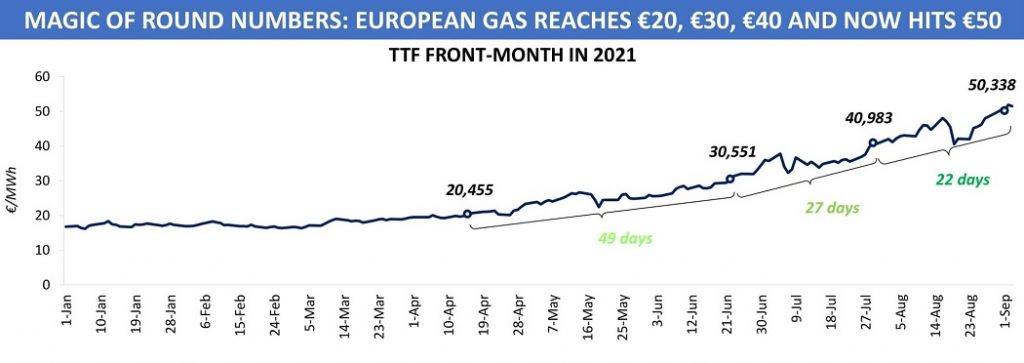

When a commodity reaches another round price level, the number of news stories on that particular product increases tremendously. Last week, this happened with European carbon allowances and natural gas, which took turns in hitting €60/CO2e and €50/MWh respectively. But while the former were practically standing still between May and August, the latter was developing in the last four months as if it got on a high-speed train.

Amid tight supply of both pipeline flows and LNG, the pace of gas price growth has only accelerated during the summer. It took just 22 trading days for the TTF Front-Month contract to rise from €40/MWh to €50/MWh in late August, in comparison with 27 days when going from €30/MWh to €40/MWh and almost 50 days for covering the distance between €20/MWh and €30/MWh.

All the three round levels have been exceeded over the summer period, which once again demonstrates the special importance of this year’s Q2 and Q3 for shaping pricing environment for many months to come. With the UGSs still lacking volumes, players are increasingly concerned about the market balance they will see shortly. If at the beginning of summer 2021 low storage inventories were partly mitigated by expectations of further increase in supply to Europe, it seems there is not much hope for a happy ending as winter approaches.

September’s gas market promises nothing less than a new wave of challenges, given that Norwegian output is restricted due to planned maintenance, LNG prices in Asia continue to rise while the Atlantic hurricane season poses risks for cargo loadings at the US Gulf. Is the sky the only limit for European gas prices in the current situation?

Source: Yakov Grabar

See original post by Yakov at LinkedIn.