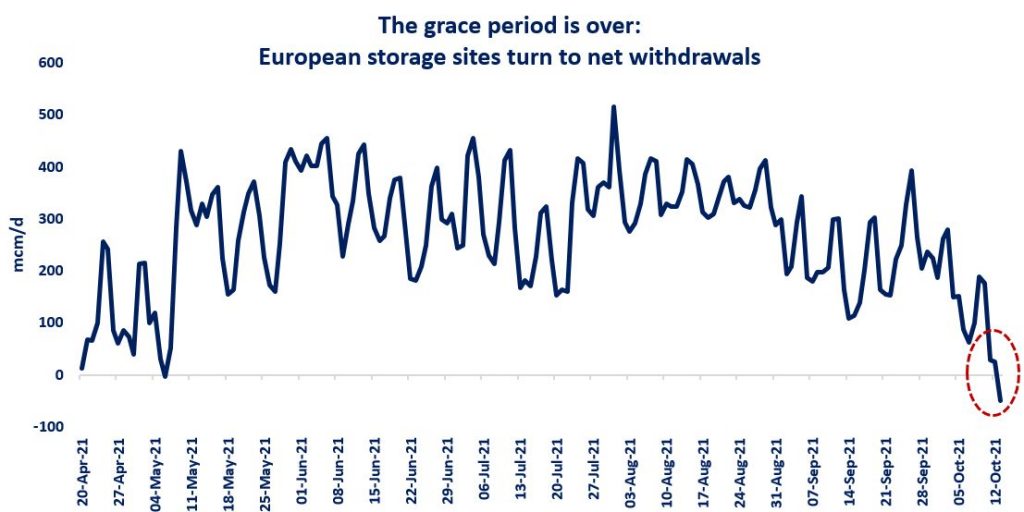

Here we go, the grace period is over: European storage sites turn to net withdrawals, 8 days before the 5-year average.

While the official start of the European heating season is the 1st October, there is typically a few weeks of grace period: if the weather is mild and supply is available some additional gas can be pushed into storage, further stocking up ahead the real winter.

This year, net withdrawals started earlier, about 8 days before their 5-year average (in 2017-19 net injections lasted almost until the end of October).

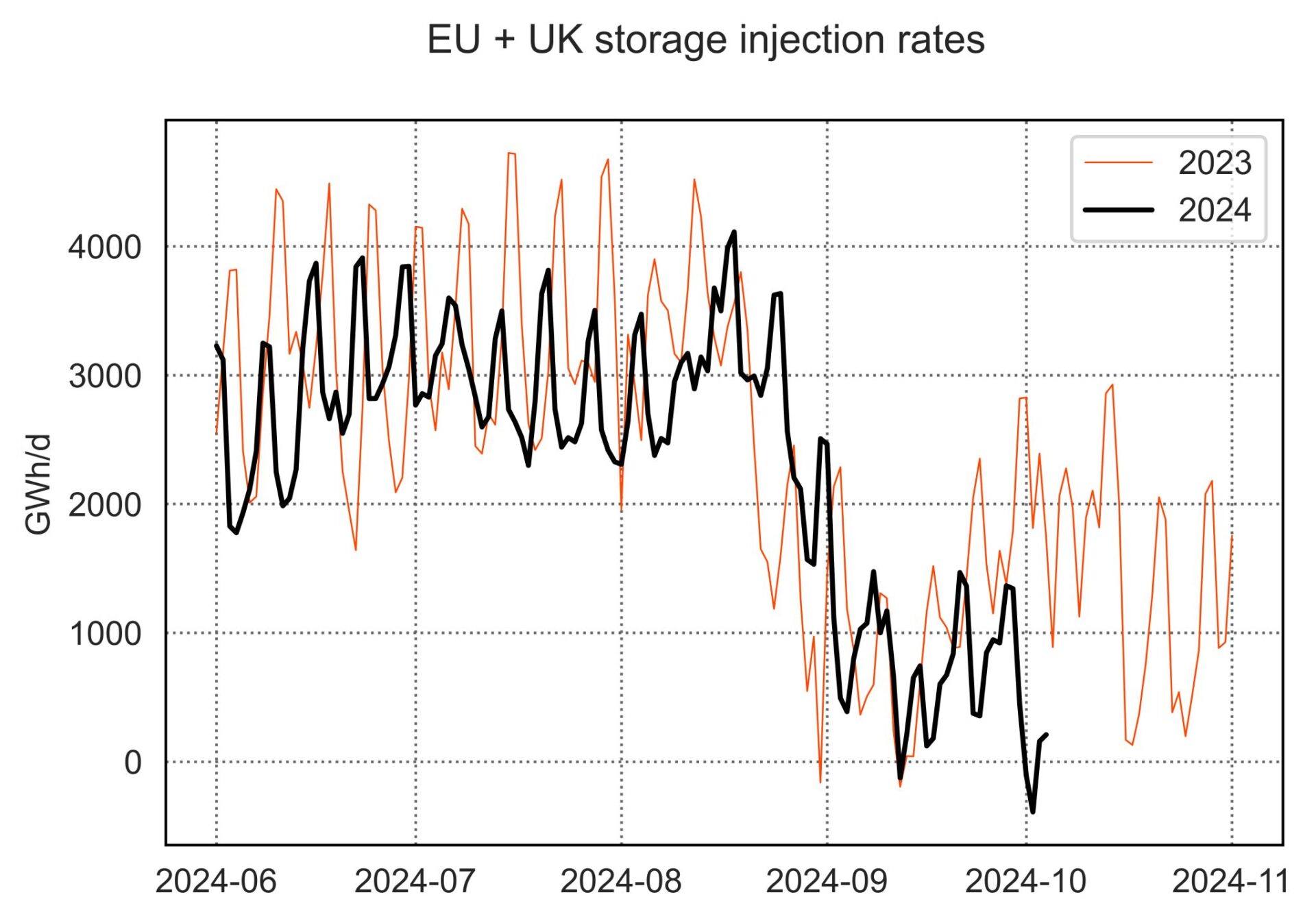

Colder weather conditions, together with tight supply prompted an early call in storage at a time when stocks were already 15% below their 5-year average due to the slow injections during the summer. large markets, such as Germany, France or the Netherlands all turned to net withdrawals by now.

Meanwhile, further in the East, Ukraine started storage withdrawals already a week ago, while the country’s storage sites are 45% full. this could increase Ukraine’s imports during the winter, from an already tight European gas market.

Of course, we could still return sporadically to net injections, however, an early start of the withdrawal season is a clear indication that winter is coming. and according to NOAA we have now 87% of La Niña…

What is your view? How will the European winter play out? Storage in the spotlight…

Source: Greg Molnar