Europe enters the 2025/26 heating season in a more stable position than the past two winters — with comfortable storage and growing LNG capacity — but flexibility remains thin.

As Timera Energy notes, “Europe has bought itself breathing space, but it hasn’t rebuilt the buffer that allows for complacency.”

The market’s calm exterior masks continued fragility: even a moderate cold spell, a shift in Russian LNG flows, or a slowdown in US exports could see TTF prices jump sharply.

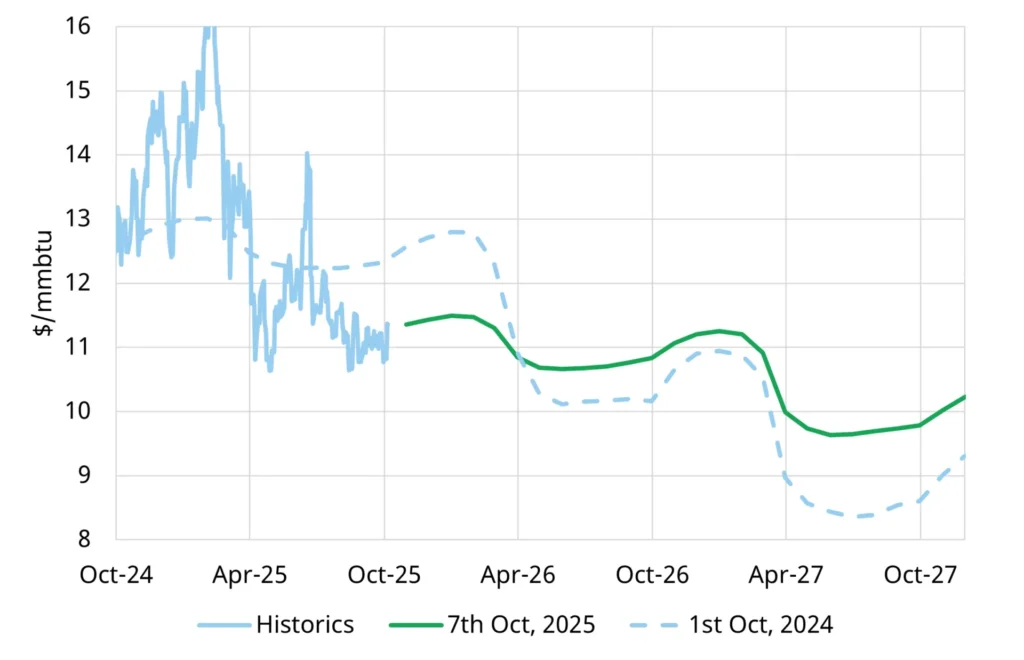

While the medium-term LNG wave arriving from 2026 should strengthen balances, this winter still demands close attention to weather, renewables output, and inter-regional LNG competition.

Source: Timera Energy