Don’t be a fool, keep your storage full: while EU storage levels bring some comfort, the winter is about to start, and the challenge will be to keep storages as full as possible…

Gas storage is in many ways the backbone of gas supply security: it is relatively close to demand centers, reactive and available under short notice.

Gas storage can cover up to 40% of EU+UK gas demand in a cold, winter day.

Its importance will be even crucial this time when Russia’s political regime is using gas as an economic weapon, and a full stop of Russian gas supplies cannot be excluded ahead of winter.

So why it is crucial to keep gas storages as full as possible this winter?

For two reasons:

(1) the reactivity of storage sites declines when they are less full: withdrawal rates typically start to drop sharply once storage sites are less than 30-20% full. hence they become less reactive to demand spikes;

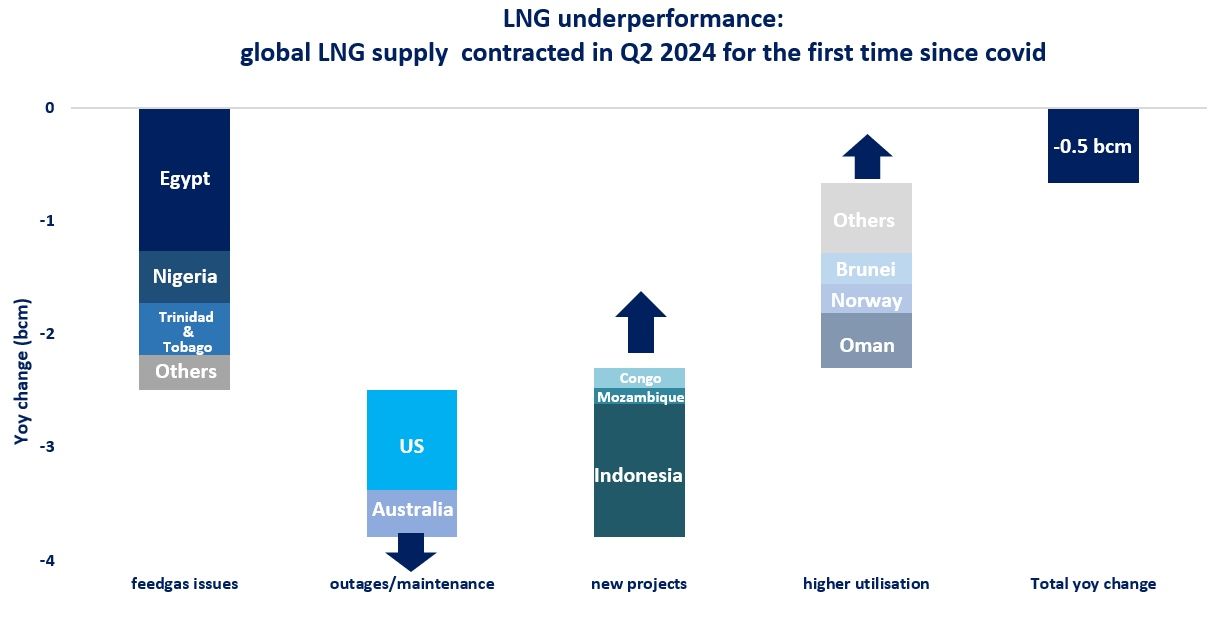

(2) depleting storages will make refilling them next summer more difficult, further tightening the 2023 market -a year with even lower Russian supplies and very limited LNG liquefaction capacity additions.

The scheme below shows the result of our simulations, indicating that we need to keep storage levels at least one-third full to sustain the double-shock of a full Russian supply cut and a late cold spell at the end of Feb22.

Storage levels above 45% would be necessary to reduce injections needs for the summer 2023, which could help to ease some of the market tensions.

Keeping storages as full as possible will be the winter for all of us, policy makers, the industry and responsible consumers.

What is your view? How will storage withdrawals evolve this winter? What action can policy makers take to reduce the pull on storage?

Source: Greg Molnar (LinkedIn)