Spot gas prices in Europe have fallen around 35% since the start of winter. 2024 forward prices in Europe (e.g. TTF) and Asian (e.g. JKM) have fallen by a similar magnitude.

This article by Timera Energy sets out what is happening and why.

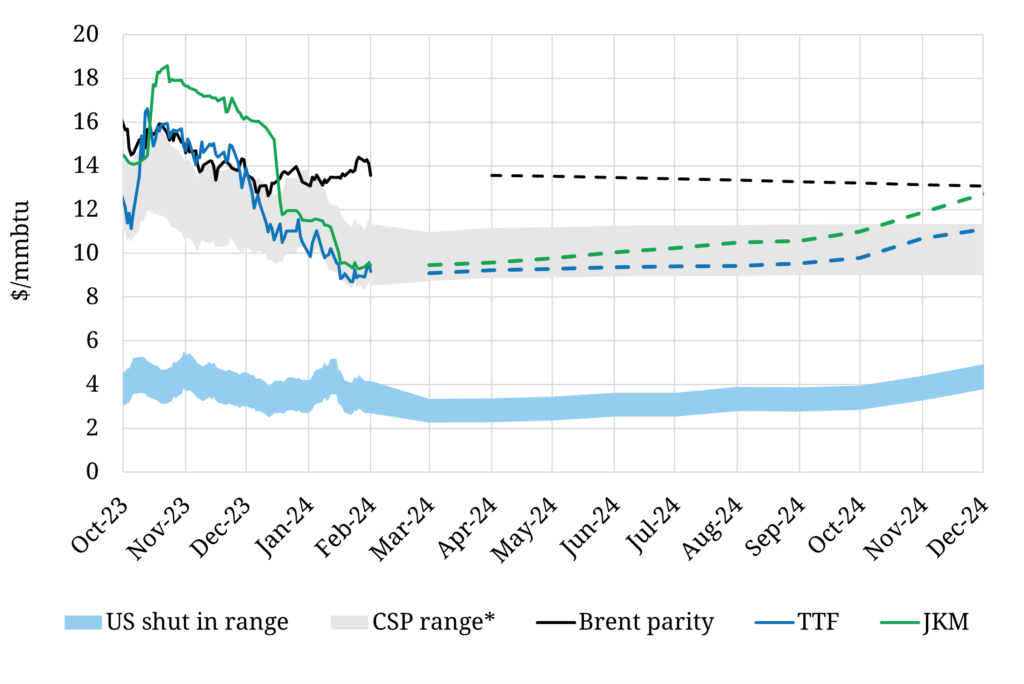

Chart 1 summarises key spot gas & oil price benchmarks (TTF, JKM, Brent parity) showing:

1. How front month spot prices have evolved since the start of winter (i.e from Oct 1st 2023 to Jan 31st 2024)

2. Recent forward curves, coal switching price (CSP) range & US LNG ‘shut in’ range

Chart 1: Winter spot price evolution & current forward price benchmarks

Source: Timera Energy, ICE, CME, Spark Commodities (forward prices from 01/02/24); *CSP = Indicative switching channel for 50-52 % efficient gas plants vs 38-45% efficient coal plants

The key drivers behind falling prices have been a mild winter, ongoing demand weakness and a decline in coal & carbon prices which set power sector switching range levels.

The forward market is pricing in a lower CSP range through 2024 consistent with lower coal & carbon forwards. A mild European winter has also left a large storage inventory overhang that has pushed 2024 forward prices below 2025 levels.

To better understand these price moves let’s have a look at the gas and LNG market supply & demand balance.

