European gas prices would face little impact should Israel shut down gas exports to Egypt and Jordan, even if the latter pair lead to increased demand for LNG on the global market, analysts told Montel.

“The small volumes of additional LNG that Egypt and Jordan are likely to import in Q1 2025 are so insignificant relative to the size of the LNG and European gas markets that the price impact would likely be minimal,” said Edward O’Toole, director of global gas analysis at RBAC, Inc., a Texas-based data intelligence firm.

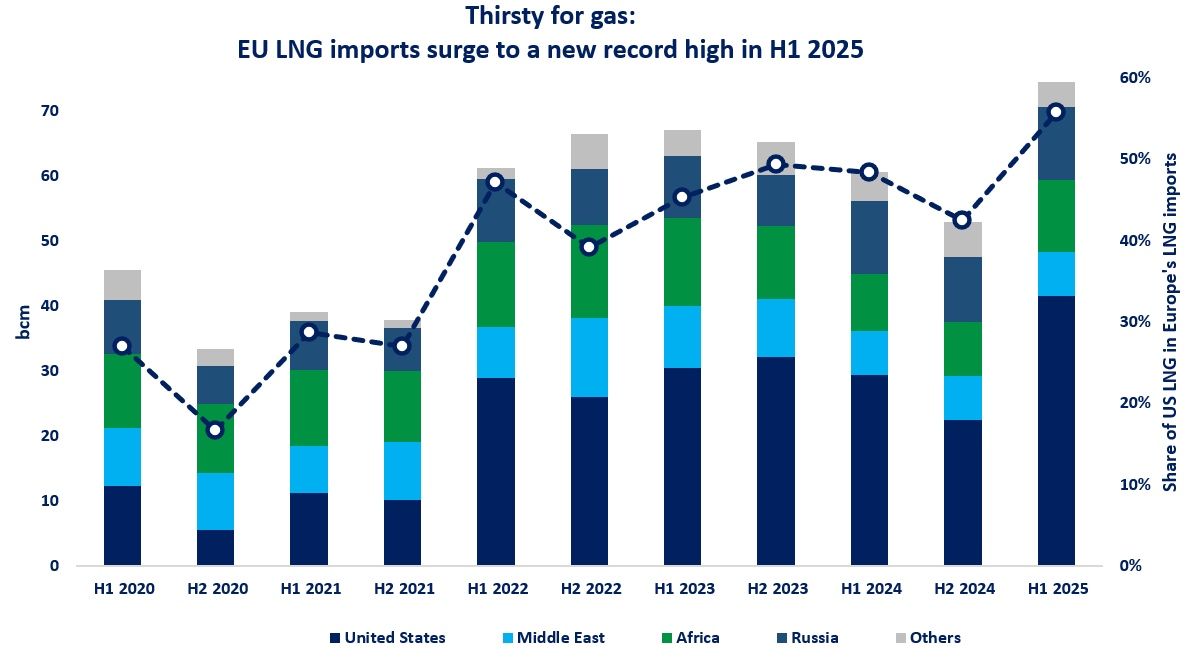

RBAC, which simulates impacts on energy markets, estimated for Montel the impact of a full shutdown of Israeli gas exports over next year’s first quarter, which would result in Egypt increasing its gas imports by 1.5bcm, or 1.1m tonnes.

The forecast came as Israel shut down its two biggest gas producing fields, Leviathan and Tamar, last week when Iran launched nearly 200 missiles at it, though the assets were restarted hours later.

Wider war?

There are also fears a wider war in the energy-rich region could lead to a blockade of key waterway the Strait of Hormuz, affecting key LNG exports from Qatar.

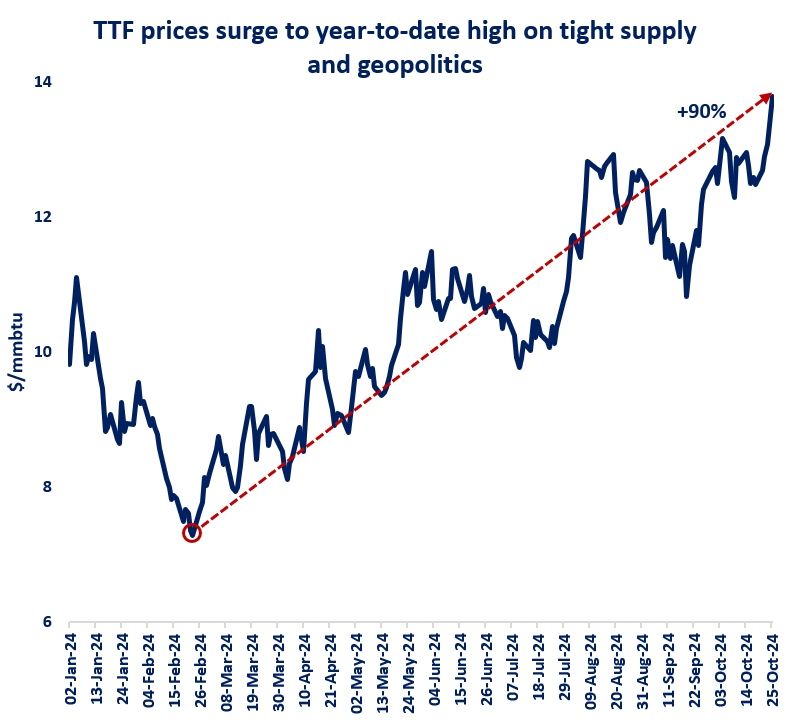

“It seems that the increases in futures prices likely reflect a much larger concern, i.e., an escalated conflict in the area that would not only reduce Israel supply, but also affect surrounding countries and have larger impact on global gas supply,” said O’Toole.

Nevertheless, in terms of a shutdown of Israeli gas flows and the subsequent impact on Egypt and Jordan, contracted volumes and underground storage in Europe would be able to offset any fundamental impact, said RBAC.

“We also do not expect that all of the additional LNG demand from Egypt/Jordan to directly compete with European gas markets,” added O’Toole.

Asia could see LNG prices increase by nearly USD 0.40/MMbtu, which was still negligible considering current high prices of around USD 13/MMBtu.

“Overall, based purely on the fundamentals, the 1.1m tonnes of additional LNG demand, which represents about 1% of total LNG supply and 0.9% of European total demand, does not seem significant enough to drive the Q1 2025 price increases on its own,” said O’Toole.

Priced in

“We think Egypt could buy further cargoes for the first quarter in normal circumstances, even without any further disruption taking place. Some expectation of continued Egyptian imports is likely already built into the market’s price view,” said ICIS LNG analyst Alex Froley.

“An unusually cold winter in Europe and north Asia would represent a bigger swing in demand than continued imports into Egypt.”

In the meantime, Egypt could face gas cuts. “Much like supply disruptions in the past, it seems that rolling blackouts or reduced industrial production is likely in 2025 Q1,” said O’Toole.

Source: Andres CALA, Montel Energy