European gas demand continued its downfall in the first half of 2024, primarily due to collapsing gas-fired generation and lower gas use in buildings.

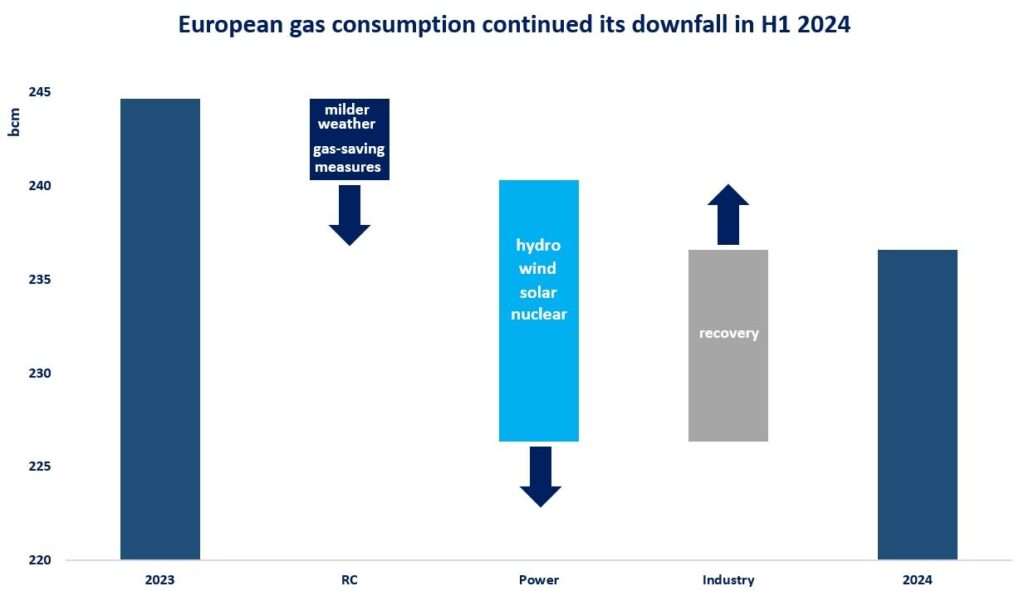

European gas consumption dropped by an estimated 3% in H1 2024 compared to the already decade low 2023 levels.

This was partly driven by lower gas consumption in the residential and commercial sectors, amidst milder Q1 weather and continued gas-saving measures.

But the key driving force was by large the power sector, where gas burn plummeted by more than 20% yoy. the strong expansion of wind (13%) and solar (15%) certainly played a key role here, but the single most important driving force was hydro. Europe’s hydro power output was up by almost 25% yoy, adding more than 55 TWh of electricity to the European power mix, and effectively squeezed out gas-fired generation in hydro-rich markets (such as Italy).

This highlights the importance of hydro cycles for gas demand, and also reminds us that a drier year could increase the call on gas-fired power plants.

Moreover, lower gas-fired generation does not mean that gas is less needed: what we see is that the volatility of gas-to-power demand is actually rising, reflecting the growing role of gas-fired power plants in backing up the overall power system and ensuring electricity supply security.

In contrast, gas demand in industry continued to recover in H1 2024 and rose by over 10% yoy -albeit remaining well-below its pre-crisis levels. most of this recovery is supported by refining, petrochemicals and fertilisers.

Source: Greg Molnar (LinkedIn)