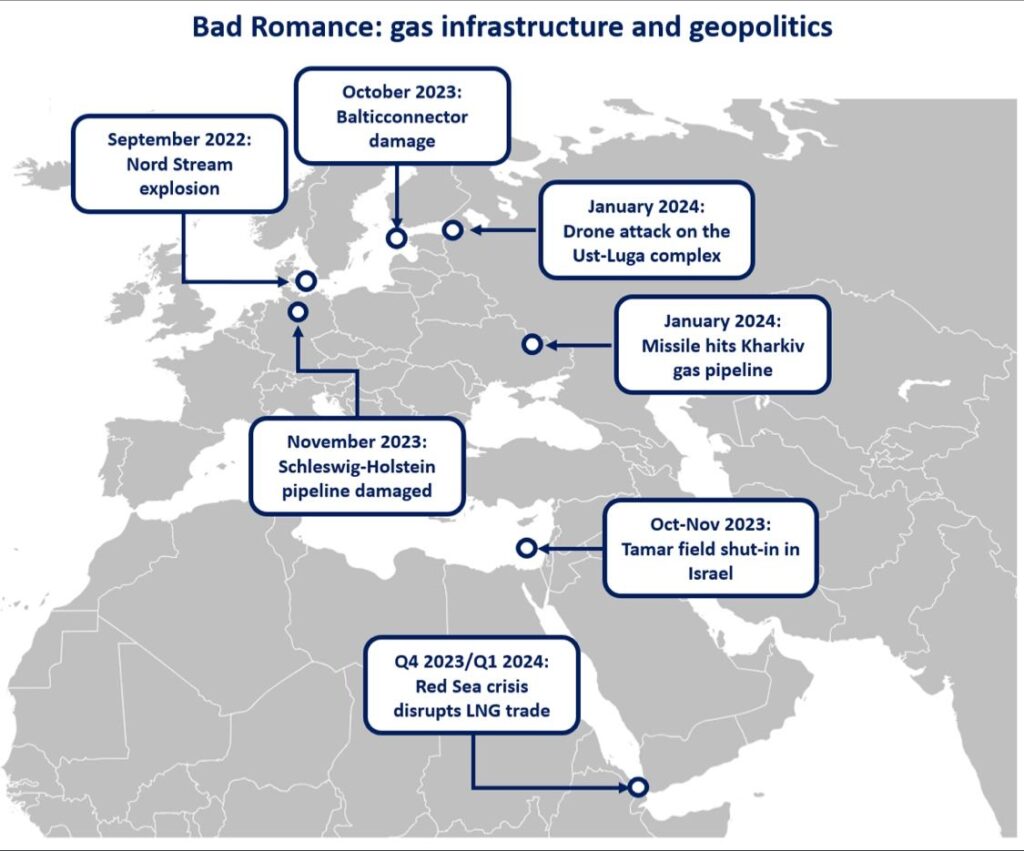

Geopolitical tensions remain the most important risk factor to natural gas markets in the coming years, as a more fragmented world is shaping up, with profound implications to energy and gas trade.

The Red Sea crisis disrupted LNG flows from the Middle East, leading to lengthier (and more costly) shipping routes. and while LNG trade dried up along the Red Sea, it did not lead to an actual reduction in LNG supply. the Strait of Hormuz would be a completely different story, with around 20% of global LNG supply transiting, and no alternative routes to market…

Piped gas transit via Ukraine remain at risk, as the full scale war continues and a firm transit agreement post-2024 remains highly unlikely.

And of course, the damage caused to pipelines in the Baltic Sea (Nord Stream, Balticconnector), in northwest Germany (Schleswig-Holstein) is a stark reminder that vigilance on critical infrastructure needs to be reinforced.

In 2023 we observed the global gas market rebalancing and demand growth is expected to return in 2024. however, geopolitics can easily renew market tensions, fuel price volatility and lead to immediate supply concerns (as in Egypt following Tamar’s shut in).

In this unfortunate context, gas and energy supply security should remain at the forefront of policy making and the international dialogue between produces and consumers should be reinforced.

Source: Greg Molnar