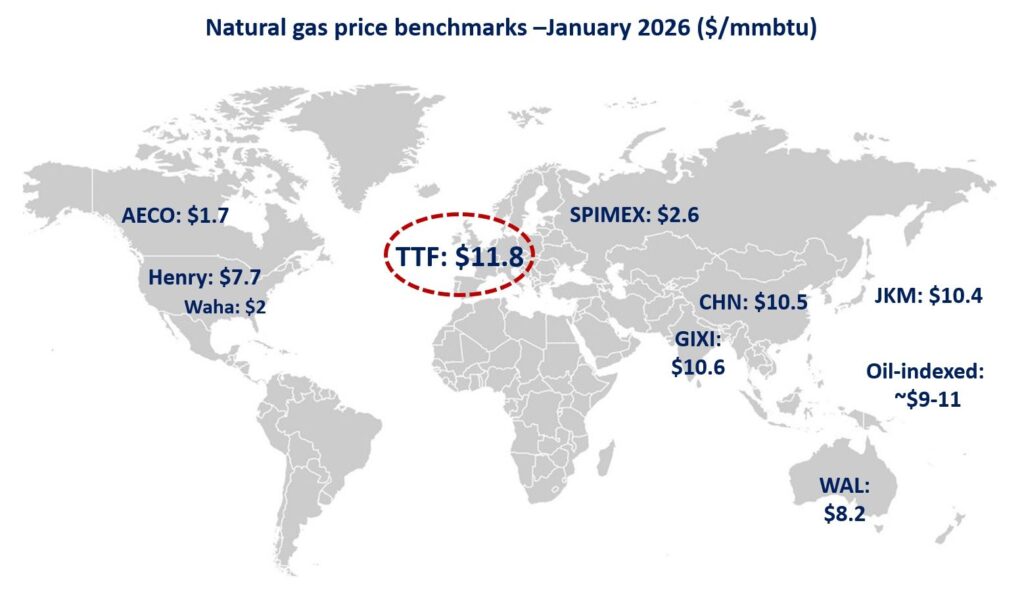

Global gas prices rose sharply across all key markets in January, with winter cold spells, geopolitical tensions, lower renewables and market repositioning all fuelling upward volatility in the first month of 2026.

In the US, Henry Hub prices soared by 80% YoY to $7.7/mmbtu — their highest January average since 2008 (so before the shale revolution). Henry spot prices surged to an all-time high of over $30/mmbtu, with Storm Fern boosting gas demand by 8% on the month.

ResCom demand was up by 17% MoM on freezing temperatures, while gas burn in the power sector rose by 5% MoM on lower wind and higher space heating demand. Meanwhile, freeze-offs were biting in, reducing dry gas production by more than 80 bcf (or 2.5 bcm), further providing upward pressure on gas prices.

And while gas prices surged to triple digits in the US Northeast, prices were relatively stable in the Northwest, which was somewhat spared from Storm Fern. In Canada, AECO averaged at a comfortable $1.7/mmbtu — despite Canadian gas demand hitting an all-time high of 540 mcm/d. Healthy supply together with high storage levels kept prices in check.

In Europe, TTF month-ahead prices surged by 25% on the month to an average of $11.8/mmbtu. Prices climbed to just over $14/mmbtu — their highest level since Feb 2025. Colder weather boosted ResCom demand, while lower wind and nuclear power generation boosted gas burn in the power sector (up by 15% YoY).

Stronger demand together with low storage levels (15 bcm below their 5-year average) supported higher gas prices, while short covering from financial players further amplified the upward swing. LNG played a key role in meeting stronger demand, with European inflows rising by 15% to a new record high of nearly 19 bcm.

In Asia, JKM prices remained broadly flat compared to their Dec 2025 levels at an average of $10.4/mmbtu. While colder temperatures were biting in the second half of January, healthy LNG supply together with ample coal capacity kept gas prices in check. Meanwhile, China is gradually returning to the global gas market, with the country’s LNG imports climbing by almost 15% YoY.

