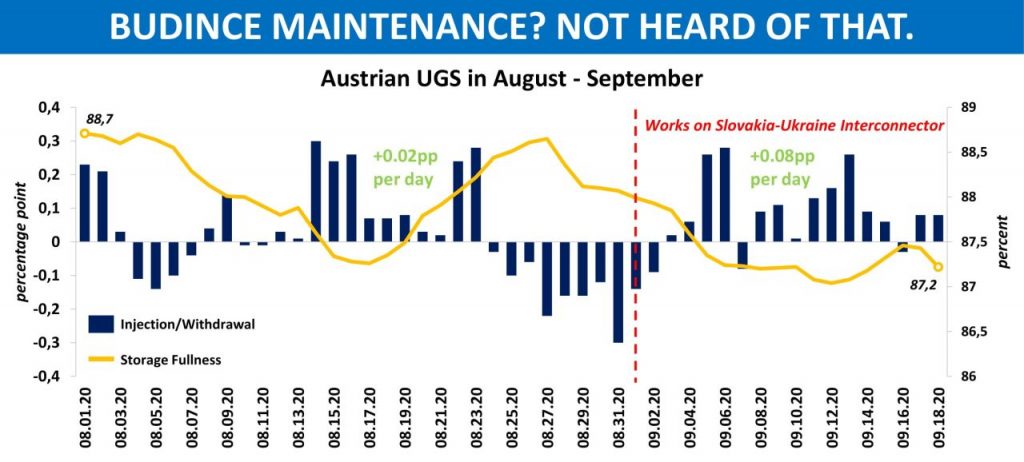

(Yakov Grabar) Business as usual. That is how the activities of market players utilizing underground storages in Austria can be characterized so far in September.

After the maintenance on Budince interconnector had started, traders were expected by many commentators to make a sort of switch from Ukrainian to Austrian capacities which in turn could have supported prices at CEGH.

Not only because that country has the largest working gas volume in the CE region but also because the UGS in Austria were filled by about 10pc less in late August YoY. However, the reality is proving to be more complicated.

The occupancy rate of Austrian storages has actually declined as of 18 September compared both with the beginning and end of August. The average daily net injection rate has risen in September MoM but still remains below even 0.1 percentage point per day.

Given that the works on Slovakia-Ukraine border ends as early as tomorrow, the storages in Austria will likely be less than 90pc full on 21 September vs. 99.2pc a year earlier. Funnily enough, the situation was quite the opposite about three months ago 🙂

See original post on LinkedIn