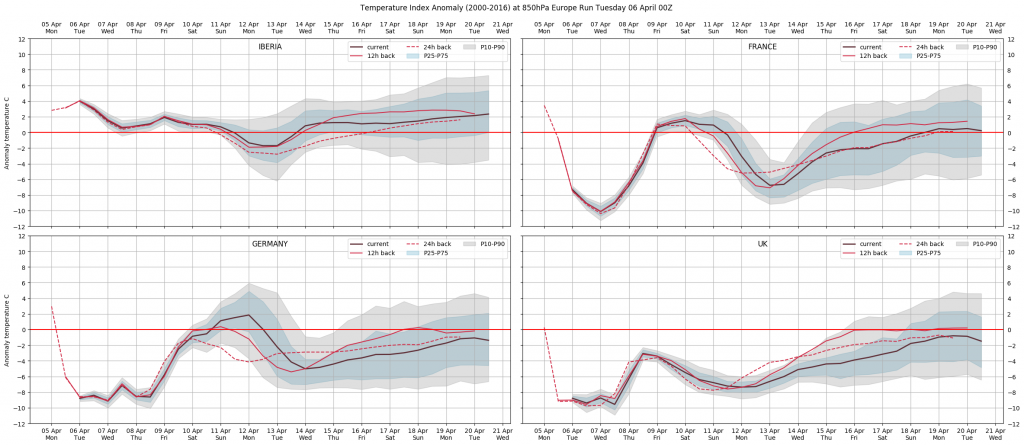

Week 14 – A strong Atlantic high pressure and a trough located over Scandinavia are bringing unseasonal cold air from the Arctic, bringing much colder than normal conditions over most of the continent. During the weekend an Atlantic front affecting the West (UK, Spain, France, Alps, Benelux, Germany) will bring unsettled conditions but a sharp rise in temperatures as the flow turns westerly.

Week 15 – The week starts with a new drop in temperatures almost everywhere, as a high pressure starts to build in the north Atlantic, favouring a northerly flow once again. The anomalies will be more remarkable over the most westerly areas, like the UK or France, a bit more moderate over Germany and other Central Europe areas.

Rest of April – We expect the Atlantic high pressure to weaken, allowing for a more westerly flow to become dominant, although short lived Atlantic ridging is still possible at times. Overall, we would expect a progressive normalization of temperatures in general, and an increase in wind generation and precipitation in most areas.

May initial outlook – It seems that the month may start with good Atlantic activity, favouring a continuation of unsettled conditions in the West and South West, therefore good levels of both precipitation and generation should be expected in the UK, France, Iberia and Germany. This could be the general note of the whole month.

Source: WeatherTrend

Follow on Twitter:

[tfws username=”WeathertrendLtd” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]