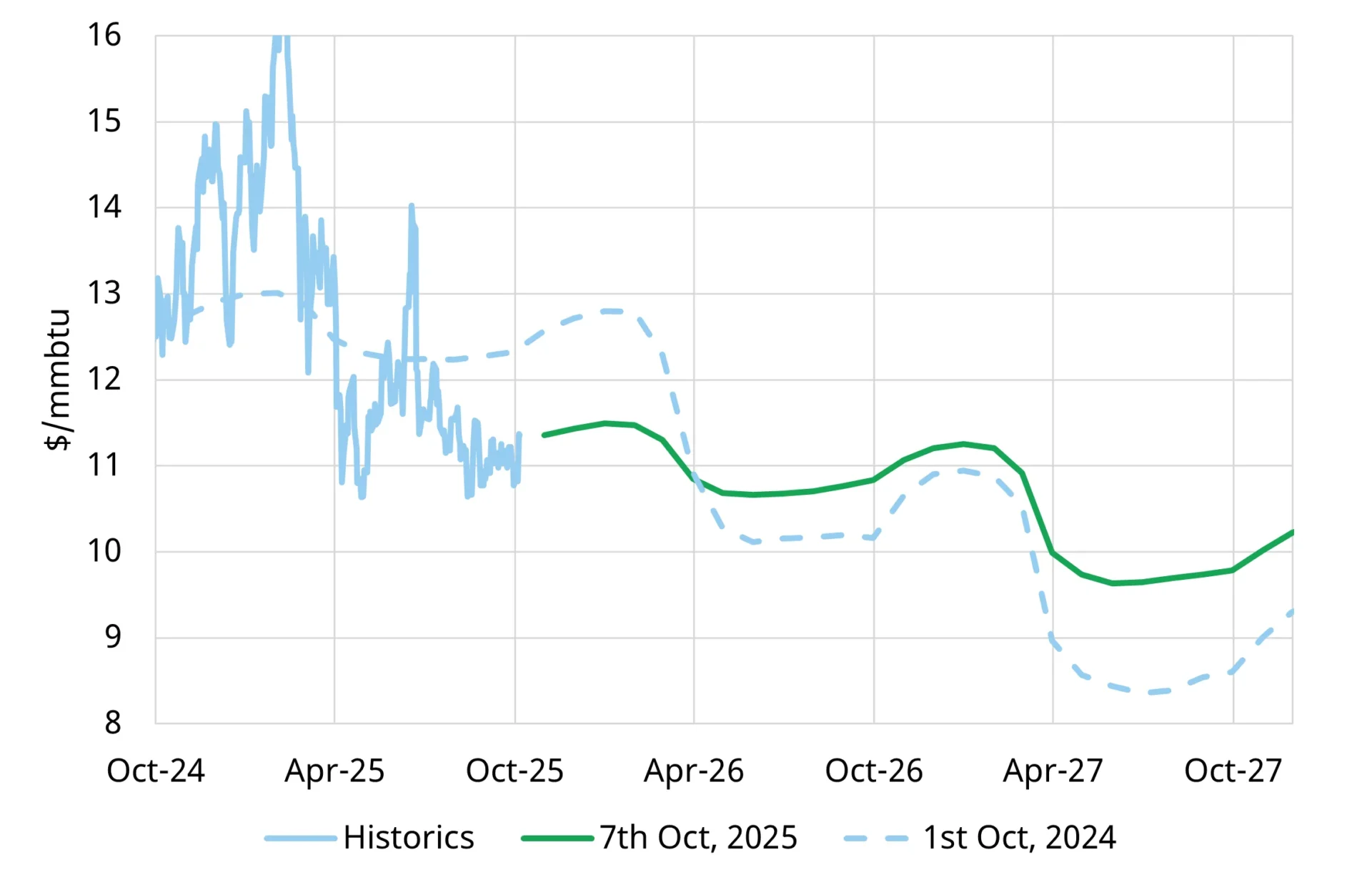

What is your view? How will global gas prices evolve this year? January started with strong upward volatility, but the unfolding LNG wave is set to ease market tensions — with geopolitics remaining the single most important risk factor.

Source: Greg MOLNAR