Many words have already been said on the impact that robust European LNG imports had on the region’s supply/demand balance in early 2022. But amid increased deliveries of seaborne cargoes to Europe another key gas exporter gets undeservedly little attention, even though it also has managed to fully seize the opportunities presented by the high-price environment. I am of course referring to Norway.

As gas hub prices reached record highs in Q4 2021, just as another period of seasonal maintenance on the NCS had been finished, Norway immediately maximized exports from its fields. Not surprising given that around 70pc of Equinor’s gas sales are day-ahead indexed with the remaining 30pc being tied to month-ahead prices, the company said during its quarter earnings conference call on 9 February.

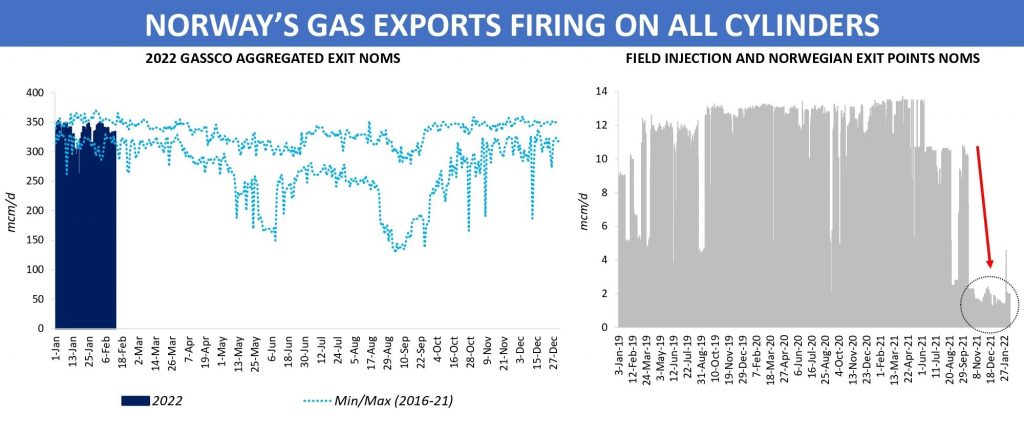

Norwegian gas supplies rose year-on-year by more than 10pc in Q4 2021, while the average quarterly gas flows from the NCS to continental Europe and the UK surpassed 320 mcm/d for the first time since Q1 2019. In early 2022, exports from Norway remained close to the previous quarter’s level and if it had not been for some unplanned issues at Troll in January 2022, last month’s flows might even have exceeded those of December 2021 which amounted to approximately 335 mcm/d.

Among many indicators, there is one that illustrates particularly well to what extent Norwegian export capacity has been recently utilized. You just need to have a look at gas field injections and deliveries to the country’s exit points, which in the context of sky-high prices slowed down on average to below 2 mcm/d in the period from mid-October 2021 to mid-February 2022. To put it into perspective, between early 2019 and mid-October 2021 the amount of gas injected into the structure of fields and delivered to Norway’s exit points averaged almost 11 mcm/d.

Unless there are unscheduled outages on the production fields, Norwegian gas exports should remain elevated up to the end of April when the first batch of 2022 annual maintenance is planned at the country’s assets.

Source: Yakov Grabar (LinkedIn)