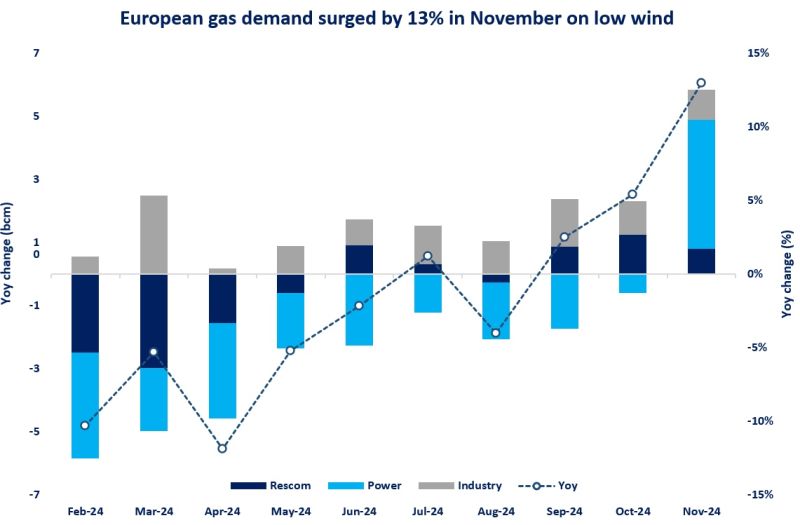

European gas demand surged by 13% in November – its strongest year-on-year increase since May 21, when Europe was recovering from the covid lockdowns.

Notably, the strong increase in November was primarily driven by the power sector, which alone accounted for 70% of incremental gas demand.

Low winds speeds boosted gas burn in the power sector by 85% yoy in the first half of the month, with gas-fired power plants providing essential back-up to the electricity system.

In addition, colder weather lifted space heating requirements in the residential and commercial sectors and rose by around 4% yoy. Industrial gas demand increased by an estimated 5%.

While gas demand surged by near 6 bcm, Europe’s LNG imports continued to decline and dropped by 15% (or 2 bcm) yoy. piped gas supplies remained broadly flat compared to last year.

In this context, gas storage sites provided nearly all the gas supply flex needed to balance out the European market: storage withdrawals more than doubled compared to last year and totalled at near 10 bcm.

This also means, the EU inventory levels are now standing almost 10 bcm below their last year’s levels, which will naturally increase storage injection needs through the summer 2025, and hence lead to a tighter market (especially without Russian piped gas transit via Ukraine).

Three key takeaways from Europe’s dunkelflaute episode:

(1) winter outlooks need to include not only temperature sensitivities but also uncertainty ranges related to wind power output, which has become a major driver for gas demand variability;

(2) gas supply flex is crucial to ensure electricity supply security: to maintain this flexibility, careful considerations are needed in terms of investment along the entire value chain;

(3) LNG flex needs time: the diversion of LNG cargoes to a market typically takes two-three weeks due to voyage time and the complex shipping logistics. There could be ways to shorten delivery times via strategic reserves mechanisms, but those are costly options.

What is your view? What lessons can we take from this November’s dunkelflaute? What future role for gas supply flex? What is your winter outlook?

Source: Greg MOLNAR