Natural gas prices continued to soften in March across all key markets amidst improving supply availability and high storage levels.

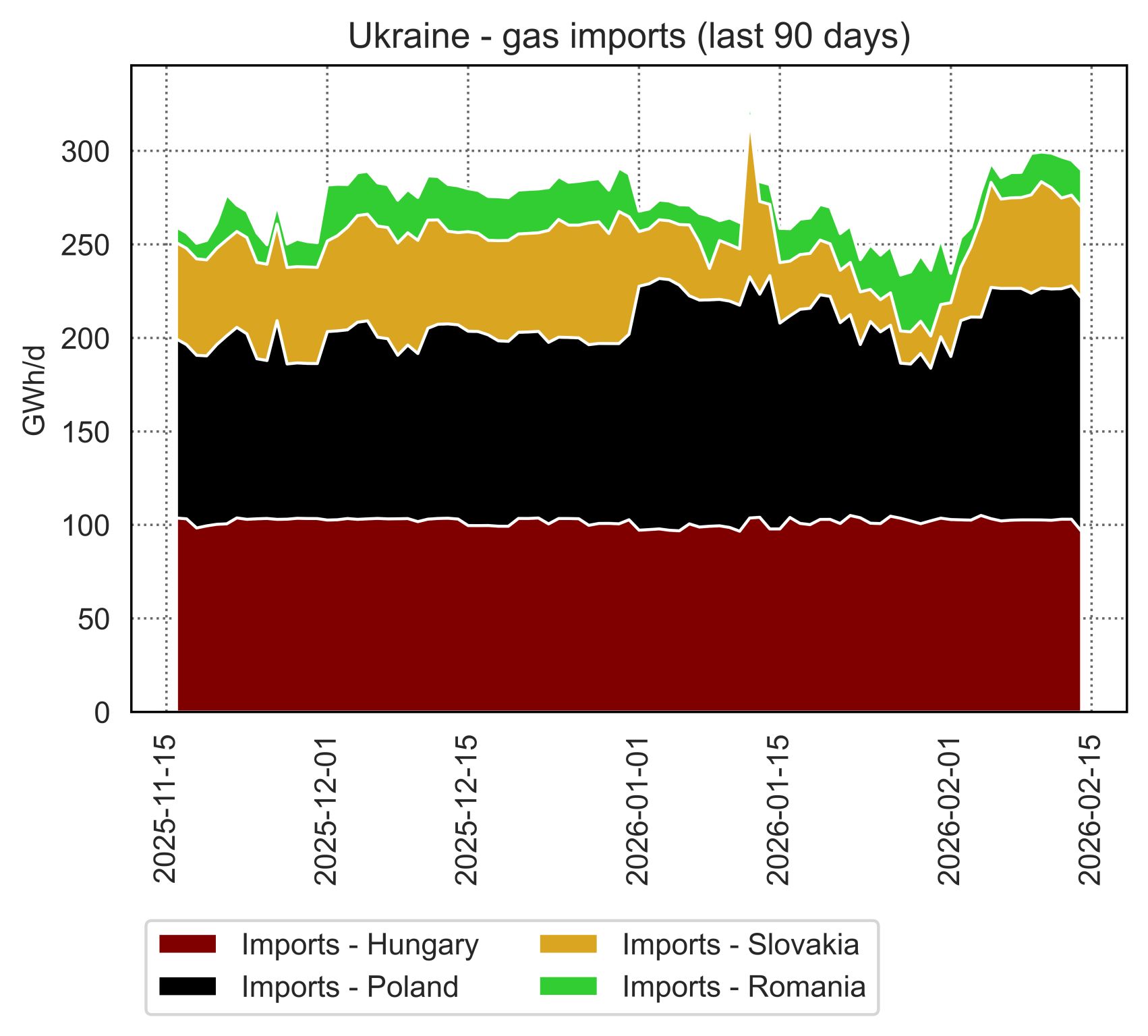

In Europe, TTF prices dropped by close to 70% yoy to average at $14/mmbtu, despite a Russian piped flows now down by 80% on the year.

