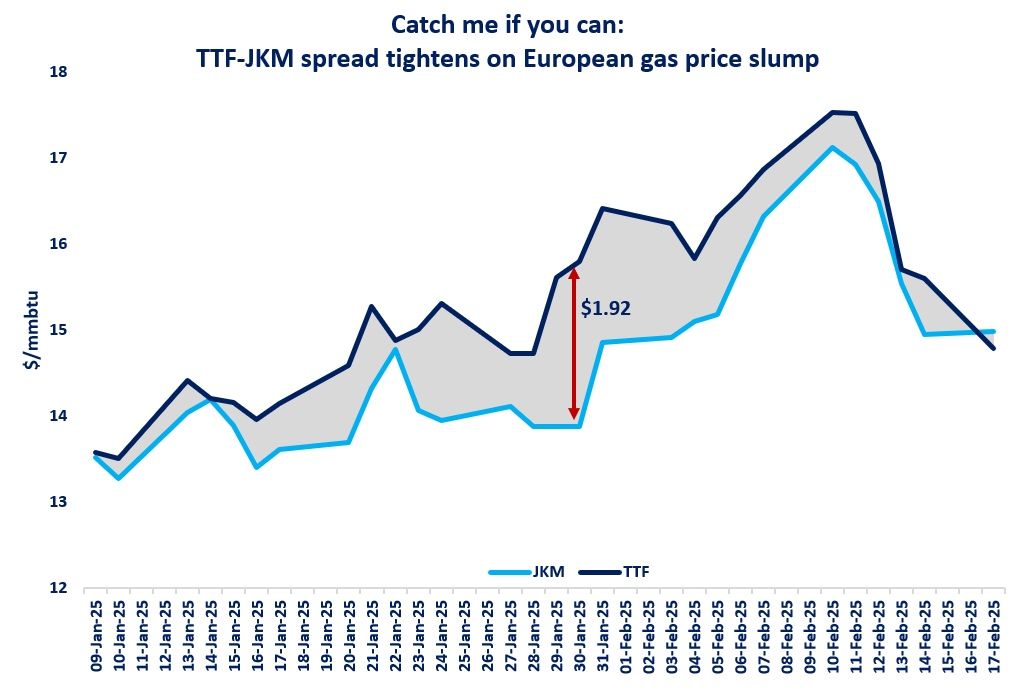

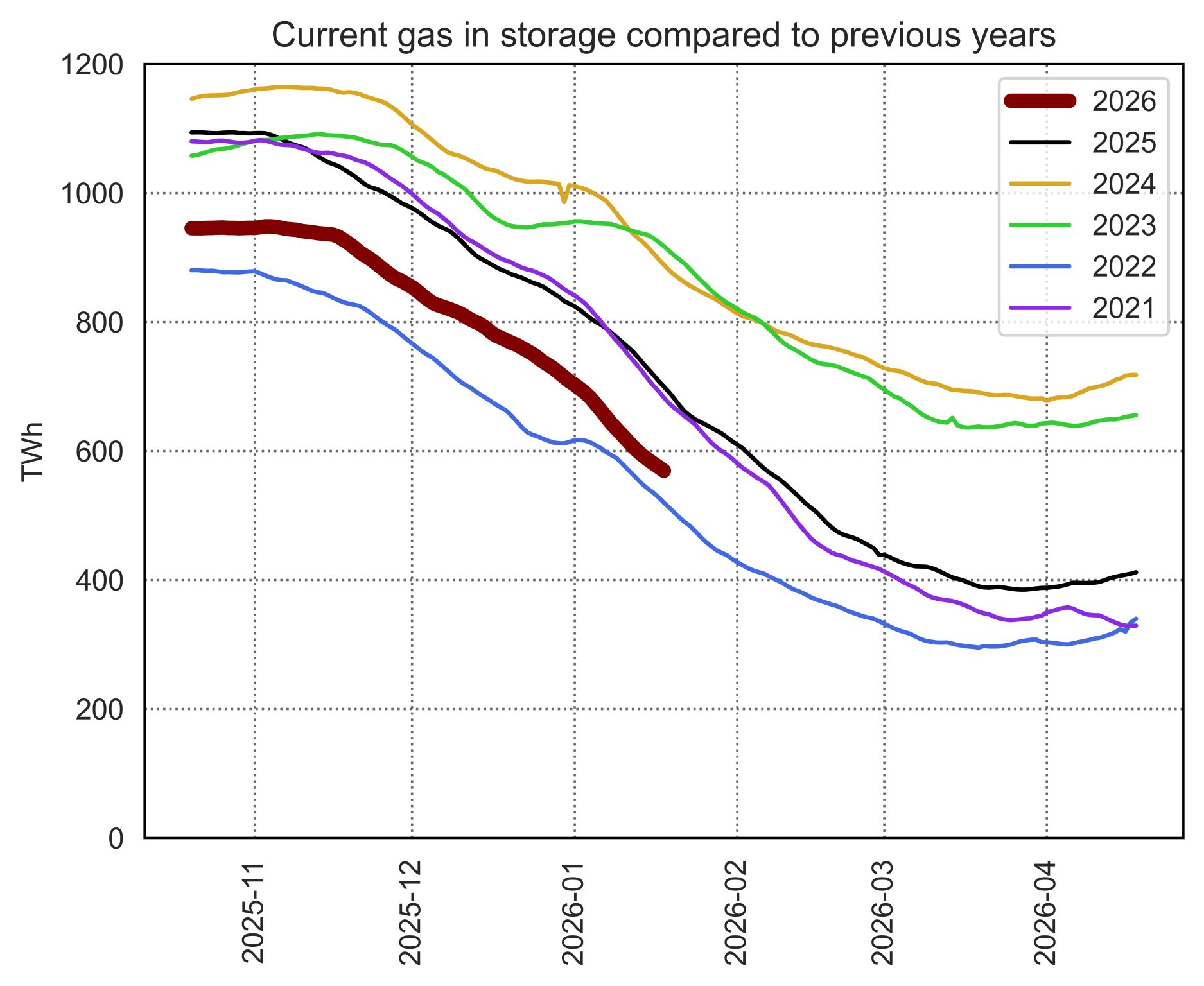

European gas prices weakened again yesterday, under pressure from the (slight) improvement in storage levels and weaker Asia JKM prices (-8.93% on the spot, to €85.705/MWh; -1.71% for the February 2022 contract, to €100.234/MWh; -1.80% for the March 2022 contract, to €84.234/MWh).

Indeed, Indonesia government eased yesterday the coal export ban, allowing 14 coal vessels to depart as soon as they got permits from mining and transport authorities. The government will conduct a review on Wednesday to decide if it scraps the ban.

On the pipeline supply side, Norwegian flows weakened to 341 mm cm/day on average yesterday, compared to 348 mm cm/day on Friday. On their side, Russian supply increased slightly, averaging 188 mm cm/day on average, compared to 185 mm cm/day on Friday.

At the close, NBP ICE February 2022 prices dropped by 9.080 p/th day-on-day (-4.22%), to 205.880 p/th. TTF ICE February 2022 prices were down by €3.57 (-4.05%), closing at €84.607/MWh. On the far curve, TTF ICE Cal 2023 prices were down by 52 euro cents (-1.10%), closing at €47.218/MWh.

TTF ICE February 2022 prices closed above the 5-day Low yesterday, but they are falling below this support level this morning. The drop in Asia JKM prices is depriving European prices of the rebound we expected. It seems the “normalization” process (ie prices trading inside the 5-day range, with the latter lying inside the 20-day range) could now take place with a downtrend.

This condition suggests a rebound above the 5-day Low is still possible today.

Source: EnergyScan