European gas prices reached new all-time highs yesterday, still supported by concerns over a potential disruption in Russian gas deliveries in the near future while European gas stock levels are at historically low levels.

However, German Chancellor Scholz dismissed this possibility, saying Europe needed Russian energy to ensure security of supply. Yesterday, Russian gas supply continued to flow, averaging 263 mm cm/day, compared to 267mm cm/day on Friday.

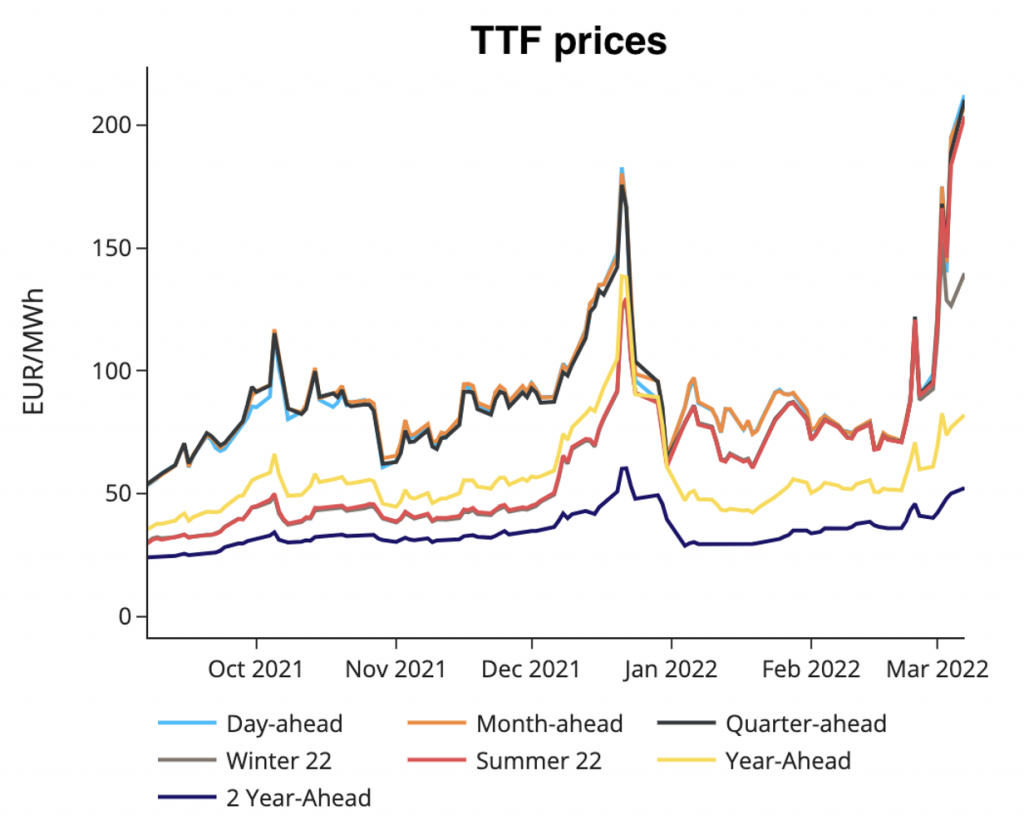

At the close, NBP ICE April 2022 prices increased by 79.260 p/th day-on-day (+17.22%), to 539.530 p/th. TTF ICE April 2022 prices were up by €34.65 (+18.00%), closing at €227.201/MWh. On the far curve, TTF ICE Cal 2023 prices were up by €9.40 (+12.46%), closing at €84.819/MWh.

In Asia, JKM spot prices increased by 83.33%, to €270.986/MWh; April 2022 prices increased by 34.85%, to €162.763/MWh.

TTF ICE April 2022 prices reached an intraday high at €345/MWh yesterday, before weakening.

The trend remains strongly upward this morning after the Russian deputy Prime Minister Alexander Novak threatened to cut off Russian natural gas supplies to Europe through the Nord Stream 1 pipeline, and the rise in Asia JKM spot prices (suggesting Asian buyers are not ready to leave to their European counterparts the few available flexible cargoes) does not contribute to alleviate it.

There is still a hope to see prices come back inside their “normal” trading range. Unfortunately, we do not know when, and every day, this trading range increases.

Finally, market players should also focus today on the proposals of the EU Commission to reduce the dependency on Russian gas imports, with reports of a 80% cut target for this year

Source: EnergyScan