The European Commission has today proposed a 12-month prolongation of the emergency measures introduced last year in response to the energy crisis provoked by Russia’s invasion of Ukraine and weaponisation of its energy resources.

While the situation on the European energy market is more secure than 12 months ago, the Commission is proposing this extension to further enhance security of gas supply and strengthen market resilience.

The three measures proposed for extension today comprise the so-called gas solidarity measures, the Market Correction Mechanism (MCM) and the rules related to permit-granting for renewable energy projects.

Their continued application now needs to be agreed upon by the Council, in line with the Article 122 procedure.

The solidarity measures under Regulation 2022/2576 support the security of EU gas supply for the winter and are currently due to expire on 30 December 2023.

The current rules establish the legal basis for the demand aggregation and joint gas purchasing system “AggregateEU”.

The regulation also includes measures to provide greater transparency in the LNG market, obliging TSOs to share capacity information, enhancing the capacity of EU LNG facilities.

The regulation also provides a basis for the European Agency for the Cooperation of Energy Regulators (ACER) to set an LNG price benchmark, which provides more comprehensive information to buyers and increases price transparency in the EU’s LNG market.

Similarly, the regulation provides a temporary intra-day volatility management mechanism to limit large price movements in energy-related derivatives contracts.

The final element outlines default rules for solidarity between Member States, where one of them faces security of supply shortages for protected customers.

