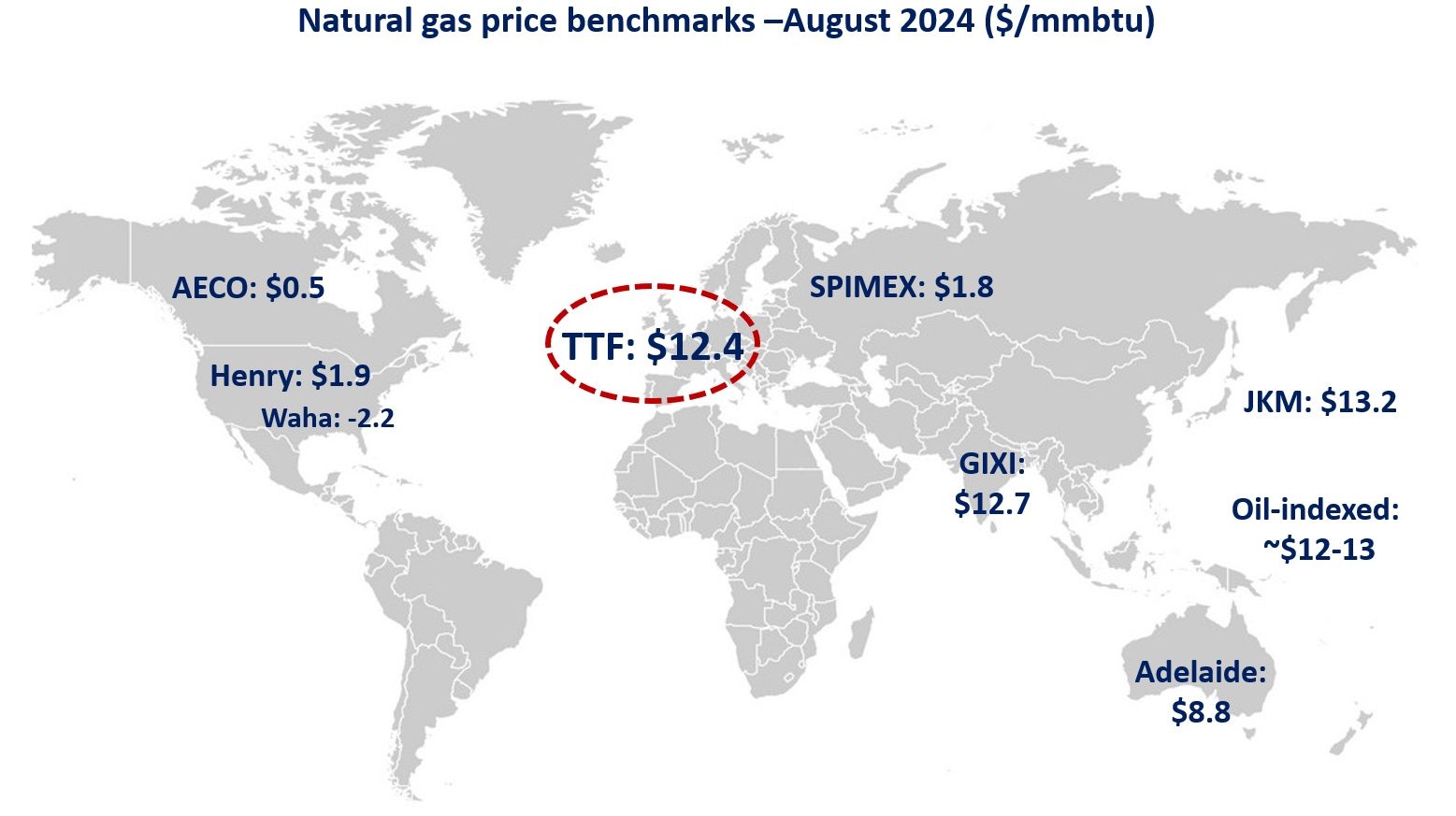

TTF gas prices have swung violently in recent days, underscoring how sensitive the European gas market remains to weather, supply flows, and geopolitics.

Between bulls and bears: After surging by nearly 40% through January, TTF month-ahead prices plummeted by nearly 15% today (January 2) — their steepest decline since Sep 2023, when crisis-mode volatility still prevailed.

