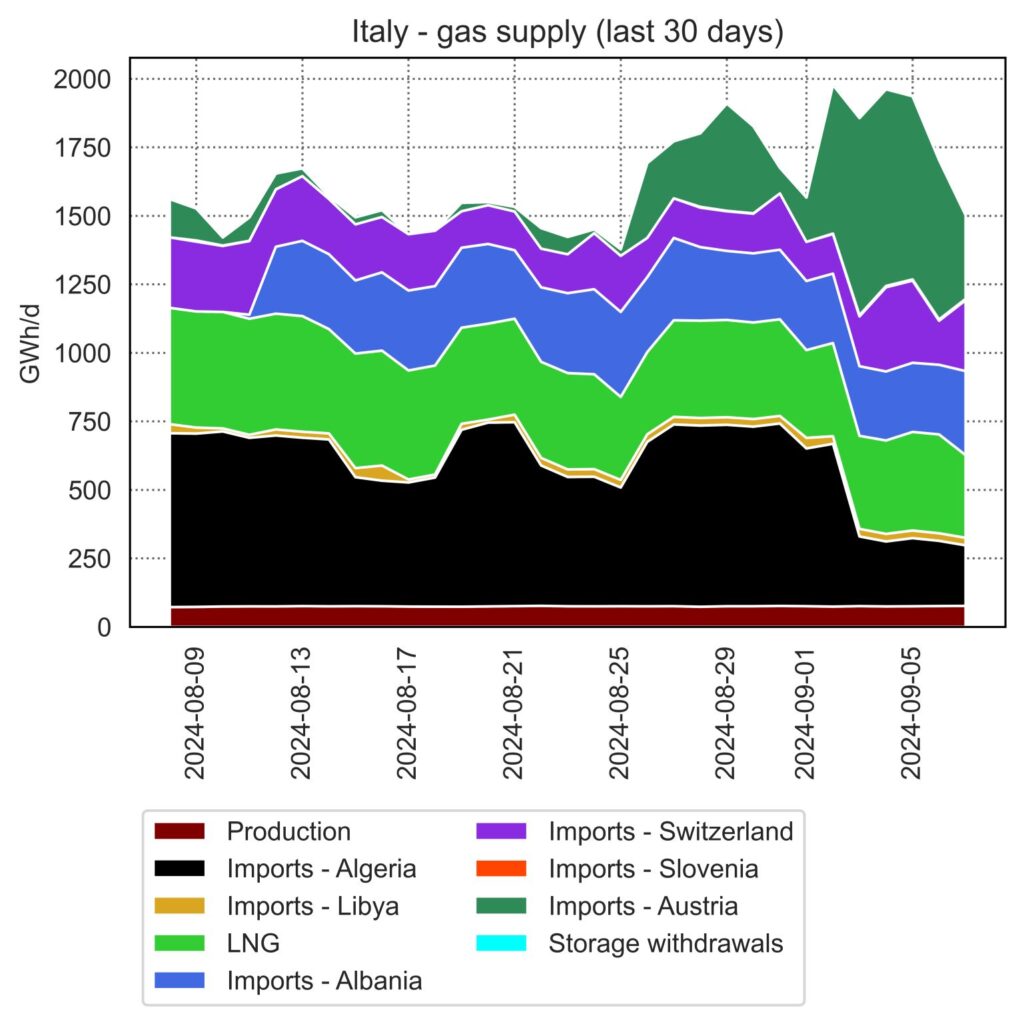

Italian gas demand has continued to grow last week, just as Algerian exports were cut by more than half due to maintenance.

The result has been a significant increase in imports from Austria, which drew gas from storage to meet this demand from Italy.

This is nothing especially worrying or unexpected, with more than enough time still available to completely fill storage capacity across the EU ahead of winter, but an increase in flows from Germany to Austria can be expected to make up these volumes, once Norwegian maintenance is over.

This shows again the level of resilience given to the market by very high storage levels, which have enabled withstanding contemporaneous outages in two of the largest supply sources without significant disruptions or changes to the outlook ahead of winter.

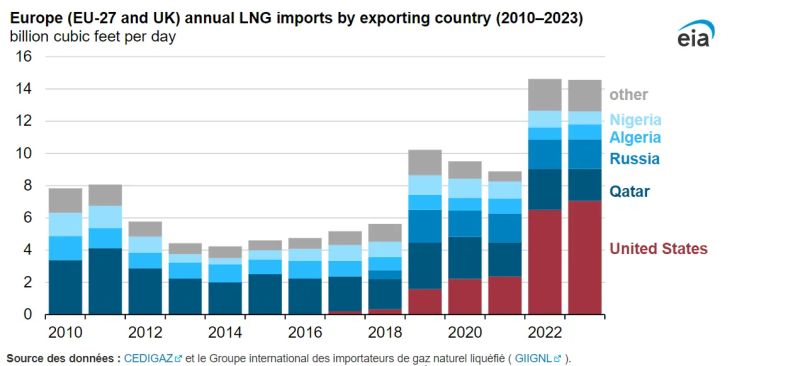

The reliance on large storage capacities in Central Europe (which this year remain mostly filled with Russian gas) shows that claiming that it is only these countries that continue to be supplied with Russian gas is a simplification: these volumes continue to help balancing the German and Italian markets and once flows via Ukraine stop they will have to be replaced with regasified LNG (most likely via Germany).

Source: Giovanni Bettinelli