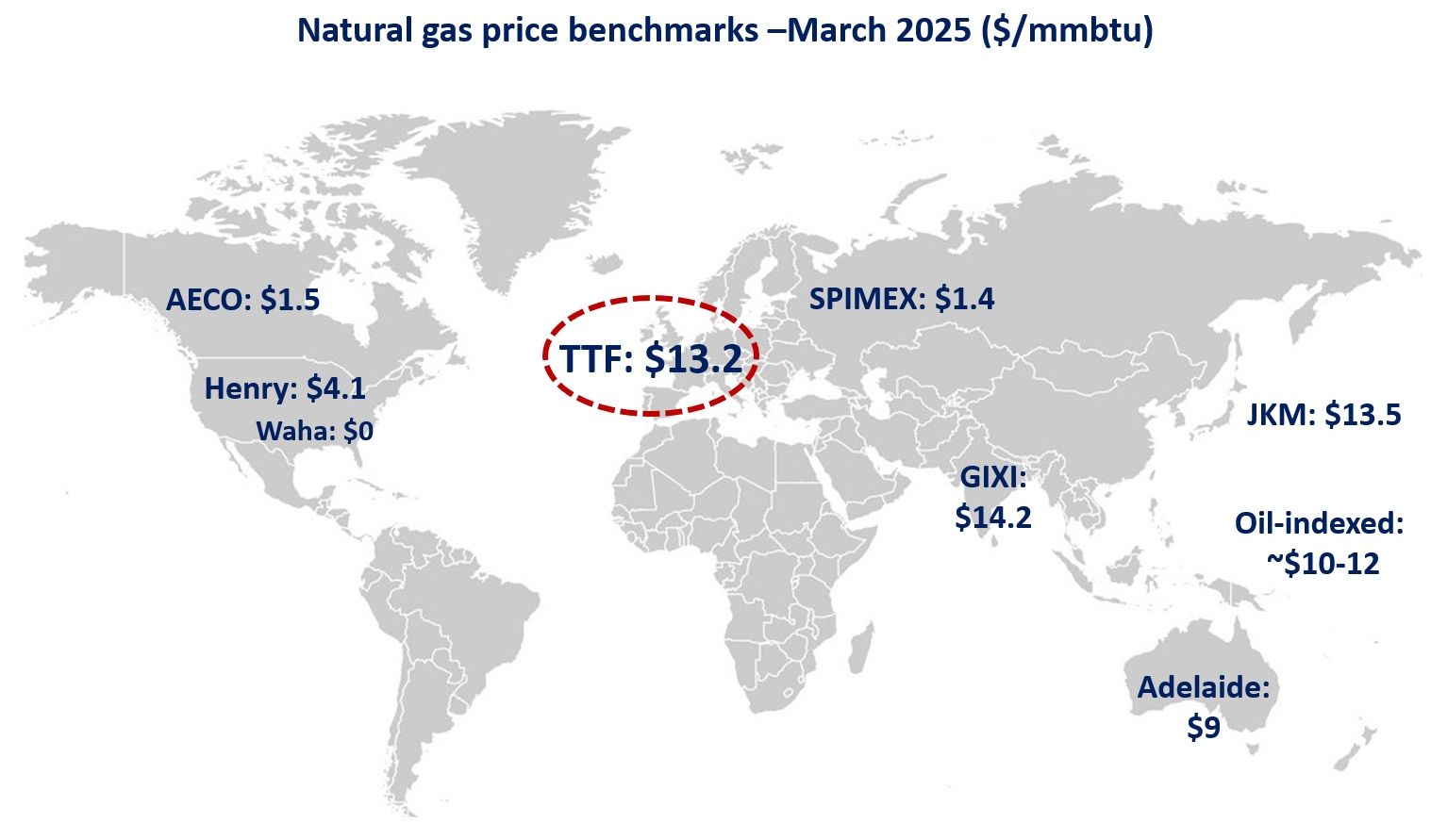

The Market Correction Mechanism was introduced in response to the excessively high prices seen in 2022 and concerns that the EU might face higher prices than other markets around the world to secure gas supplies.

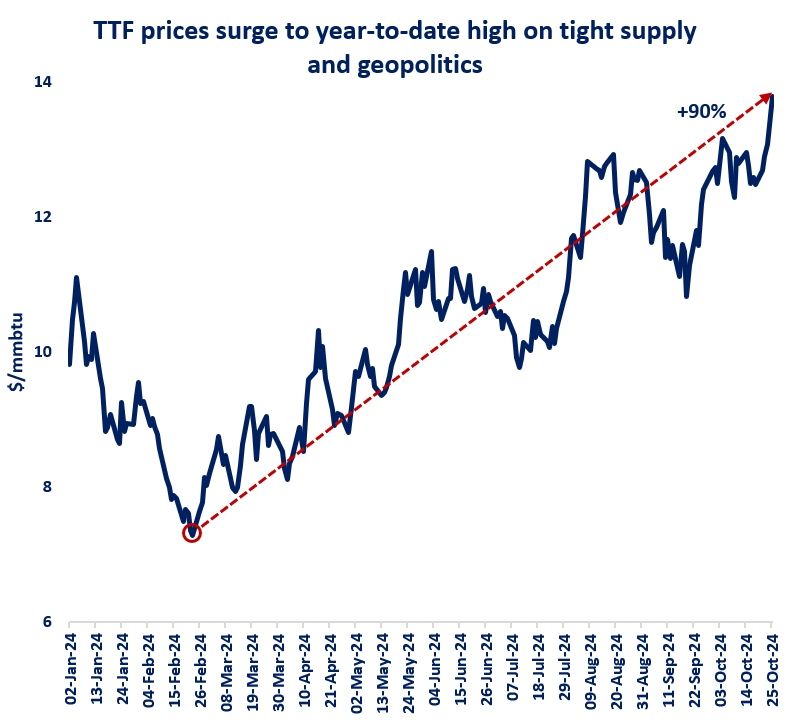

It is due to expire on 1 February 2024. It foresees a dynamic bidding limit which is triggered if the month-ahead Title Transfer Facility (TTF) price exceeds 180 €/MWh for 3 working days and if the TTF price is 35 €/MWh higher than a reference price reflecting prices on international markets for the same 3 working days.

It was agreed by Ministers in December 2022 and entered into force on 1 February 2023. The mechanism has never been triggered and gas prices in 2023 have returned to much lower levels than in the summer of 2022 (currently fluctuating around 45 €/MWh). However, the market remains fragile and has seen a number of episodes of significant volatility in recent months, so the Commission considers that continuing the measures as a necessary additional safeguard for the coming year.

See the complete release by the European Commission