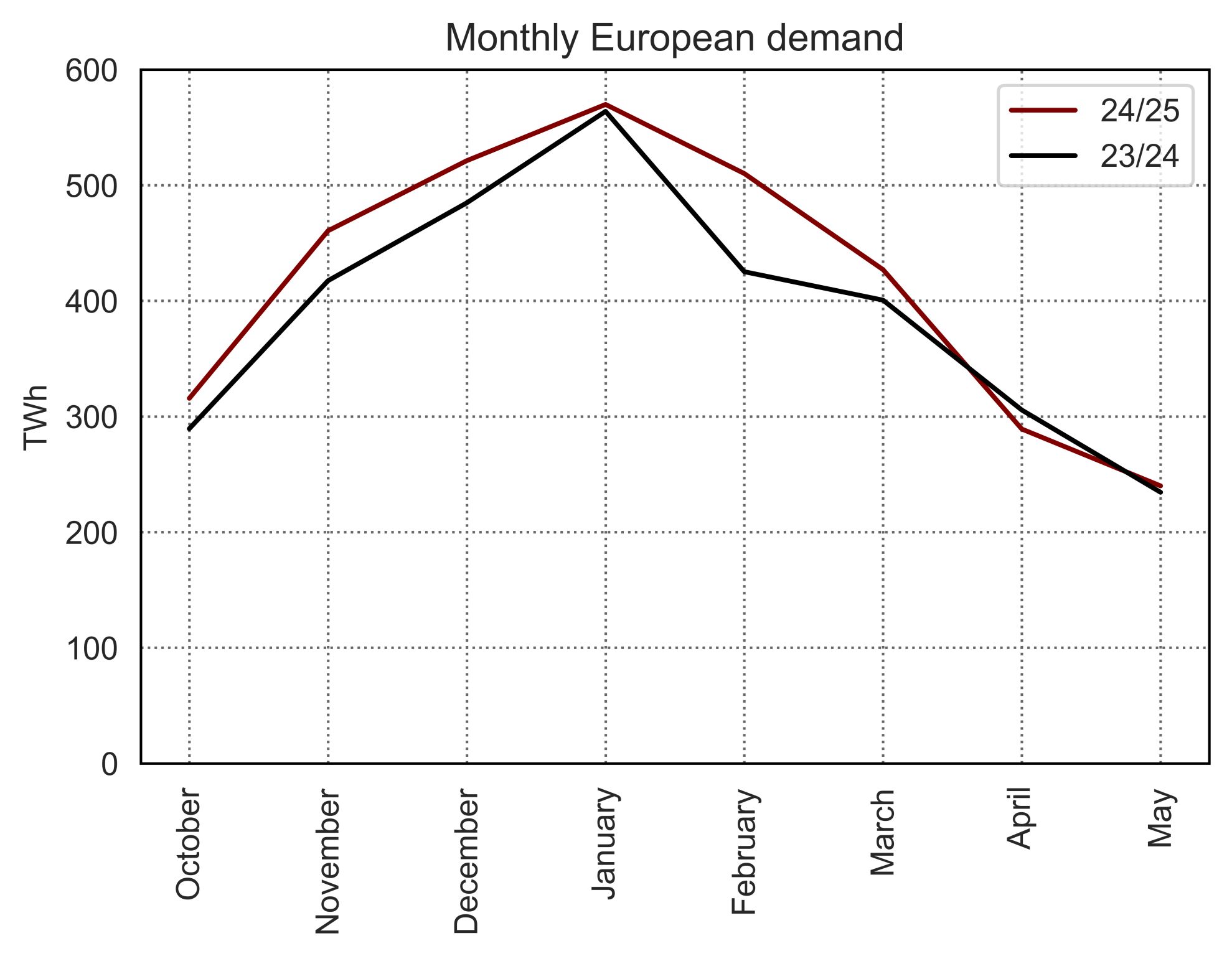

Lower demand (-14%) together with strong LNG inflow (up by 25%) and very high storage levels continued to provide downward pressure on prices, which are now falling into the coal-to-gas switching range.

In Asia, JKM prices followed a similar trajectory, down by over 60% yoy to an average of $13.5/mmbtu. hence, spot LNG prices are sliding back to the range of oil-indexed LNG – for the first time since summer 2021.

We also start to see some demand resurgence from China – with LNG imports up by 10% yoy, although remaining well-below its 2021 levels.

In the US, Henry Hub prices more than halved compared to last year, and fell below $2/mmbtu by the end of March – their lowest level since Sep20.

Strong production growth (up by 7%) and high storage levels continued to depress gas prices.

What is your view? How will gas markets evolve through the injection season? Could we see a rebound in prices?