Switching the other way: the steep decline in European gas prices, together with the strong gains in carbon prices are putting coal and gas-fired generation in closer competition for 2023.

TTF prices collapsed by close to 60% since last mid-December, one of their steepest drop on record.

We all know the reasons: mild weather, strong winds, high LNG inflow and near record storage levels…

Rotterdam coal prices meanwhile were more resilient, while carbon prices rose to above €90/t mark.

The combination of these factors is gradually changing the outlook for fuel-switching dynamics in the power sector, with the most efficient gas-fired plants now entering the coal-to-gas switching range.

Lower injection needs over the summer could reinforce those dynamics…

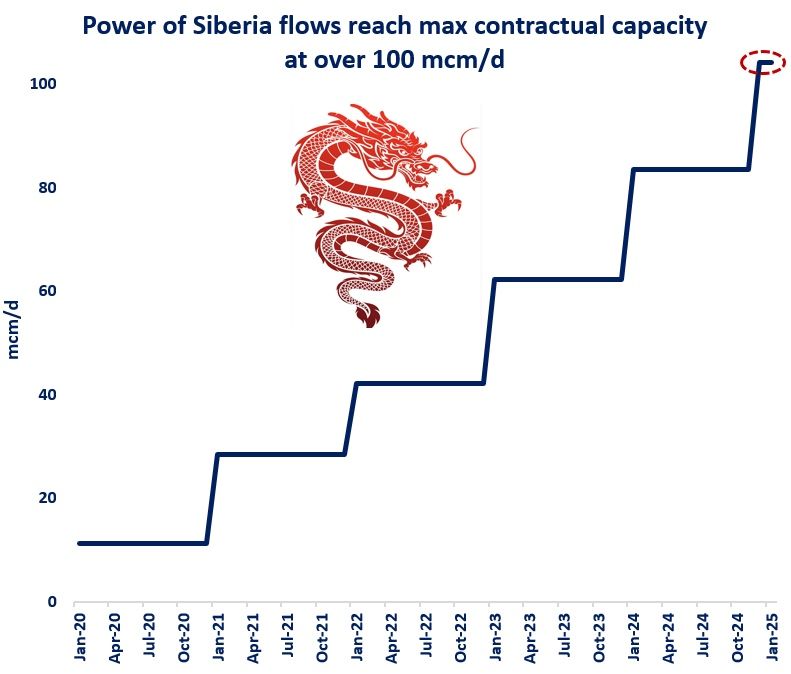

This being said, the global and European gas balance remains fragile and subject to major exogenous risks (China, Russia, weather), which could rapidly shift those dynamics the other way around.

What is your view? How will European gas and power dynamics evolve in 2023? What is your view on emission prices?

Source: Greg MOLNAR (LinkedIn)