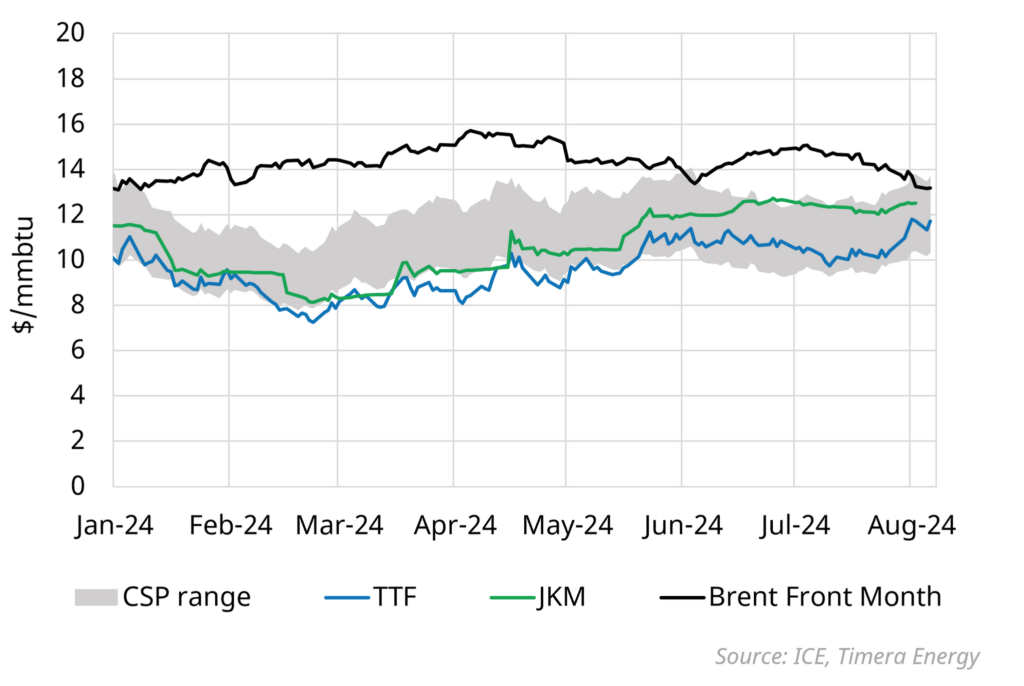

TTF front-month prices surged above 12 $/mmbtu (~38 €/MWh) this week, reaching their highest levels since December 2023. This increase occurs despite ample European storage levels, and persistently weak gas demand across the continent.

Both JKM & TTF front-month prices strengthened across Q2 due to a combination of resurgent Asian demand and LNG supply disruptions. Price levels had been range-bound for much of June & July until the latest upward move, seemingly spurred by rising tensions in the Middle East and Ukraine.

These tensions have yet to directly impact market fundamentals, but market participants are concerned about the risks of either an early cessation of Russian flows through Ukraine, or a disruption to Israeli gas exports further tightening the global balance going into this Autumn.

TTF is now trading towards the top of the European Coal-to-gas Switching channel, a key source of demand flexibility which (along with Asian industrial-switching) will likely cap the extent of any further price rally.

Source: Timera Energy