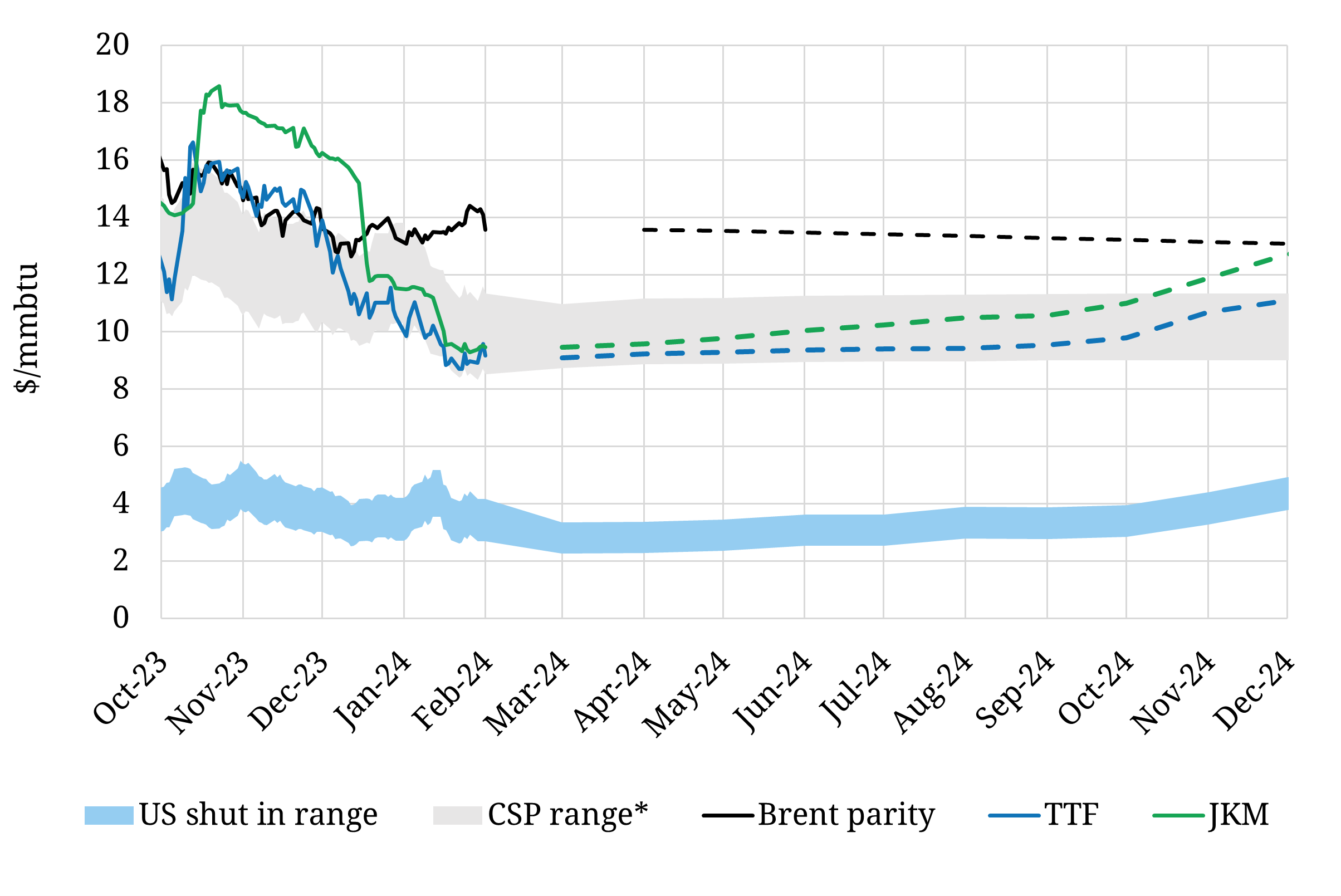

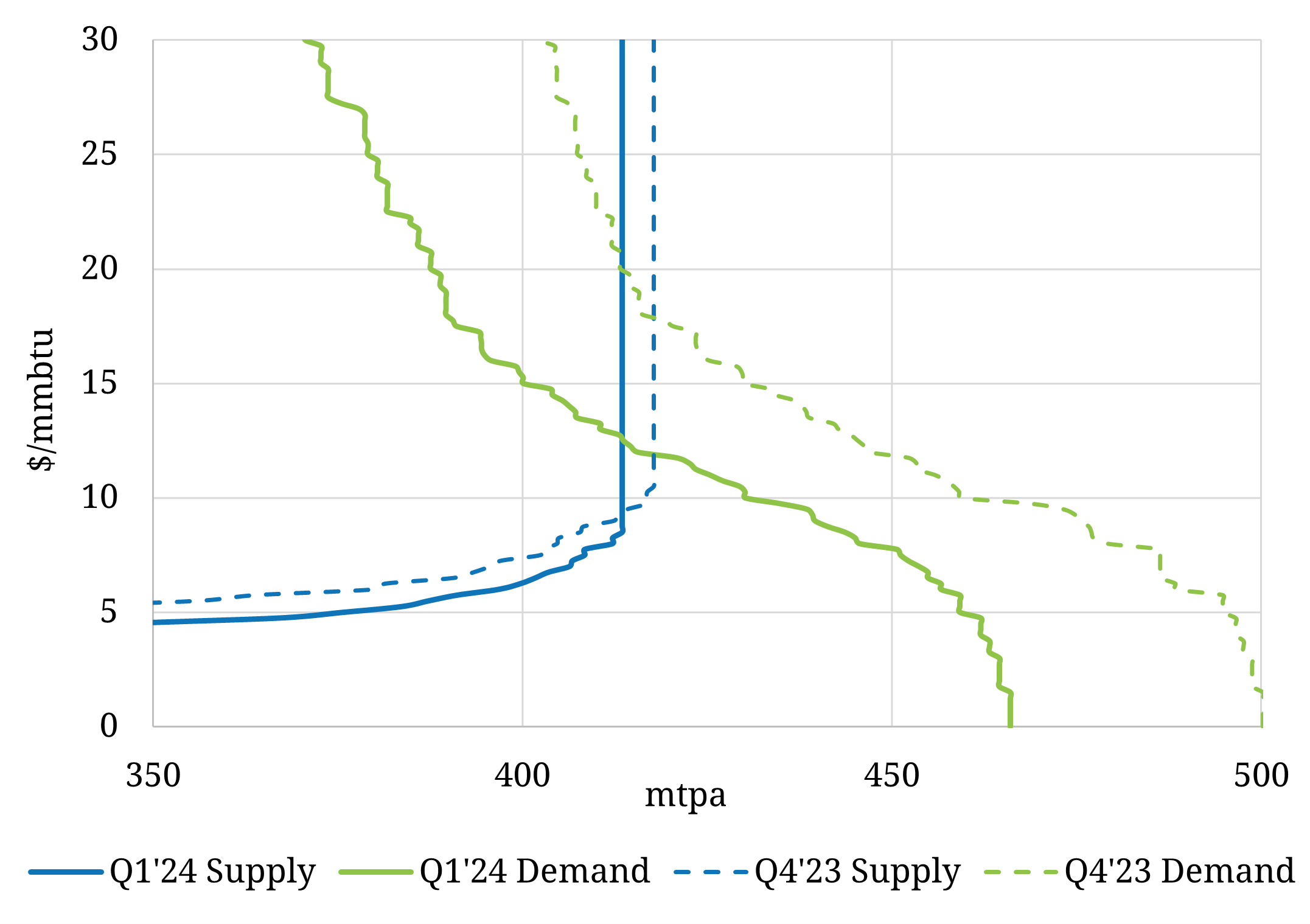

Chart 2 shows the current supply & demand balance in the global gas market.

We define the global market as the aggregate of supply & demand in the LNG market and the European gas market. We include the onshore European gas market as it is a key provider of flex to the global LNG market and has an important influence on global marginal pricing dynamics.

Chart 2: Shift in 2024 supply & demand balance since Oct 2023

Source: Timera Energy

Analysis of the aggregate supply & demand balance as show in Chart 2, is one of the core elements from our global gas modelling that we incorporate in our quarterly gas service. It provides a powerful insight into marginal pricing dynamics and how these change as the supply & demand balance shifts.

The chart shows several important shifts in global balance and pricing:

1. Shift left volumetrically in the demand curve (green curve), driven by

2. Shift down in the demand curve (green curve), driven by:

3. Minor supply curve (blue curve) shift

The combination of these moves in supply & demand have driven marginal prices down sharply since the start of winter, with the demand curve shift the dominant driver.

In the winter gas outlook we published in Q3 2023 we finished with a section titled ‘time to show a respect for uncertainty’. Our key points were:

Our latest global gas modelling shows a fundamental balance consistent with TTF & JKM prices being around ~20% higher than current levels – you can see this in Chart 2 where the intersection of supply & demand curves is around 12 $/mmbtu (vs current forward prices just below 10 $/mmbtu).

More interesting than the absolute level of projected prices, is the data we get from the model on the sensitivity of global prices to shifts in supply & demand balance. That is something we’ll come back to in a future article, but the current set up points to more volatility ahead.

Source: Timera Energy