Geopolitics remains a decisive factor in the European gas market, but over the last month players have somehow got used to the new realities marked by increased uncertainty. This is particularly evident from prompt and near-curve contracts, which have decreased sharply as compared to their early March levels. But the picture is quite different when looking at the far end of price curve.

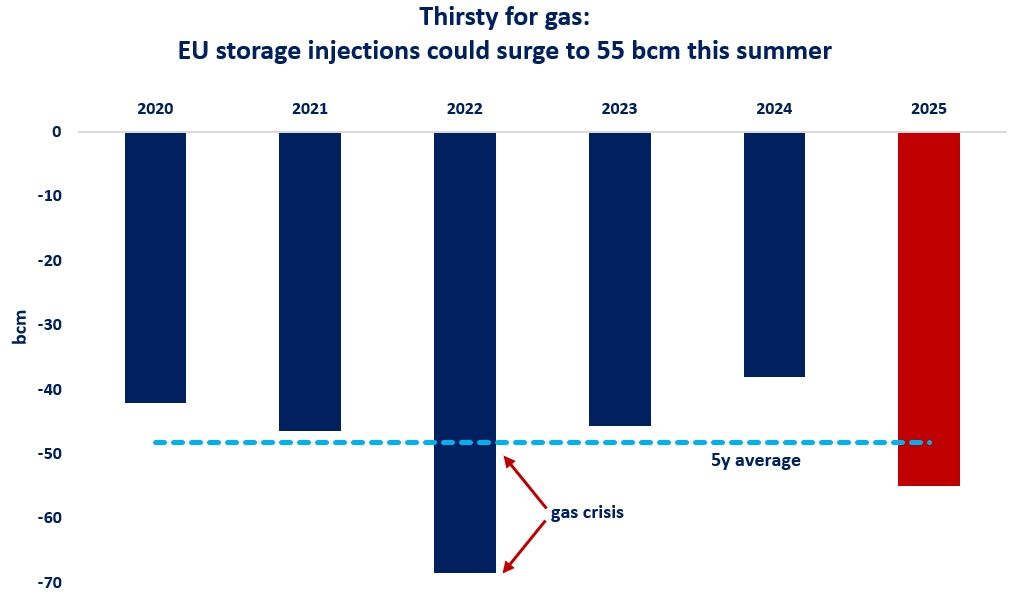

Since the start of the second decade of March, gas products for delivery in 2022 have fallen by more than one quarter. Despite ongoing concerns about prospects for Russian supply, the end of winter season in combination with near-record LNG imports to Europe helped to calm market participants down. Amid strong injection rates, the region’s storage fullness has for the first time this year exceeded that of 2021 (29,6pc vs. 29,2pc, on April 18th).

Just recently, Norway has entered a period of annual maintenance which will be affecting exports from the NCS up until June. At the same time, LNG imports to the European terminals continue to gain momentum, with next week’s deliveries being on track to hit a new record, according to Kpler.

In the meantime, the TTF year-ahead price rose by about 15 pc between 11 March and 22 April, while the 2024 calendar year increased almost 1.5 times and the year 2025 soared more than 60pc. Far-curve products have been supported by robust coal and crude oil markets, which in their turn started to feel more strongly the impact of geopolitical factor.

Importantly, higher allied commodity prices have come on top of players’ expectations of tight gas supply across Europe over a long period of time. The sharp rise in the year 2024 and 2025 contracts, especially in contrast with recent near-curve price developments, gives a strong signal as to what supply/demand situation market players see themselves in over the coming years. Given the unprecedented crisis in EU-Russia relations as well as only a few additions to LNG liquefaction capacities in the near future, there are now fewer illusions about a quick return to the old low-price environment.

Source: Yakov Grabar (LinkedIn)