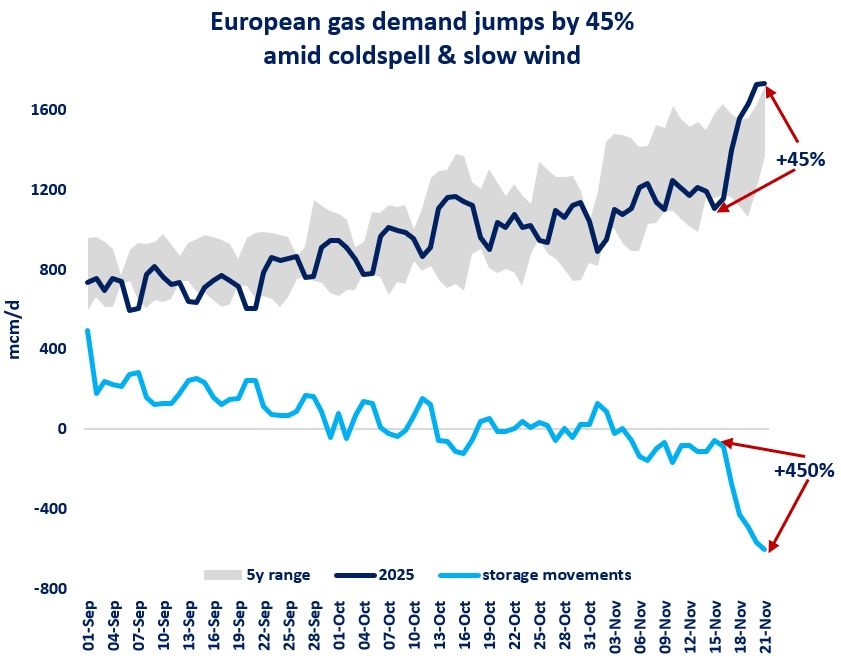

European gas demand surged by 45% over last week amid the winter’s first coldspell and slower wind speeds.

Daily gas demand soared by more than 45% between 14-21 Nov, or around 0.6 bcm/d in absolute terms. This strong increase was largely driven by colder temperatures, which boosted space heating requirements and drove-up rescom demand by a staggering 75%.

Heating degree days in the Netherlands (where TTF lives) stood 35% above their 5y average.

In addition, wind speeds slowed down between 14-21 Nov, with wind powgen plummeting by 20% over the week. This drove-up gas-fired powgen by over 40% during the same period, further boosting overall gas demand through Europe.

The gas flexibility is not easy to match: to put into perspective, 0.6 bcm/d would equate in energy terms to the daily output of 220 nuclear power plants (almost 5 times France’s nuclear fleet).

Gas storage sites played a key role in providing this flex, meeting around 90% of the daily demand increase between 14-21Nov.

Daily storage withdrawals surged by nearly 450% during this period to just over 600 mcm/d last Friday.

Overall, more than 2.5 bcm of gas was withdrawn during the coldspell, driving down storage fill levels to below 80% -with inventories now standing 10% (or 9 bcm) below their 5y average.

Despite this early coldspell, TTF prices continued their downward trend and fell by 3% between 14-21Nov amid the continued ramp-up of LNG supplies, primarily from the United States.

The relative resistance of gas prices to the demand surge might indicate that we are entering calmer waters for gas markets.

Coldspells with slow wind speeds highlights the growing systemic value of molecules for energy supply security and the importance of gas supply flexibility.

What is your view? What role will play gas flexibility in the European energy system? How to renumerate these flexibility services? Especially at times when storage closures are once again back on the policy agenda…

Source: Greg MOLNAR (LinkedIn)