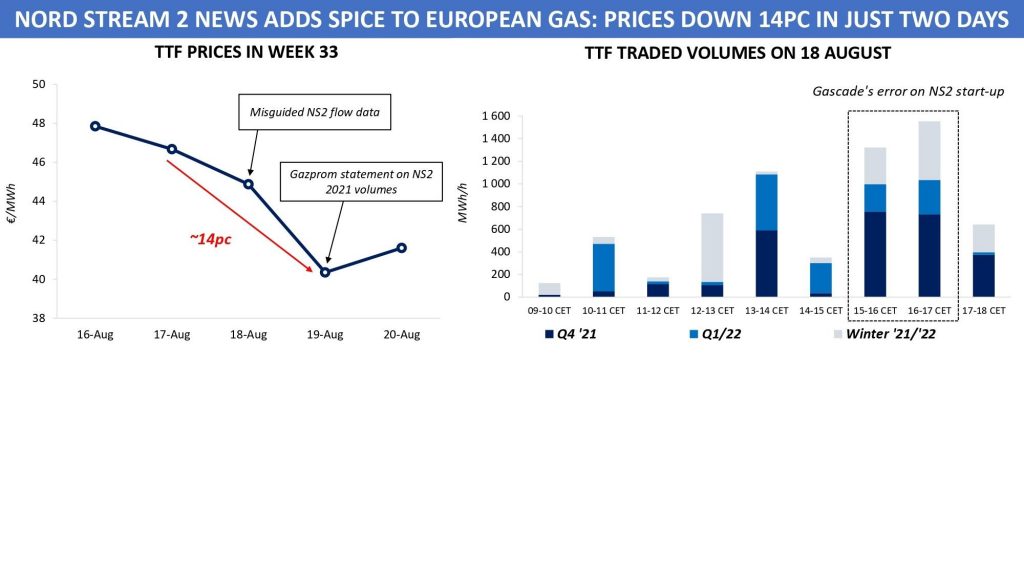

Week 33 was developing on the European gas market in the spirit of high volatility that characterizes the better part of 2021.

Between 16 and 20 August, the Front-Month product reached another record high first and then, in just two trading sessions, dropped by about 14pc. This time, the status quo of past weeks, when prices were rising uncontrollably, has been violated by the issue of current and future Russian gas supplies.

On Monday, the TTF September ´21 gained 6.5pc day on day in response to the firm capacity auction results, with 0.65 mcm/day out of 15 mcm/day being secured at the Ukrainian border. In the following few days, however, the prevailing market sentiment changed profoundly amid news on the Nord Stream 2 pipeline.

On 18 August, German grid operator Gascade falsely reported that physical gas flows to the Lubmin II point had started, resulting in this year´s unprecedented changes in price movements the market has seen within one day.

A sharp decline of €4.5/MWh in TTF Front-Month was immediately followed by a €3.5/MWh price rise in only two hours. Symbolically, that sort of error, which is not so common, occurred in 2021 that is full of twists and turns.

On 19 August, the sell-off continued across major European gas hubs after it was announced that the Nord Stream 2 could deliver 5.6 bcm this year. Following the announcement, the TTF gas curve up to Q1 ’22 came under the strongest pressure and lowered by €4.5/MWh as compared to the previous close.

This week’s developments have clearly demonstrated not only the effect that Nord Stream 2 start-up may have on gas prices in Europe, but also has shown how a significant growth in supplies from any other source, for example LNG, could affect market environment.

As winter approaches amid low storage levels, players will be carefully listening to any signals indicating a potential change in the market balance.

Source: Yakov GRABAR

Connect with Yakov on LinkedIn