Several factors contributed to this major price correction:

(1) Calm me down: Geopolitical tensions between the US and Iran seem to be easing, potentially paving the way for a diplomatic solution;

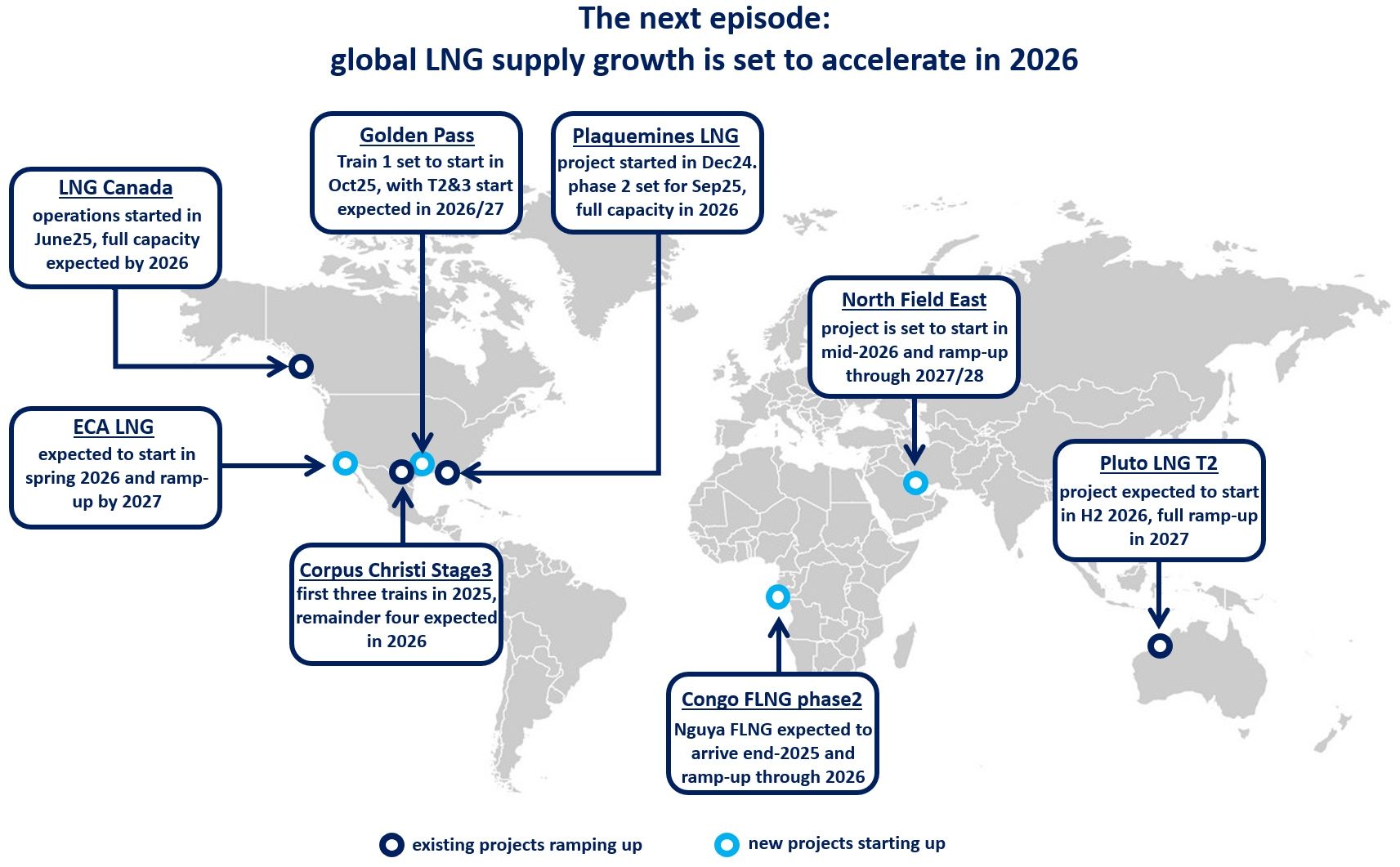

(2) Guess who is back: US LNG feedgas flows surged by more than 60% and fully recovered to their pre-storm levels. Strong US LNG supply is providing comfort to the global gas market;

(3) Cross-commodity moves: The collapse in gold and silver prices might transmit to commodities more broadly, further fuelling bearish sentiment;

(4) Profit-taking: Dwindling down positions after a 40% bull run eventually makes sense, especially if physical fundamentals suggest a downside risk.

But is the bull run really over? EU storage levels are now standing 15 bcm below their 5-year average, while Central and Eastern Europe might face another cold spell — and geopolitics… they are usually full of surprises.

What is your view? How will gas prices move through the remainder of the winter? Could we see bulls back for another wild run, or are we now in bear territory?

Source: Greg MOLNAR