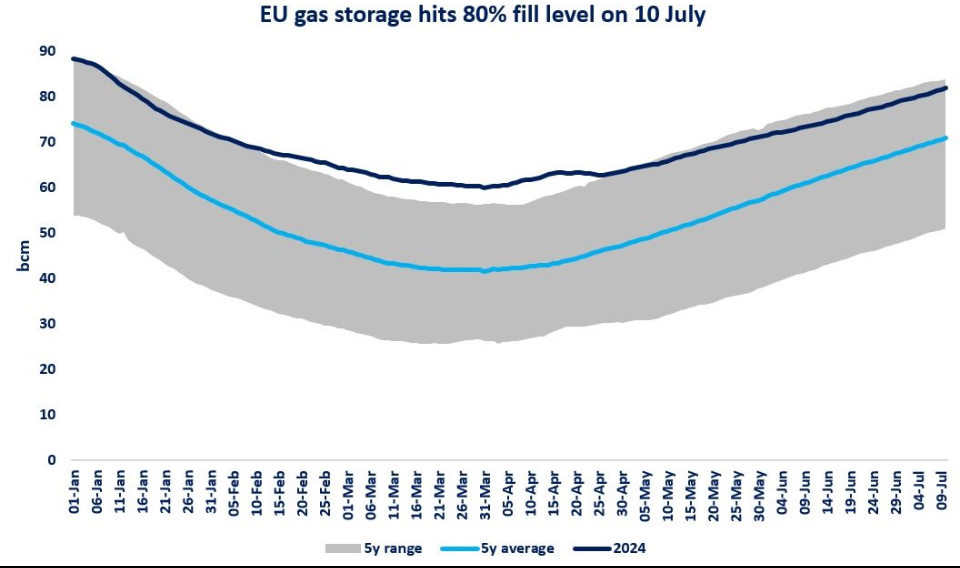

Gas storages in the EU are well above the 1st Sep filling target.

My colleague Jacob Mandel’s assessment: “The overshoot signals potential relief for prices in the short term, but storage alone is not enough to meet winter demand. The threat of shortages remains – an unexpected cold snap could quickly drain inventories if imports do not keep pace.”

EU gas stocks on 31 August: 84 bcm

1 September target: 65 bcm

1 October target: 79 bcm

1 November target: 88 bcm

As a whole, the EU is 19.2 bcm ahead of its 1 September target and even 5.5bcm ahead of 1 October targets, with only 3.3bcm to go to hit its 1 November targets. This would be equivalent to injections of just 51mcm/d, which would be the lowest in recent years in September-October, suggesting that European storage could enter winter nearly full.

Some countries are ahead of others, with many already having hit their 1 November targets, including France, Poland, Italy and the Czech Republic. Germany has the most storage space left to fill, at 2.6bcm, because of its higher target of 95% and the vast size of its storages, followed by Austria with 1.3bcm to go. Austrian storage helps Germany and Italy — much larger gas consumers — meet demand in winter.

The only country still behind its 1 September target is Latvia. Latvian storage capacity is small, but the country’s Inčukalns storage site is crucial for meeting winter demand across the Baltics.

However, this is not enough to relax given that Russian gas flows will be far lower than historic average levels this winter, the risk adverse weather, and reliance on the global LNG market.

Source: Anise GANBOLD