The CEO of Naftogaz, Oleksiy Chernyshov, the Ukrainian national energy company, has issued a call to EU countries to urge them to help protect natural gas storage facilities against recent Russian attacks.

This is crucial to maintain Ukraine’s contribution to stabilizing gas prices across the continent. Despite several attacks on gas storage sites in western Ukraine in recent months, only surface facilities have been damaged.

Ukraine continues to serve as a transit corridor for Russian gas to Europe. Moreover, tts underground gas storage facilities have been crucial in providing European traders with vital storage space for their gas surplus before last winter, as EU storage sites reached their maximum capacity.

In 2020, Ukraine harmonized its regulatory framework with that of the European Union (EU) and significantly reduced the cost of gas storage in Ukrainian storages for traders based in the EU by reducing transportation tariffs and exempting temporarily stored gas from customs duties.

In April 2023, Ukrtransgaz (the Ukrainian public gas storage operator) was certified as a European storage operator, meaning it can hold strategic gas reserves for EU member states.

This year, Ukraine is offering foreign traders to reserve up to 10 billion cubic meters (bcm) of its natural gas storage capacity, according to the state oil and gas company NJSC Naftogaz Ukrainy. This figure could be expanded to 15 bcm if Ukraine regains territory occupied by Russia, according to Naftogaz.

The gas storage facilities of the EU can only hold a maximum of about 100 bcm, while the annual demand in the bloc ranges between 350 and 500 bcm, depending on weather conditions and other factors.

Long a key player in gas trade with Europe, Ukraine boasts more storage capacity than any other country on the continent, except for Russia. The country has a total capacity of 31 bcm spread across 11 underground storage facilities.

Reducing the risks associated with the use of Ukrainian storage could enhance energy security both within the EU and in Ukraine itself. Ensuring that the current gas surplus in Europe extends into the winter could help Ukraine’s western neighbors continue to supply gas to Ukraine, which has received almost all of its gas imports via EU countries.

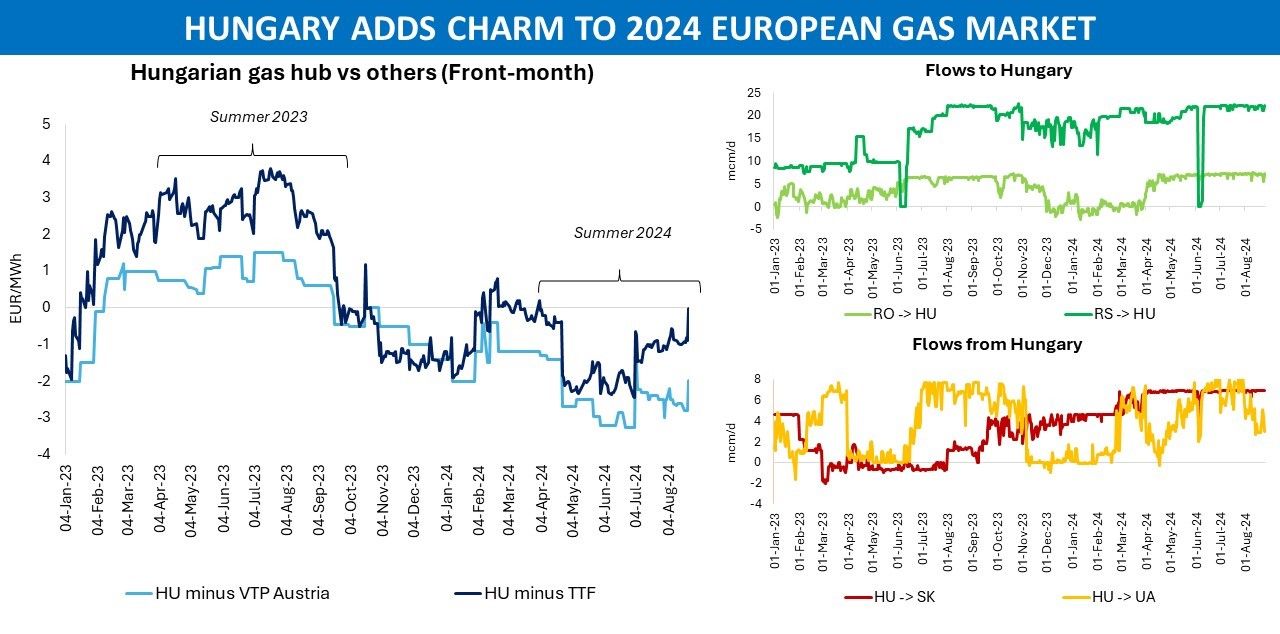

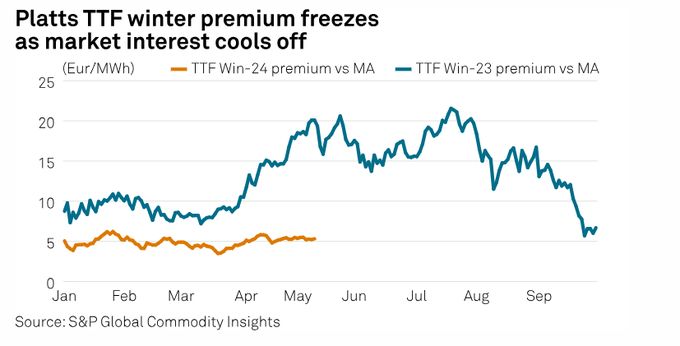

Market players continue to view seasonal spreads as currently unfavorable, although they still allow for sufficient injections into Ukrainian storages by the end of the summer. Platts assessed the winter 2024 premium compared to the upcoming month at the main Dutch TTF hub in Europe at 5.32 euros/MWh on May 11, with the spread averaging around 5.325 euros/MWh since the start of the summer season.

In comparison, Platts had evaluated the TTF Winter 2023 premium compared to the upcoming month at 20.075 euros/MWh on May 11, 2023. This spread would then peak at 20.6 euros/MWh on May 24, remaining around 15 euros.

Source: Vincent Barret