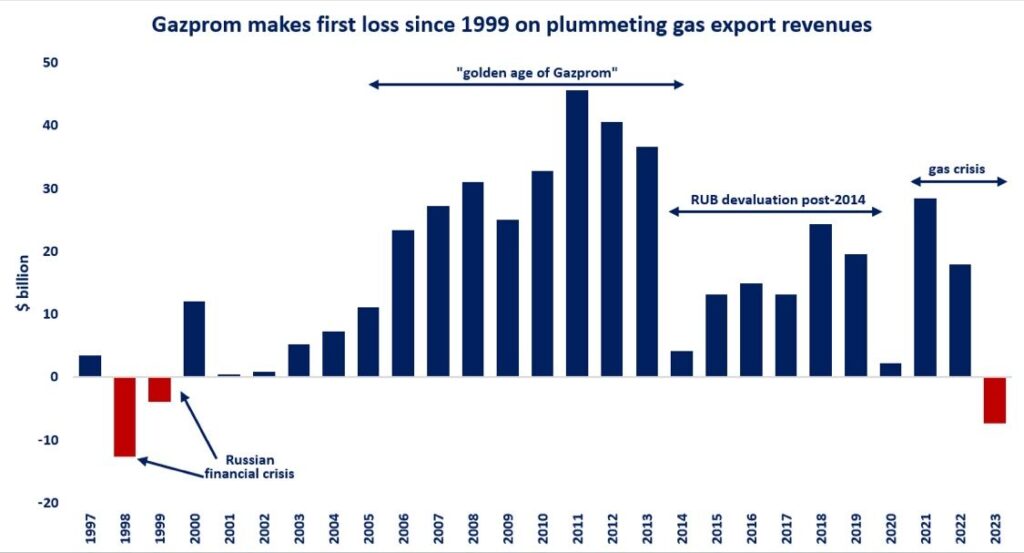

Gazprom made last year its first loss since 1999, the great Russian financial crisis.

Russia’s Gazprom made a loss of around $7.4 billion in 2023, according to the company’s most recent financial report. this comes after a year of record high (RUB denominated) profits in 2022.

the company’s gas sales revenues more than halved, due to: (1) lower export volumes to Europe and (2) steep decline in export prices as the European and global gas market moved towards a gradual rebalancing.

Gazprom was Russia’s most successful company, which remained profitable even during the years of the global financial crisis. its solid upstream base, long-term portfolio contracts and European customers formed the basis of this successful and lucrative business model.

Gazprom becoming a loss making company highlights several facts, including:

(1) Russia was not able to replace its European customer base: the extra sales to China and Central Asia don’t make up for the lost European market;

(2) the profitability of the Russian gas market is low and probably not sufficient to cover investment costs (especially if the great gasification programme continues);

(3) profits turning to losses could undermine Gazprom’s diversification plans away from Europe (and make it more reliant on external, primarily Chinese, financors);

(4) Russia is not winning the energy war against Europe, on the contrary: while Europe’s gas market rebalanced the financial pains of Gazprom increased.

Source: Greg Molnar (LinkedIn)