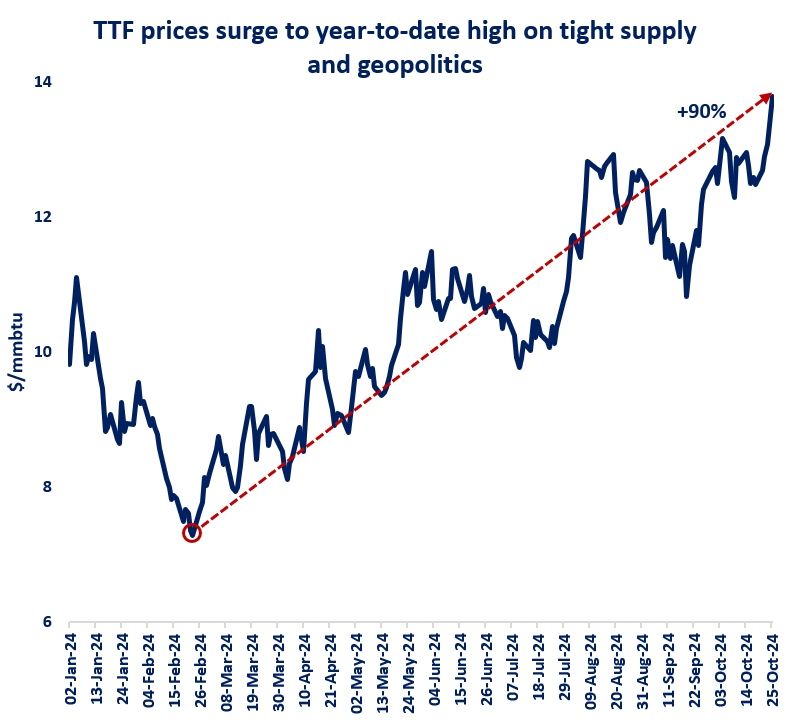

The European gas price TTF rose slightly to USD 12.5/MBtu on 1 May from USD 12.4/MBtu the previous week before falling to USD 11.8/MBtu on 5 May due to abundant supplies, mild weather and ample underground gas storage.

ACER published the 5 May spot LNG assessment price for delivery in the EU at EUR 30.1/MWh (equivalent to USD 9.7/MBtu). According to AGSI+, the European underground gas storage rate as of 5 May was 61.0%, up from 58.9% the previous week.

The Northeast Asian assessed spot LNG price JKM for the previous week (1 May – 5 May) remained mostly unchanged from the low USD 11s of the previous week through 2 May due to high inventories.

On 3 May, JKM fell to the high USD 10s amid oversupply and low demand for prompt cargoes, hitting its lowest level since May 2021. JKM continued to decline, falling below USD 10s on 5 May.

According to METI, Japan’s LNG inventories for power generation totaled 2.56 million tonnes as of 23 April, up 0.14 million tonnes from the previous week, up 0.60 million tonnes from the end of the same month of last year and up 0.61 million tonnes from the average of the past five years.

The U.S. gas price HH fell to USD 2.3/MBtu on 1 May from USD 2.4/MBtu the previous week amid firm production and limited demand. HH remained in the low USD 2s as feed gas supplies to LNG export facilities picked up after a brief decline, falling to USD 2.1/MBtu on 5 May.

According to the EIA Weekly Natural Gas Storage Report released on 4 May, the U.S. natural gas underground storage on 28 April was 2,063 Bcf, up 54 Bcf from the previous week, up 32.6% from the same period last year, and up 19.8% from the historical five-year average.

Updated 09 May 2023

Source: JOGMEC