European natural gas prices surged higher yesterday (August 7). TTF front-month futures settled more than 4.8% higher on the day taking prices to their highest level this year.

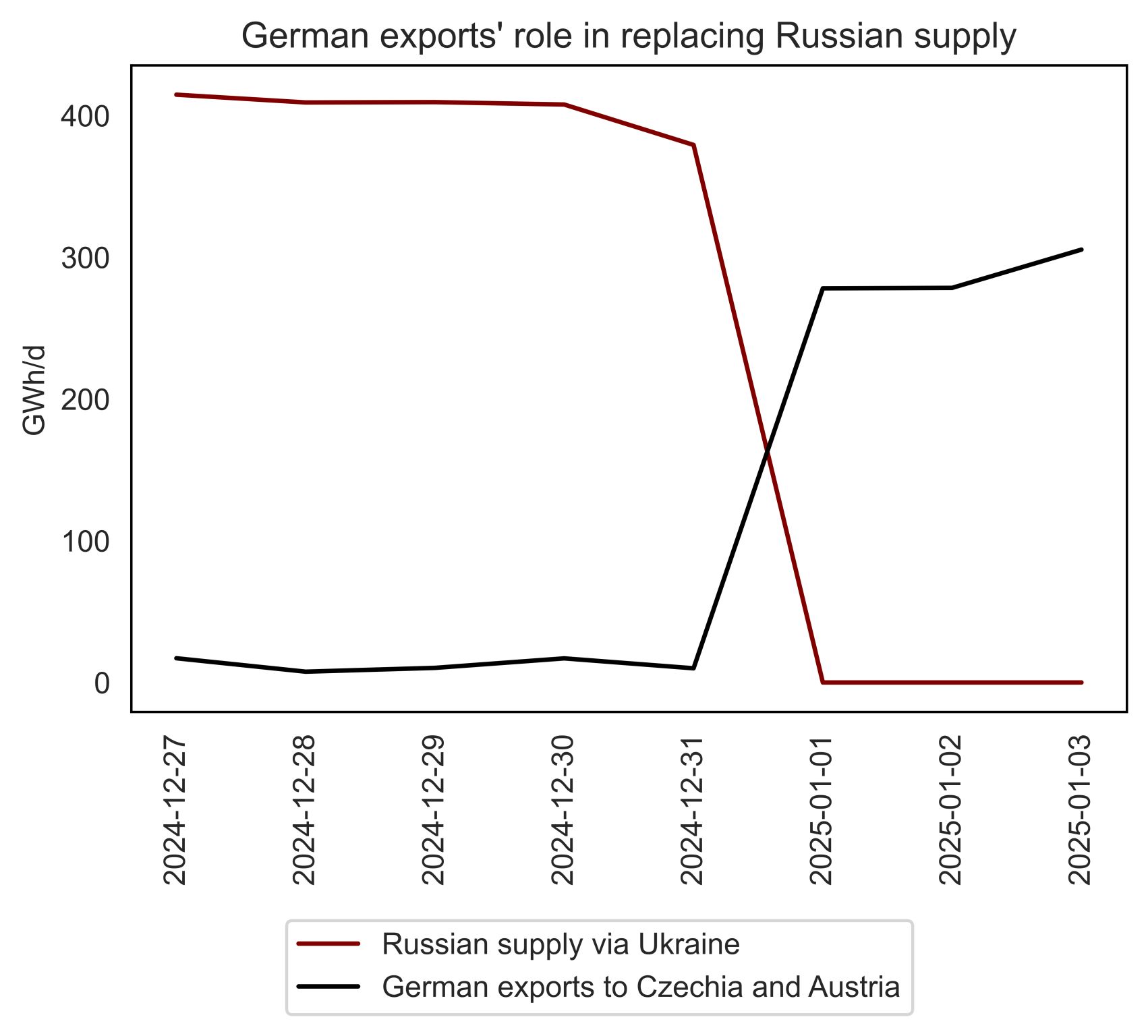

The rally comes after reports that Ukrainian troops launched an attack on the Kursk region in Russia, which has led to a state of emergency being called. There are also some unconfirmed reports that Ukrainian troops captured the Sudzha entry point, which is the only current entry point of Russian pipeline gas into Ukraine, which ultimately ends up in the EU.

Around 42mcm/d of gas comes in via this entry point. If these reports turn out to be true, it increases the risk that we see a more sudden stop in Russian pipeline flows via Ukraine. However, there does not appear to be any disruption up until now.

The market is already bracing itself for an end to these flows at the end of the year when Gazprom’s transit deal with Ukraine expires, but the potential to lose this supply even earlier would be a shock to the system.

This recent development will provide speculators with another excuse to add to their net long in TTF. The latest positioning data shows that investment funds increased their net long by a significant 60.5TWh over the last reporting week to 192TWh – the highest level since September 2021.

Source: ING