New month, new highs: gas benchmarks continued their bull run in July across all key gas markets.

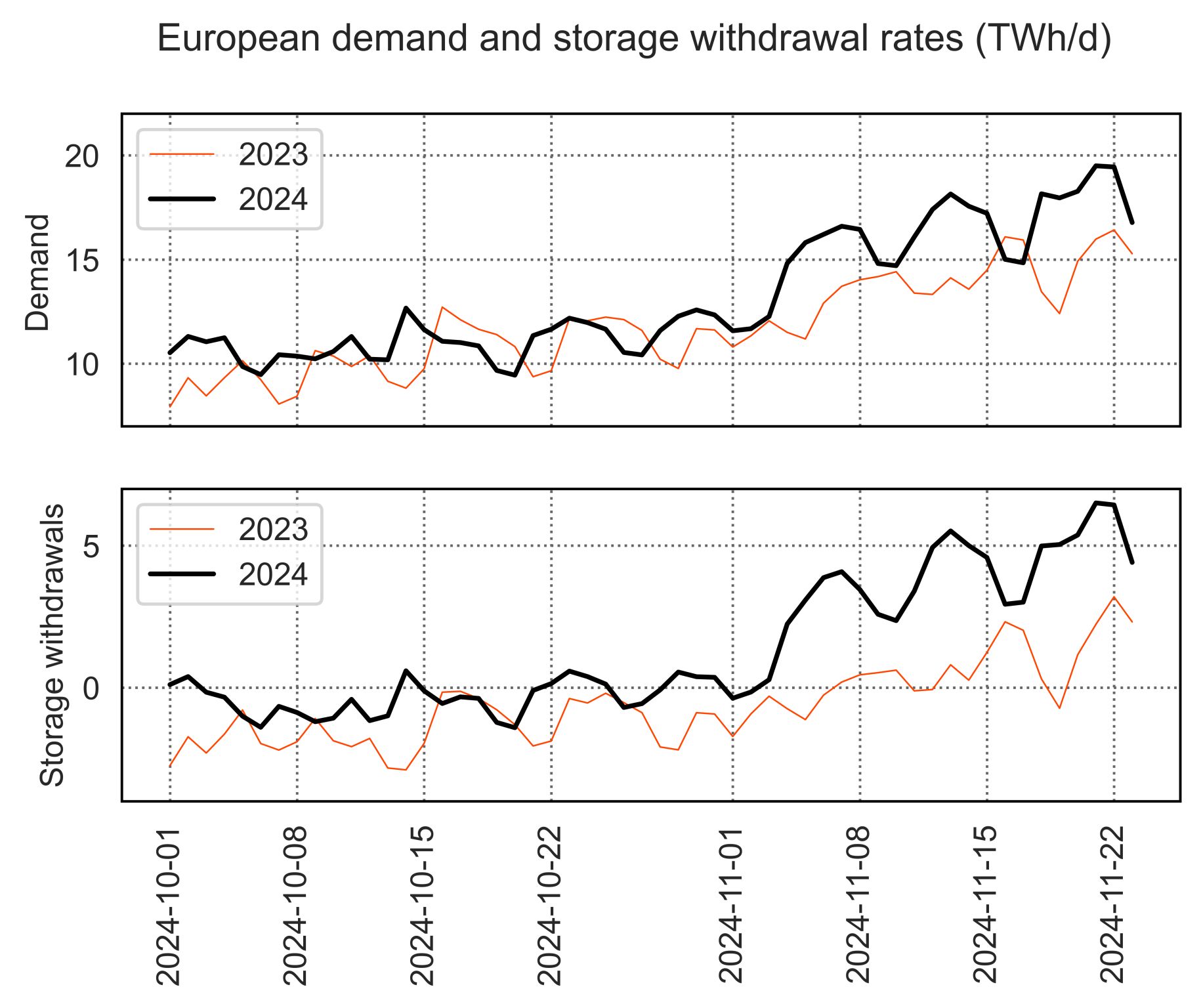

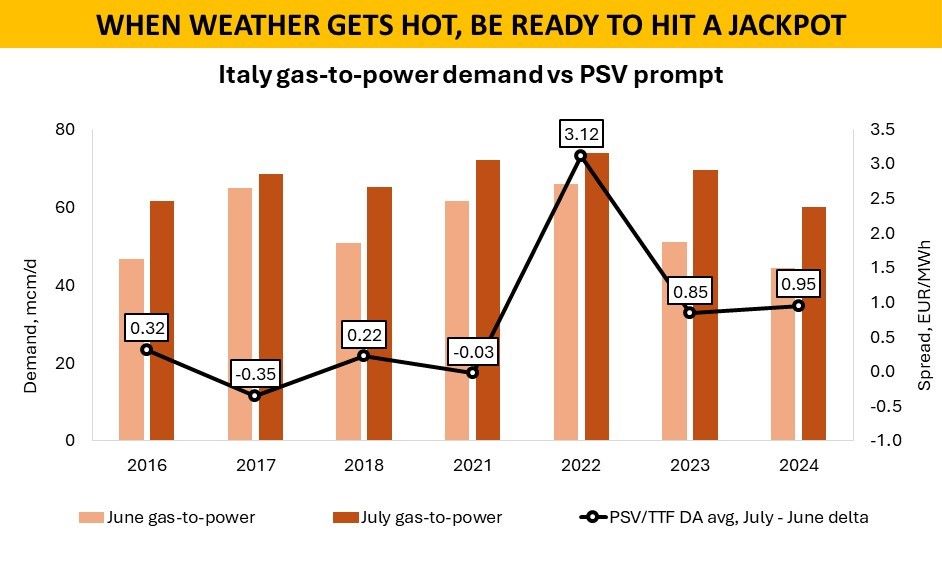

In Europe, TTF rose by more than sevenfold compared to last year lows, to $12.5/mmbtu -its highest July price on record. strong drop in LNG inflow (down by 20%), muted response from Russia and Norway (both up by 5%), low storage levels and low wind generation all supported the strong gains on TTF. Meanwhile we start to see the first signs of demand response to high prices: EU+UK demand was down by 8%, mainly due to lower gas burn in the power sector.

In Asia, JKM jumped by 20% compared to last month, up to $13.8/mmbtu -its highest July since 2013. Heat waves and fierce competition for cargoes with Europe continues to drive JKM gains. We could start to see some demand response from the more price sensitive markets, including India where LNG imports dropped by 20% yoy in July. Meanwhile, oil-indexed contracts are trading at about 30% below spot.

In the US, Henry climbed to $3.8/mmbtu, more than doubling from last year. This is despite lower gas-fired powgen (down by 3% yoy) and largely driven by booming LNG exports (more than tripling) and higher piped flows to Mexico.

In Australia, the winter season coinciding with outages at key production facilities on the east coast (e.g. Longford) sent spot prices to record highs, with Adelaide hitting an average of $13.5/mmbtu.

What is your view? Will the summer bull ride continue, or could we see some readjustment as demand response starts to kick in?

Source: Greg Molnar

See original post by Greg at LinkedIn.