation;

(4) coal-fired facing logistical constraints is further limiting gas-to-coal switching in certain markets.

In our short-term forecast we foresee a greater demand response over the summer season, leading to a 5% drop in European gas burn for 2022.

What is your view? how will European gas demand and gas-fired power generation react to the record high prices? what are the up and downside risks?

join us tomorrow at 10am CET at our traditional gas webinar!

Source: Greg Molnar (LinkedIn)