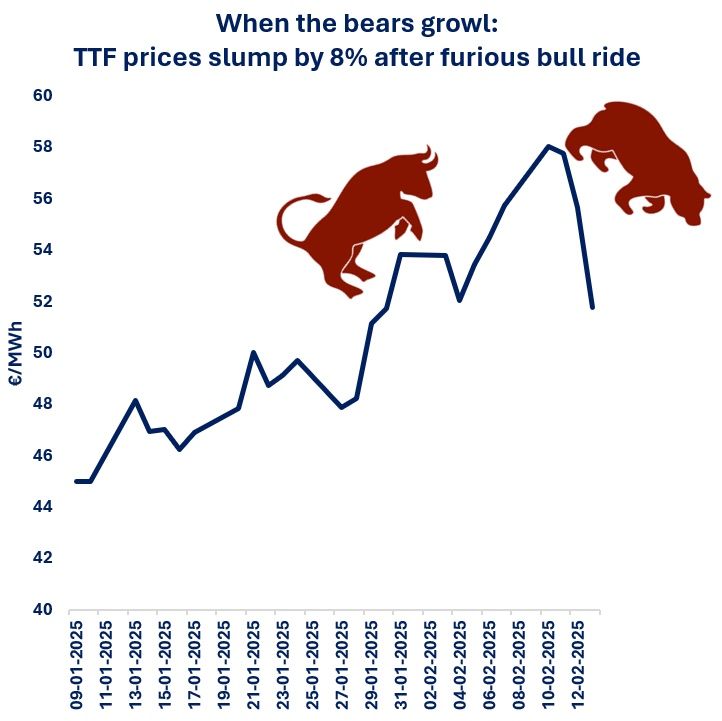

When the bears growl: TTF prices slumped by near 8% today, their steepest decline in more than a year.

As always several factors were at play:

(1) EU storage targets: there is a growing call from Member States (including France and Germany) to loosen the EU’s storage fill targets. And while TTF prices plummeted, seasonal price spreads improved from -€5/MWh last week to €2/MWh, as the market now expects less injections pressure;

(2) Peace talks: President Trumps announcement on potential peace talks with Putin is bringing back questions on Russian gas, which might be part of the bargain package;

(3) US LNG breaking new records, with Plaquemines LNG ramping up its operations;

(4) Hoarding: with TTF rising to its highest level since Apr23, many market players might fell that this is the right moment to cash.

What is your view? How will EU prices move in the comings weeks? Geopolitics and policy announcements are set to drive price dynamics? Bulls or bears?

Source: Greg MOLNAR