Getting tight: TTF MA breached the $10/mmbtu mark this week, whilst JKM spot prices are now nearing $12/mmbtu, their highest level for July delivery since 2013 and 2014 respectively.

How did we get there? A number of short-term supply-demand factors are at play:

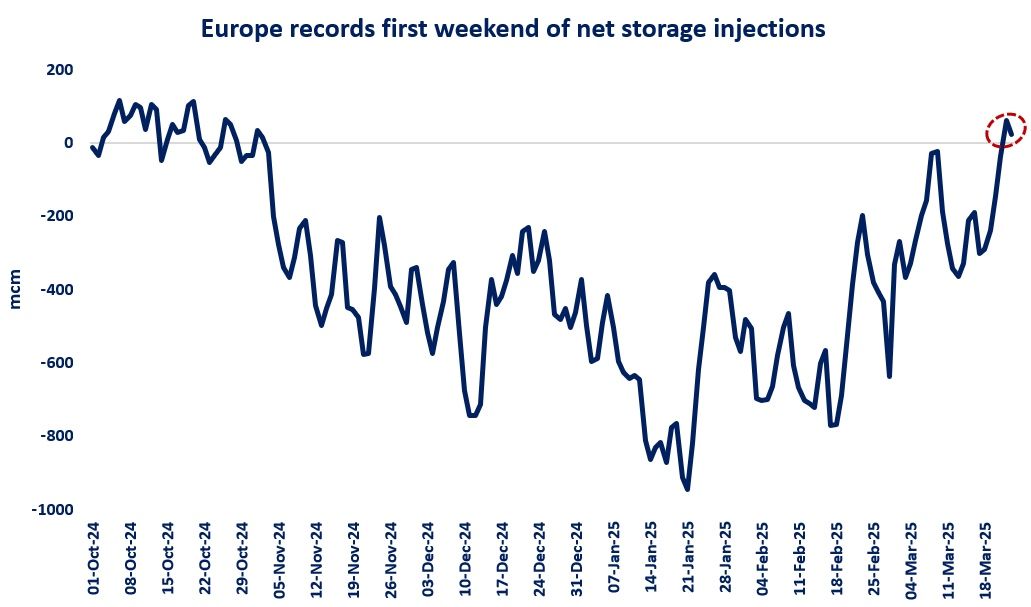

1. Cold spring temperatures in Europe exacerbated the region’s storage deficit: we are now 25% below 5-y average, indicating higher injection needs and firming up summer gas;

2. Delayed maintenance due to covid in 2020 is weighing on summer supply both piped and LNG (e.g. Norway, Gorgon, Ichthys) which together with unexpected outages and lower feedgas availability (Trinidad&Tobago) is leading to lower than expected gas volumes;

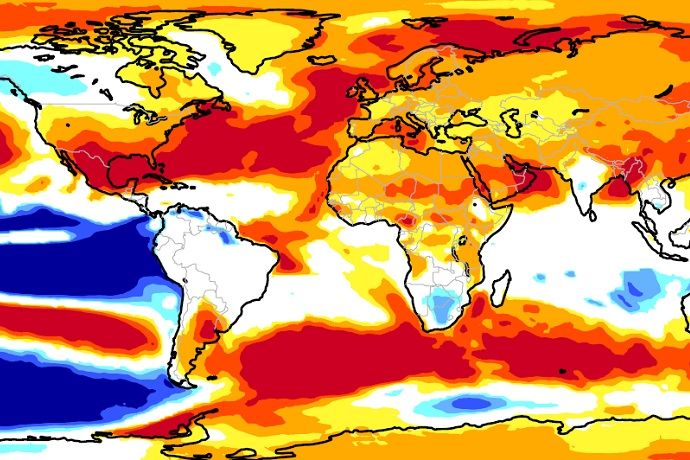

3. Summer heat and dry hydro year: with CDDs in the Asia Pacific region edging up and hydro generation drying up (e.g. down by 26% in Guangdong, China) LNG imports are likely to receive an additional boost;

4. Commodities inter-play: the strong growth in coal and carbon prices is further supporting gas prices through switching levels in the power sector.

The key question is how structural is the current market tightening? The forward curve suggests, that gas prices are set to average ~30% below current spot prices through the medium-term, 2022-24, as gas supply availability improves.

What is your view? How will prices evolve this summer? How long will the market remain tight? Any implications for the heating season?

Source: Greg Molnar

See original post by Greg at LinkedIn.