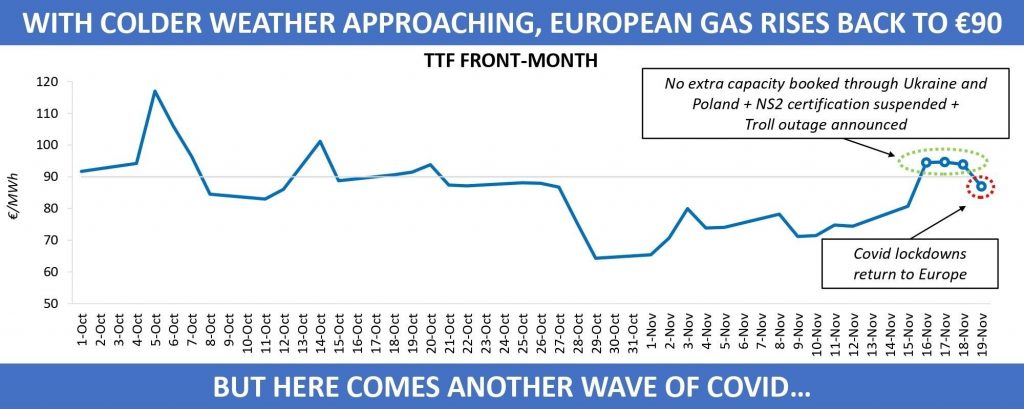

It has been an eventful week for the European gas, which added dynamism to the market that had been in a (relatively) steady state since early November. This week, players hardly had time to digest the supply-side news when the developments on the demand side rose to the forefront of the agenda.

Due to low storage levels, gas imports into the region have been a constant concern of everyone this winter, and with colder temperatures approaching supply patterns only have a stronger impact on the pricing environment. Just look at how gas hub prices reacted to the information on no monthly capacity bookings for December both at the Mallnow point and on the border between Russia and Ukraine as well as on the temporary suspension of the Nord Stream 2 pipeline certification process, announced by BNetzA on 16 November. Within one day the TTF December contract rose by about 18pc, which is the second-highest DoD growth, behind only that of early October when the front-month product spiked to an all-time high.

Limited supply from Russia, together with more LNG sent to Asia, naturally result in that the changes in the gas flows from alternative sources come into the focus of market participants. An unplanned outage at the Troll field in Norway served as a bullish factor on 16 November, even though Gassco said during the session that the maintenance would be shorter and affect less production than previously planned.

Winter contracts held firm above the €90/MWh mark for three consecutive days until 19 November, when COVID-19, forgotten by many amid widespread vaccination, was back on the radar. Contracts for delivery between December 2021 and February 2022 weakened to around €87/MWh on Friday on a record surge in the number of coronavirus infections. On 19 November, Austria became the first country in Western Europe to announce a full lockdown starting on Monday, only a few days after bringing restrictions for the unvaccinated. Germany also does not rule a national lockdown, with other European countries reintroducing partial lockdowns.

As a new wave of COVID-19 is sweeping across Europe, another source of price volatility has been added to the region’s gas market. The list of uncertainties over supply/demand balance is getting longer, while it is not even cold on the continent yet.

Source: Yakov Grabar (LinkedIn)