(Greg Molnar) Covid19 was a real stress test for gas markets, unveiling the multitude of flexibility mechanisms along the gas value chain and highlighting once again the key balancing role of Europe in an increasingly globalized gas market.

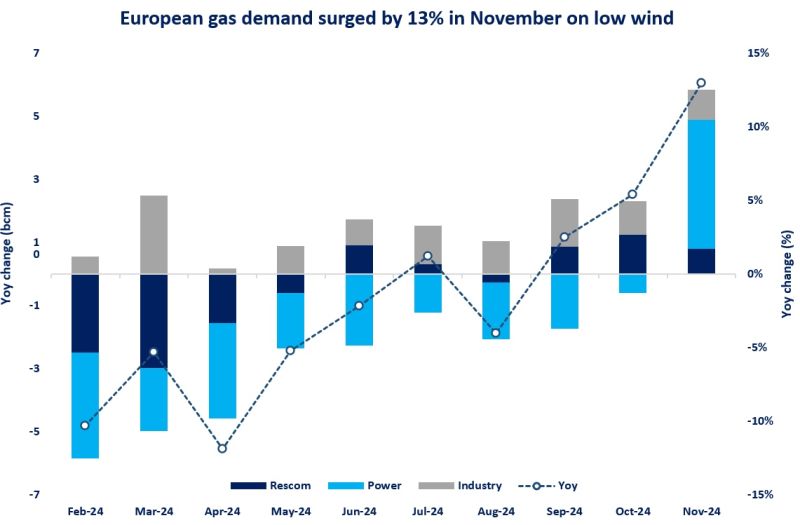

After the steep fall in the first half of the year, global gas demand is showing first signs of recovery and spot prices in Europe are now well above last year’s price levels.

What are the main risks of this fragile recovery? What could be the long-lasting impacts of covid on gas markets? How did LNG contracting trends changed and what does it mean for portfolio players?

Source: Greg Molnar

See original post by Greg on LinkedIn