(Yakov Grabar) Lower supply, higher demand. Together, these developments have shaped the landscape of European gas market in August.

Prices on hubs are ending the month with a strong growth but there is a more important effect generated by the combination of heatwave, limited LNG imports and Norwegian maintenance.

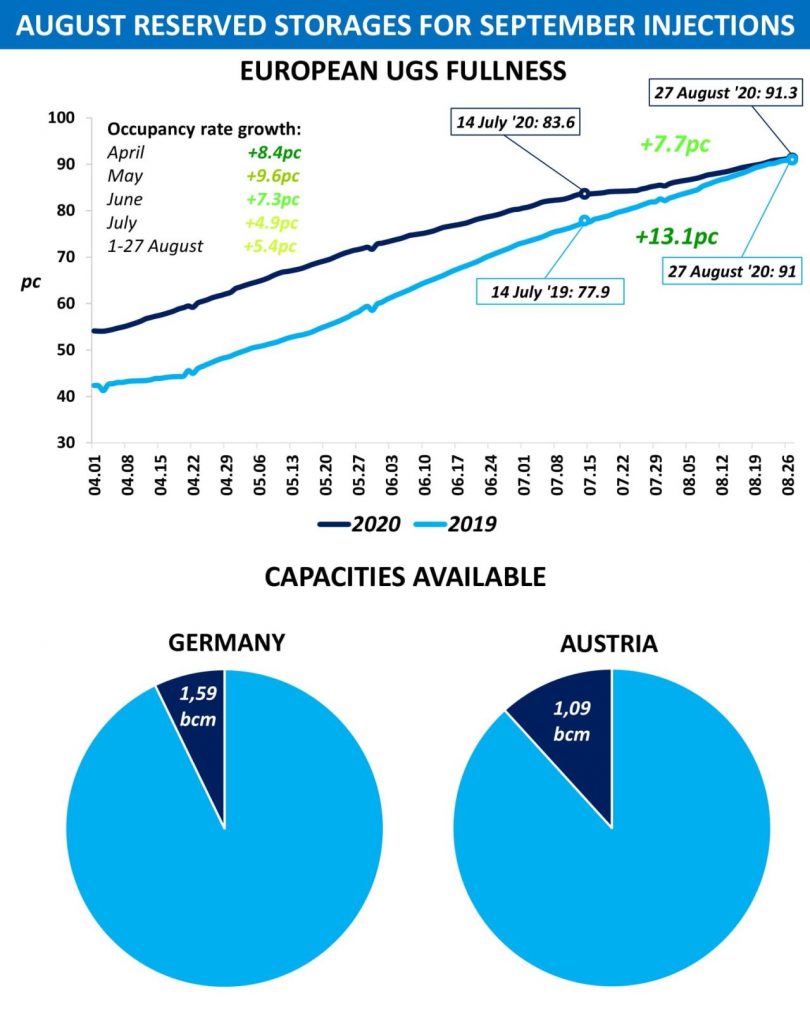

The fact is that August has left enough capacities unfilled for next month’s injections. Average fullness of the UGS in Europe is almost equal now to the same period of 2019, while the figure was higher by more than 3pc YoY in late July. Country-level data is even more illustrative as Germany and Austria can provide traders with some 2.6bcm of free space in September.

The storage issue is of significance not only because Europe is entering the final phase of injection season, but also because of a strong need for additional flexibility in the coming weeks. Capacities are required to accommodate more LNG expected next month in the region, particularly given the low base of July – August arrivals. The access to Ukrainian capacities will be seriously limited due to the outage on Budince interconnector.

Reason enough to thank August for delivering much needed relief to the oversupplied market 🙂

Connect with Yakov Grabar on LinkedIn