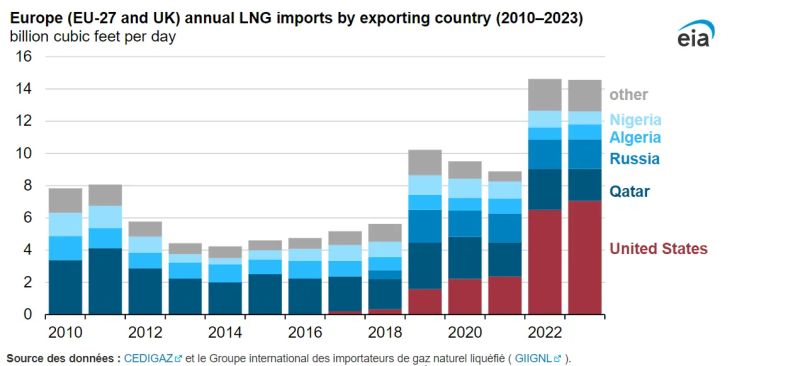

LNG now accounts for 40% of the European Union’s gas imports from alternative sources and suppliers. Last year Qatar remained Europe’s second largest LNG suppliers. The country supplied 14%.

In 2023, Qatar exported 79.8 million tonnes of LNG, of which 15.1 million tonnes (19%) were delivered to Europe, almost exclusively via the Suez Canal.

Over the 60 weeks from the week beginning January 2, 2023, to the week beginning February 19, 2024, Qatari LNG exports range between 1.19 and 1.82 million tonnes, with an average of 1.54 million tonnes, which can be considered a “normal” level of Qatari LNG exports.

Among these weekly export volumes from Qatar in 2023, an average of 0.29 million tonnes was delivered to Europe and 1.24 million tonnes to Asia.

The continuation of exports to Europe suggests an acceptance of diversion via the Cape of Good Hope, although weekly shipments to Europe have drastically decreased since the beginning of the year.

This is because cargoes are being redirected to other markets, notably Asia, and the longer journeys are starting to negatively impact effective maritime transport capacity.

While the sailing distances to Northwestern Europe and Northeastern Asia are comparable when the Suez Canal is available, the difference between the two is striking when deliveries to Europe require a voyage around the Cape of Good Hope.

The journey from Qatar to Rotterdam takes 17 days via the Suez Canal but 29 days via the Cape of Good Hope. From Qatar to Asia, it takes 13 days to Hong Kong and 17 days to Tokyo via Sri Lanka and Singapore.

The LNG trade between Qatar and Europe is experiencing a significant shift, with Europe accounting for only 10% of Qatar’s LNG exports so far this year, down from 20% during the same period last year (Q1 2024 compared to Q1 2023). In the first three months of 2024, Qatar has realigned its export strategy towards closer destinations, specifically China (25%), India (17%), Pakistan (11%), and Kuwait (5%).

Qatar’s LNG shipments to Europe have decreased, falling to 870,000 tonnes in May, the lowest since August and down from a recent peak of 1.23 million tonnes in January.

But they could recover as Kpler is tracking exports of 1.02 million tonnes of LNG to Europe so far for the month of June, and a continued recovery in volumes to Europe could reduce those available at discounted prices to India and Pakistan.

However, Asian LNG imports show a contrasting dynamic in May.

Indeed, the recent rise in spot prices may start to impact imports in South Asia starting from July, as well as in China, where a rise of over $10 per mmBtu makes LNG competitiveness challenging in the domestic market.

There may be early signs of this phenomenon, with Kpler having tracked 1.13 million tonnes of arrivals in June so far, more than half of which came from the United States, meaning these cargoes would have been secured at pre-recent hike prices.

Source: Vincent Barret