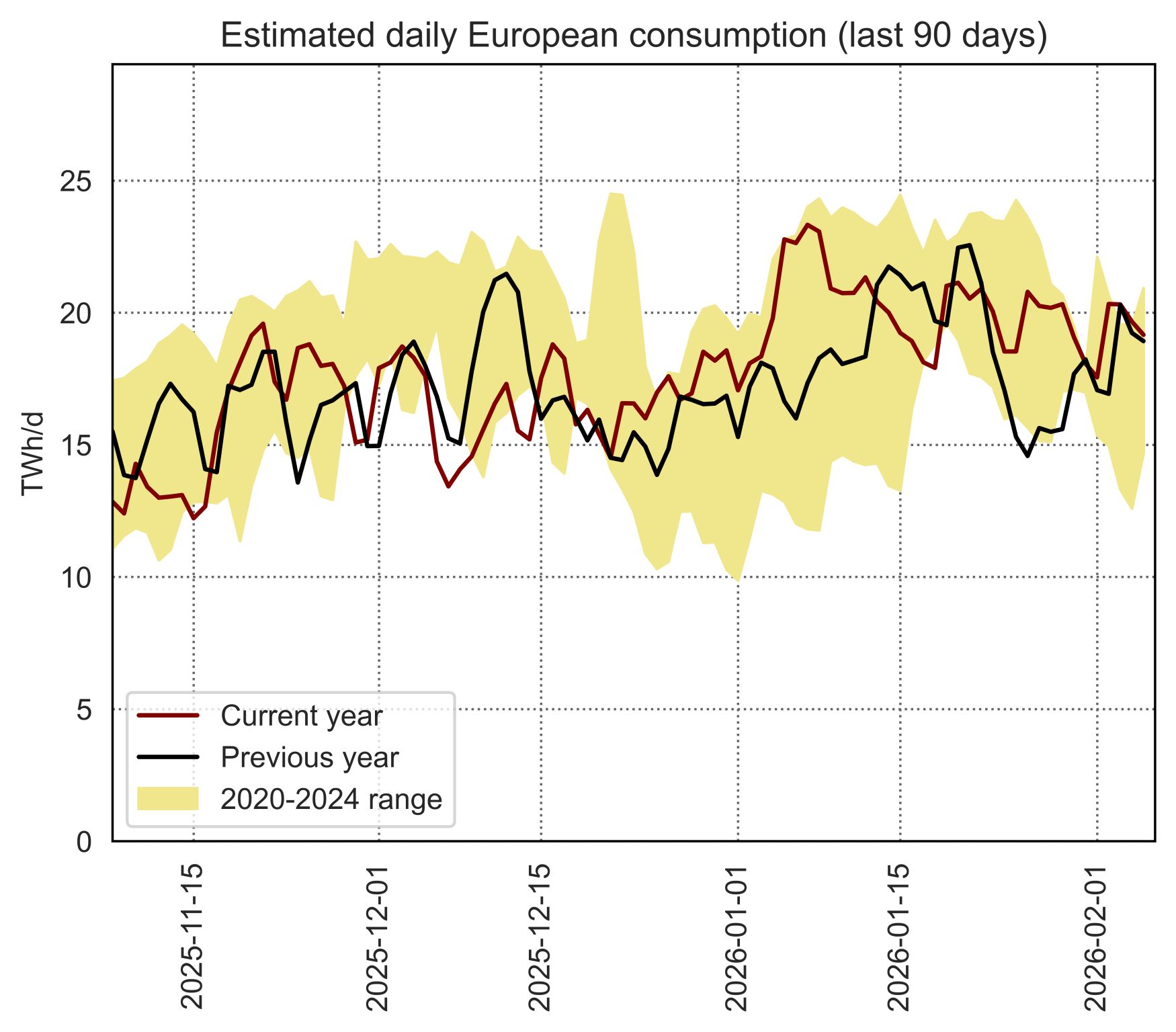

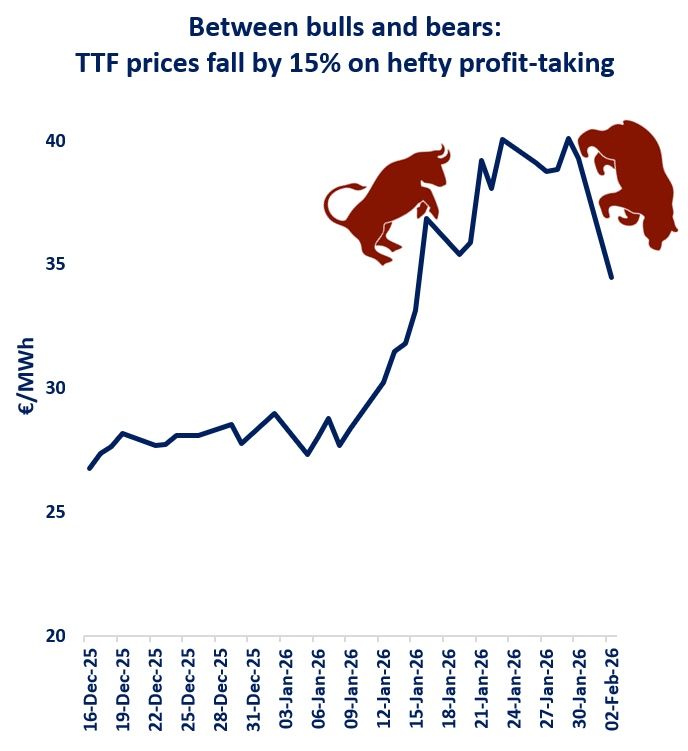

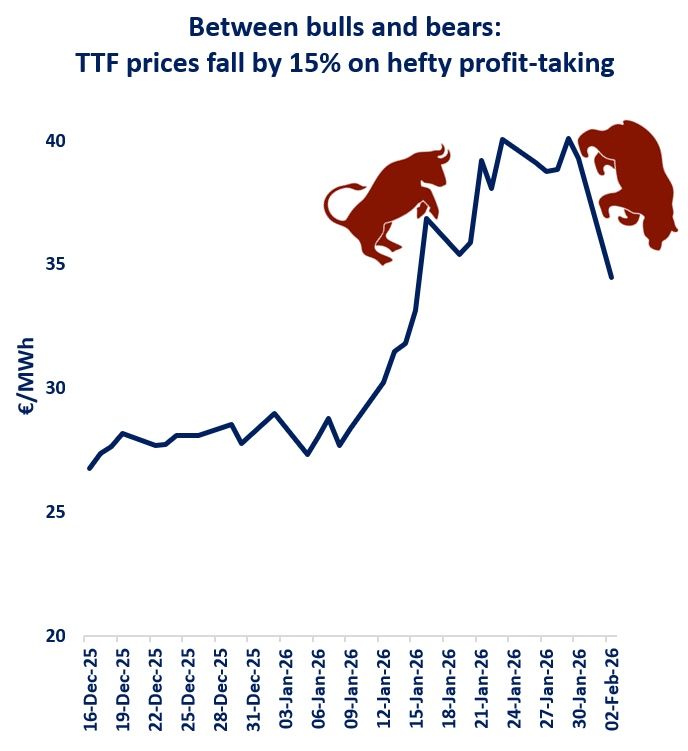

Prospects of mild and windy weather in the coming two weeks (except at the end of this week) and a rebound in Russian gas flows at the Velke Kapusany entry point compared to Friday exerted some bearish pressure on European gas prices on Monday.

Thermal coal prices remained relatively steady, notably as some Chinese players are back from the Lunar New Year break and concerns over lingering supply issues in the Pacific Basin are mounting as the Indonesian Ministry of Energy and Mineral Resources wants to tighten rules for coal miners who do not meet their domestic supply obligation such as revoking their mining licenses for up to 60 days and monitor the situation on a monthly basis rather than an annual one, a move that could further reduce Indonesian coal exports this year.

Newcastle ICE API 6 coal month-ahead prices jumped by more than 9 dollars yesterday at $216/ton.

The picture is overall bullish for European gas prices today with news that EDF further cut its 2022 nuclear production target (see power section for more details) likely to provide support to prompt and forward prices but relatively positive statements after the Putin-Macron meeting in Moscow could limit gains overall, even if Russian officials insisted on the fact that Russian security concerns had yet to be alleviated.

