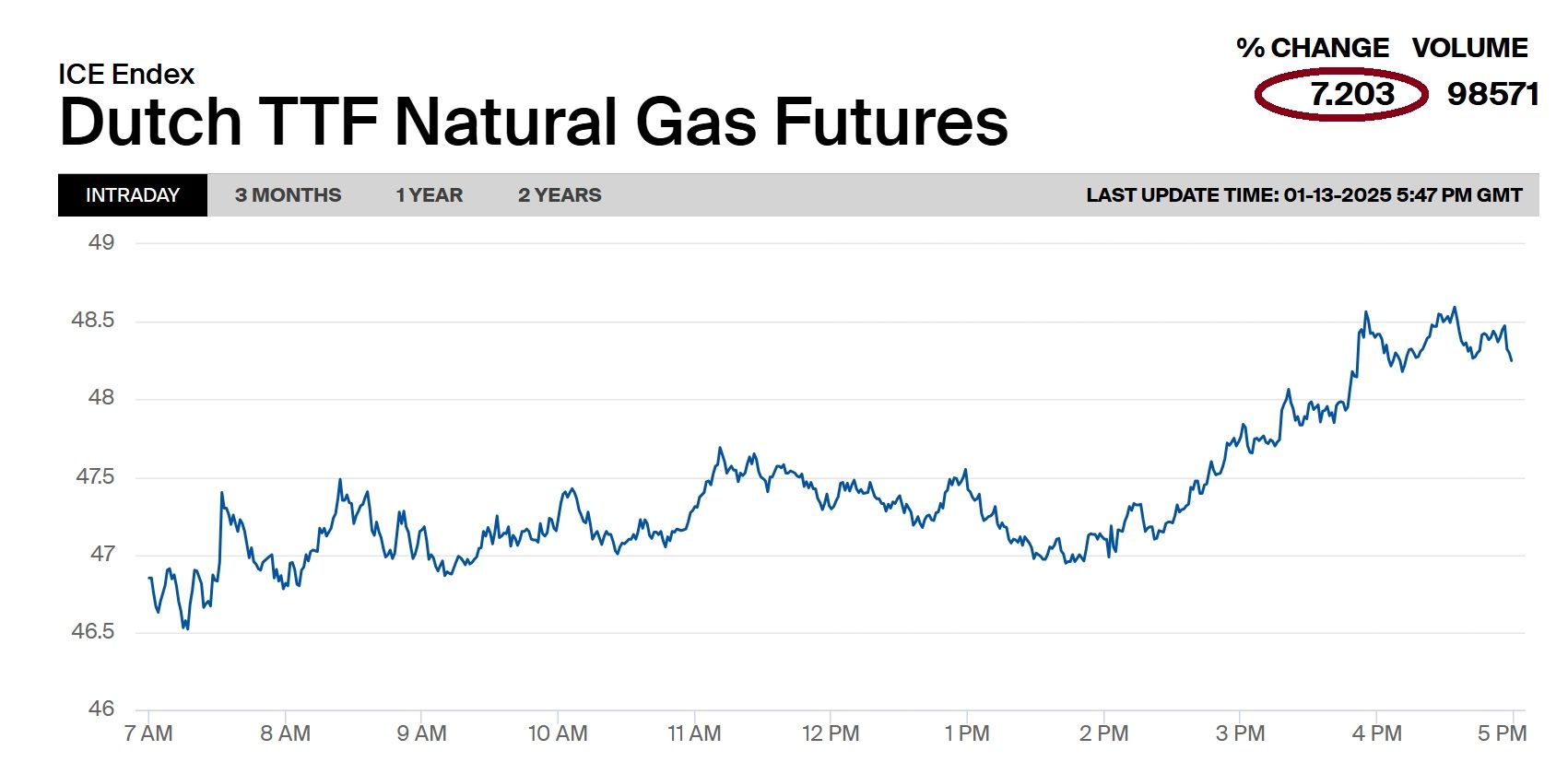

European gas prompt prices, which fluctuated in a narrow range earlier in June, have ended this week with solid gains.

At first glance, there is nothing special about this recalling how many times contracts jumped (or dropped) within one trading day since the start of 2022.

However, the way prices evolved in week 23 perfectly characterizes the current regional market.

The TTF day-ahead product rose by as much as 10pc compared to the previous trading day’s closing price after the explosion at Freeport LNG facility.

