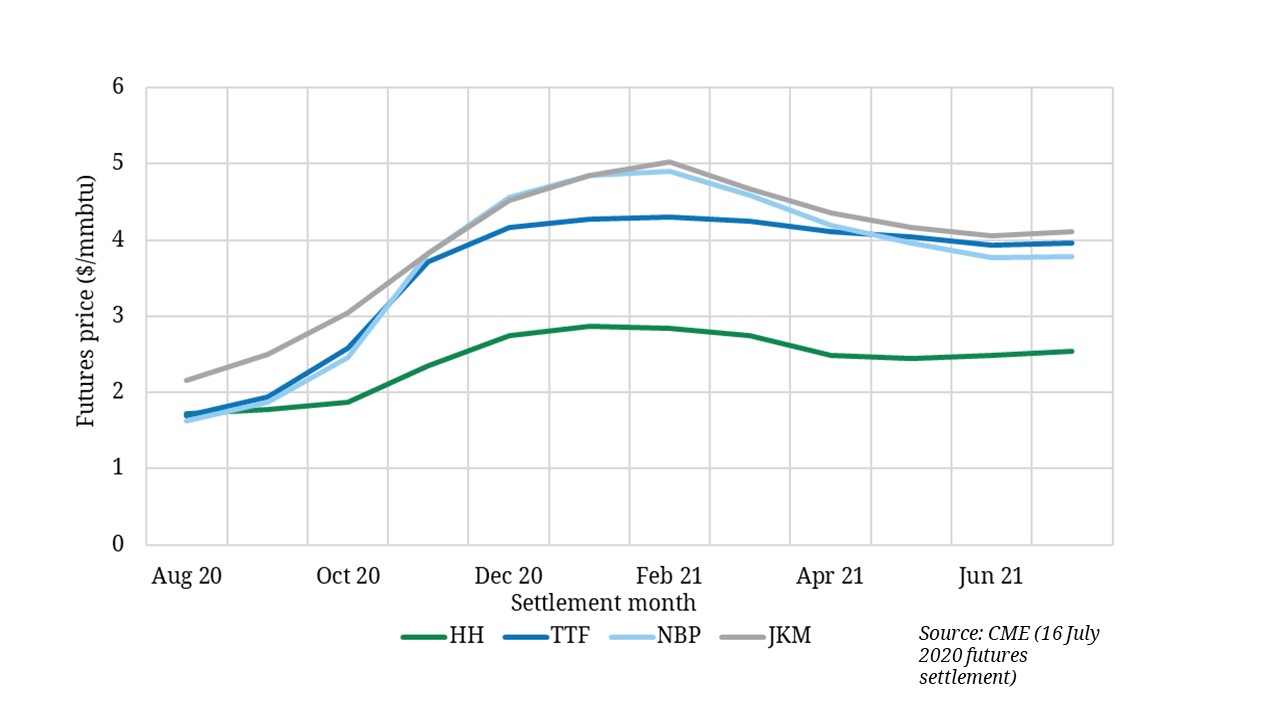

It is unlikely that the charts below can surprise anyone familiar with the matter, but they largely explain the current market environment.

A combination of powerful factors emerging in Q4 ’20 has resulted in Asia’s complete dominance over alternative directions of LNG spot supply this year.

The first half of January witnessed a further widening of spread between Platts JKM marker and NWE/MED prices for LNG to unbelievable $17/MMBtu on average, which in fact caused sellers to lose interest in non-Asian routes.

Netherlands have received only one spot cargo so far this month, while the last shipment to Belgium was loaded in early Nov ’20. Similarly, spot supplies have rarely made their way to other major regional LNG terminals in 2020.

Europe has been deprived of flexibility, so much needed in the deep of winter. As a result, gas from the UGSs enjoyed greater demand, and a sort of market rebalancing started.

The availability of LNG spot cargoes, together with pipeline supplies and weather patterns, will primarily shape the fundamentals in the next two months.

With regard to LNG part of that equation, the utmost attention will be given to the latter half of Q1, as one can hardly expect large inflows until at least the second part of Feb.

Source: Yakov Grabar

See original post by Yakov at LinkedIn.