The European gas market is facing a paradox: LNG-dependent even as demand steadily declines. The IEA’s World Energy Outlook 2025 points to European consumption falling by roughly a quarter by 2030 versus pre-crisis levels, driven by efficiency, electrification and rapid renewable deployment.

Yet Europe will continue to rely on LNG for flexibility and winter balancing as domestic output wanes and Russian pipeline flows diminish.

Globally, the IEA expects natural gas demand to rise by ~20% by 2035 and ~30% by 2050, led almost entirely by Asia Pacific and the Middle East.

Europe therefore becomes a smaller share of global trade even while remaining a pivotal LNG buyer for system security.

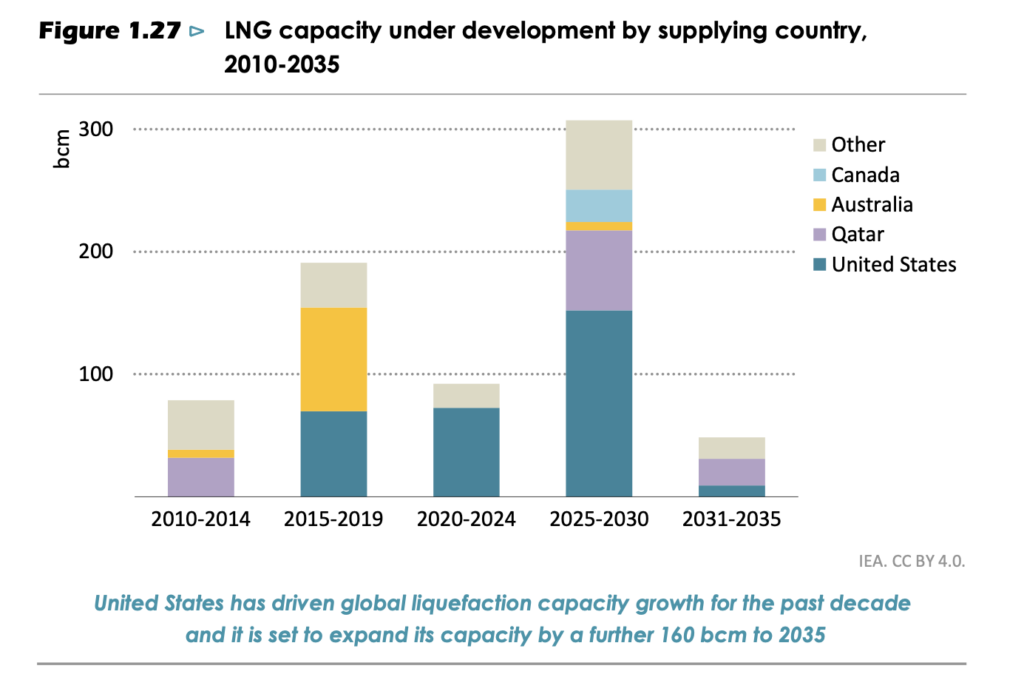

The next supply wave is already locked in: the United States and Qatar lead a surge in liquefaction capacity to the early 2030s, intensifying competition and reshaping price dynamics.

Energy analyst Anne-Sophie Corbeau highlights several market signals from WEO 2025: LNG export capacity no longer peaks around 2030 but plateaus closer to 2032 after recent FIDs; the previously expected surplus narrows sharply in the STEPS scenario (about 65 bcm spare in 2030, gone by 2035); and utilisation risk concentrates in US portfolio positions.

She also notes that in the CPS scenario the EU is the largest source of incremental LNG demand over 2024–2035—outpacing China and Southeast Asia—even as overall European demand trends down.

Price expectations matter too: STEPS implies European hub prices near $6.5/mmBtu by 2035, with additional demand unlocked only if delivered prices approach $5/mmBtu in price-sensitive markets.

Taken together, Europe’s gas transition looks “lower-volume, higher-complexity”: declining baseload gas burn, persistent LNG dependence for flexibility, and tighter linkage to global spot dynamics.

For market participants, that means renewed focus on: (1) contract flexibility and destination optionality, (2) storage and system resilience, and (3) price competitiveness as the US–Qatar capacity wave rolls through the early 2030s.

That’s the European gas market paradox—smaller in volume, still central to security.

Source: International Energy Agency – World Energy Outlook 2025

Commentary based on public LinkedIn post by Anne-Sophie Corbeau (Center on Global Energy Policy)