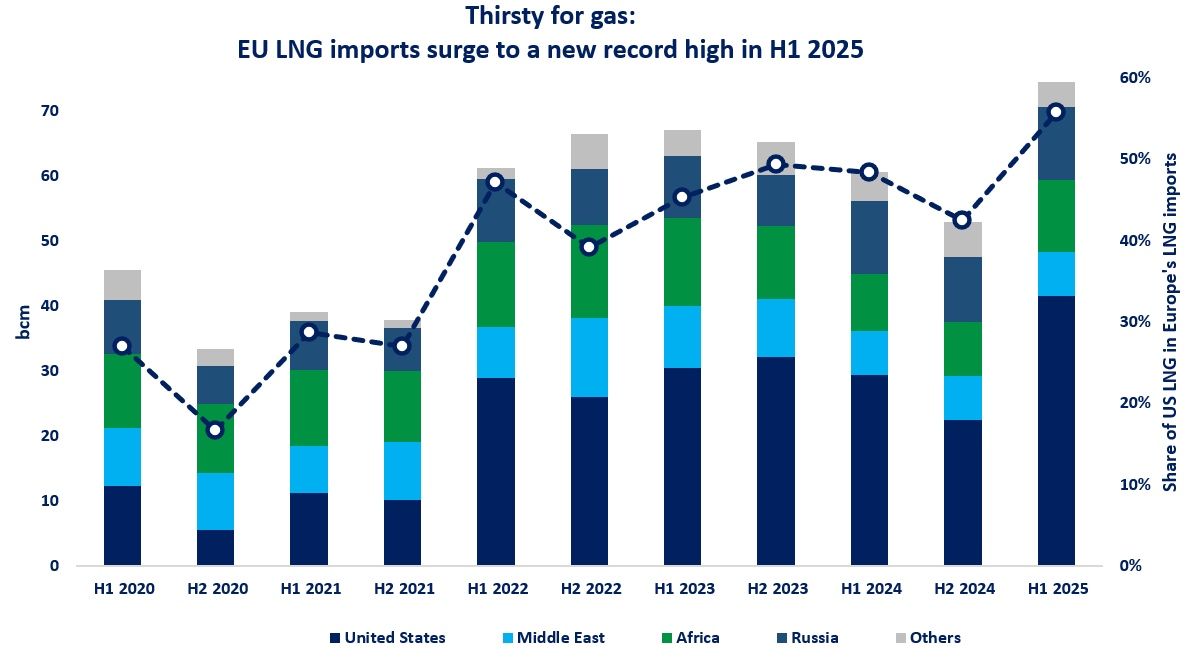

The Texas-based liquefaction terminal is expected to be offline for at least three weeks, which can reduce US LNG exports by approximately 700 thousand tons.

Based on the plant’s supply structure in the last few months, European buyers might lose around three quarters of that volume.

Put differently, with no cargoes being sent from Freeport LNG until the end of June total seaborne imports to Europe can decline by a little over 30 mcm/d.

Continentally, that is not a huge amount. But this Thursday’s surge in spot contracts’ in response to such an event is just another sign of how sensitive regional gas hub contracts have become to changes in supply balance.

Prices would most certainly have reacted nearly the same way even if there had been only rumours of some technical issues at the facility, not an actual decline in exports.

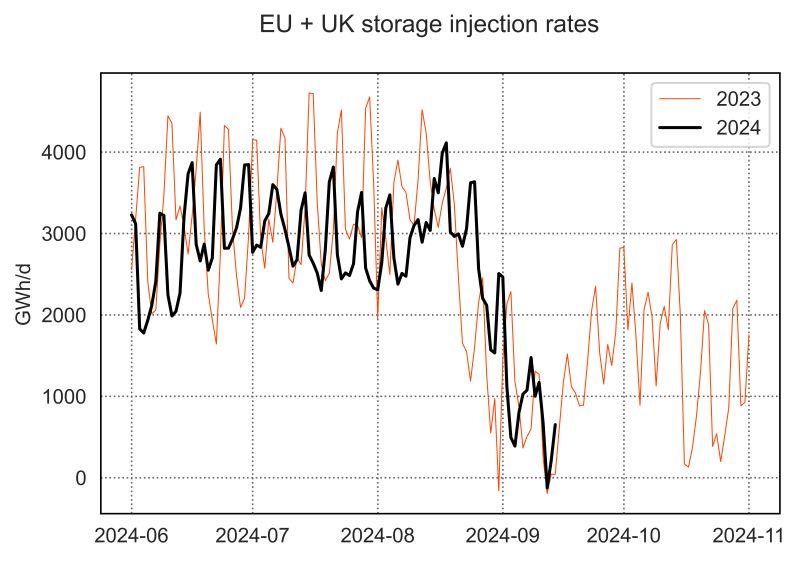

And this is understandable, given lower Russian flows with no room left for any substantial rise in imports from Norway or Algeria.

LNG deliveries at the European regasification terminals have also remained near all-time high over the past months.

In a tight market like this any unexpected, albeit not always significant, decrease in supply immediately contributes to increasing nervousness among players.

Source: Yakov Grabar (LinkedIn)