Russia’s invasion of Ukraine is reshaping global gas markets and putting security of supply at the top of gas importing countries’ agenda.

Europe: gas storage essential for security of supply and market resilience

New EU regulation requires that stocks levels are filled ahead of winter, at least at 80% by 1 November 2022, and 90% the subsequent winters.

Increased supply of LNG, mainly from the US, and gas by pipeline from Norway and Azerbaijan, together with demand reduction, have enabled Europe to fill its stocks at 95% of their maximum working gas capacity on 1 November 2022.

European countries are reopening storage facilities (Rough in the UK) and investing in UGS expansion (Poland).

Despite difficult conditions, Ukraine has filled its UGS

Russia: Reduced exports led to fast replenishment of gas stocks

Pivot to the East strategy requires a significant development of the gas transmission and UGS facilities.

But China may not want to rely too heavily on a supplier that has shown a willingness to use gas as a political weapon.

US growing demand and exports lead to lower stock levels

Growing LNG exports and rising domestic consumption have led to lower stock levels all along 2022, putting pressure on the HH price.

Higher injection rates in September and October 2022 have reduced the storage deficit, reducing spot prices. This trend is expected to continue after winter2022/23.

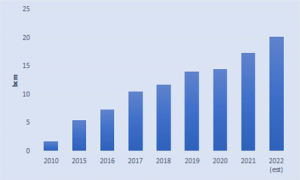

China: Significant increase in storage capacity

The global gas crisis has reinforced the acceleration of UGS construction with significant increases in working gas capacity in 2021 and 2022. Working gas capacity totalled more than 20 bcm at the end October of 2022.

Total gas storage capacity is expected to reach 55 bcm to 60 bcm in 2025 (of which 32 bcm of working gas capacity in UGS), accounting for around 13% of expected natural gas demand.

Source: Cedigaz

Central and South America advances UGS projects

Brazil is building the first UGSs in the country, while Mexico has revived its previous gas storage policy, including the building of strategic storage of natural gas.

The Middle East is expanding its storage market

The storage market is expanding in the Middle East.

Sharjah opened the second UGS facility of the Emirates at the beginning of 2021 (Moveyeid gas storage).

Saudi Arabia is building its first UGS facility, the Hawiyah Unayzah Gas Reservoir Storage (HUGRS).

Source: Cedigaz