On the French side, officials declared that Vladimir Putin promised not to take new “military initiatives” at this stage. But in the US, President Biden stated after a meeting with the German Chancellor that “There will be no longer a Nord Stream 2. We will bring an end to it” if Russia invades Ukraine, which could be interpreted as a hardening of the US position on the pipeline.

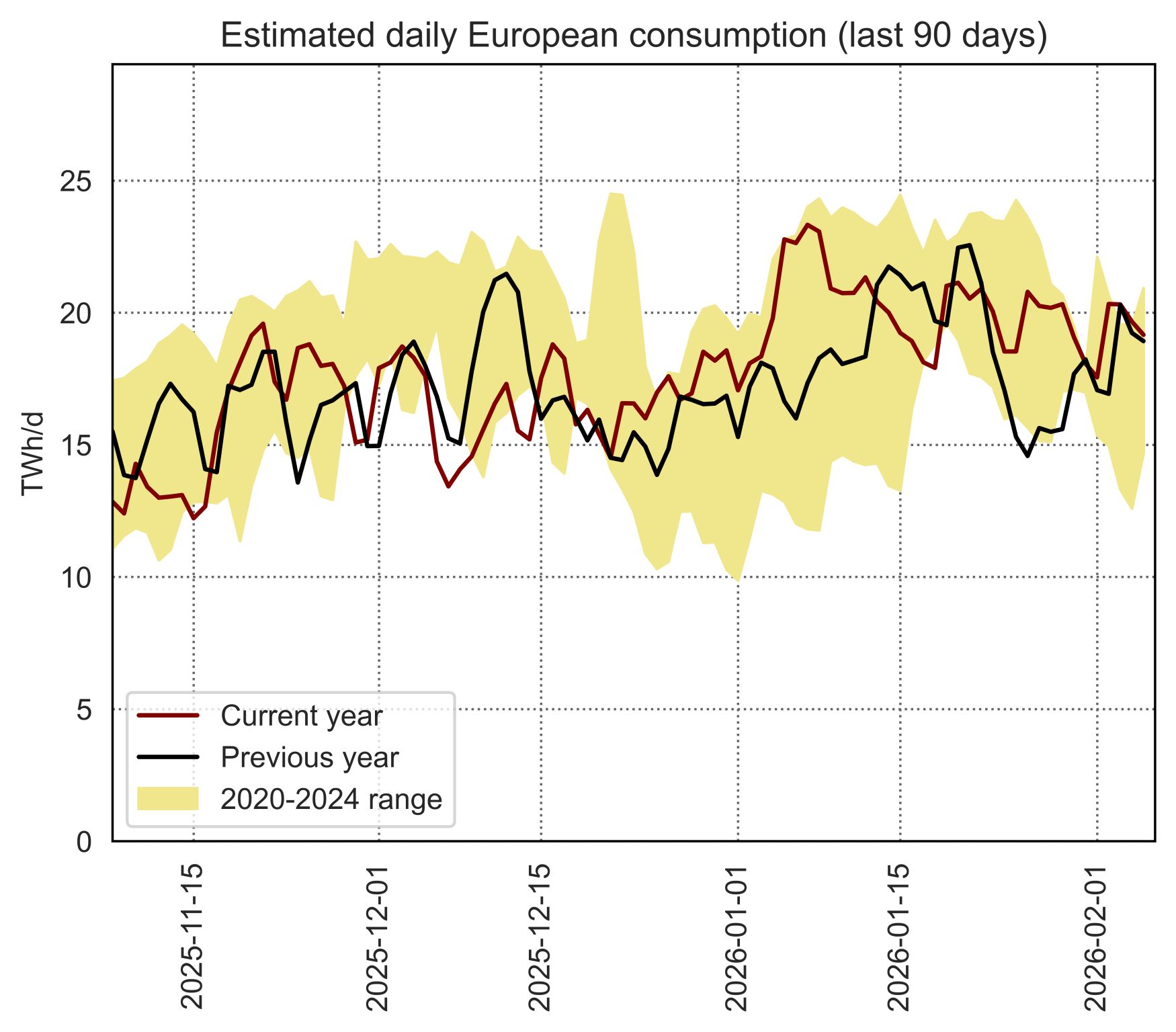

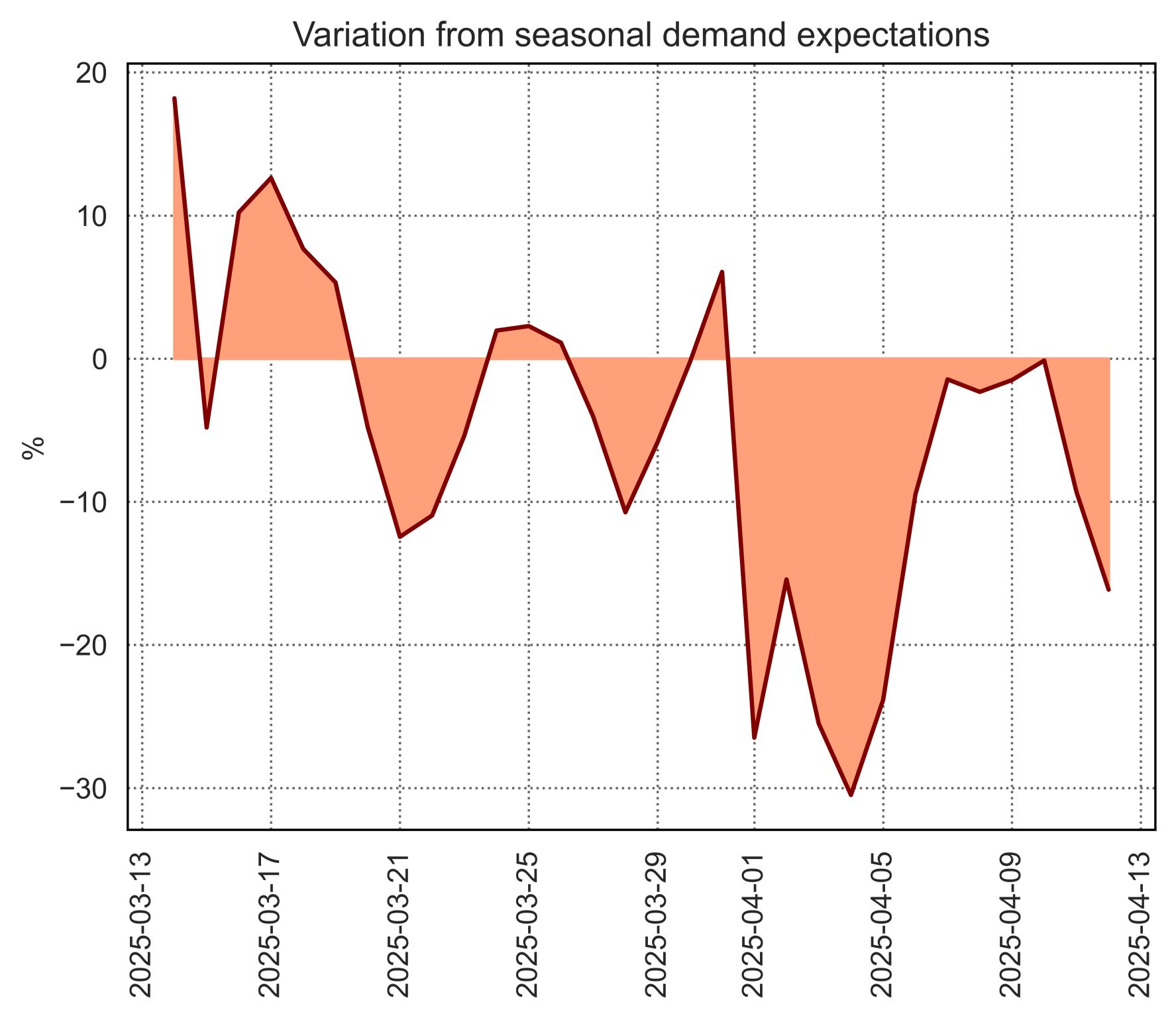

At the spot level, nominations at Velke Kapusany are down this morning but mild weather should continue to limit heating demand. But the combination of weak nuclear and hydro generation in France, Italy and Spain could continue to keep demand from CCGTs at high levels overall (see chart).

Source: EnergyScan