Utilisation of European import terminals remained high in April. The Covid-19-crisis did not have a visible impact on utilisation rates so far. The global oversupply of LNG and the weak demand from Asian buyers led to significant volumes being dumped into the European market.

The average daily send-out from terminals was about 3,470 GWh/d (Q1’2020: ~3,420 GW/d). Especially the Northern European terminals in France, the Netherlands, Belgium and Poland recorded high utilisation rates of over 65%. The average daily send-out rate increased compared to the previous as well as the previous-year quarter. With exception of the Italian terminals utilisation at Southern European terminals decreased slightly.

Unlike pipeline gas flows, that had been likewise very stable since the beginning of the year, LNG flows have a certain sluggishness inherent in their nature. Market participants likely have reacted to the global oversupply situation and the thereto related low price environment by now.

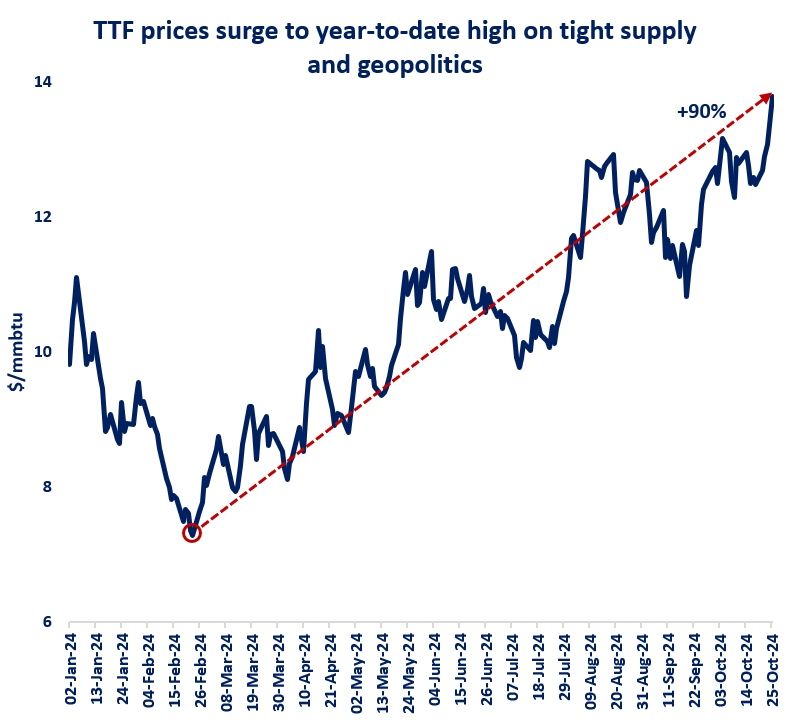

The TTF front month contract lately traded below 6 EUR/MWh (04.05.2020) and recently traded repeatedly below the US natural gas lead index Henry Hub (front month contract closed at 6.29 EUR/MWh (1.993 USD/mmBTU) an 04.05.2020).

Cancellations of US cargos to be delivered in June were reported lately. In light of the current low price level, weak demand and European gas storages being filled above average for this time of the year, it is likely that a decrease in send-out rates from European LNG terminals will now be observed in the coming weeks.

Source: Team Consult (Germany)