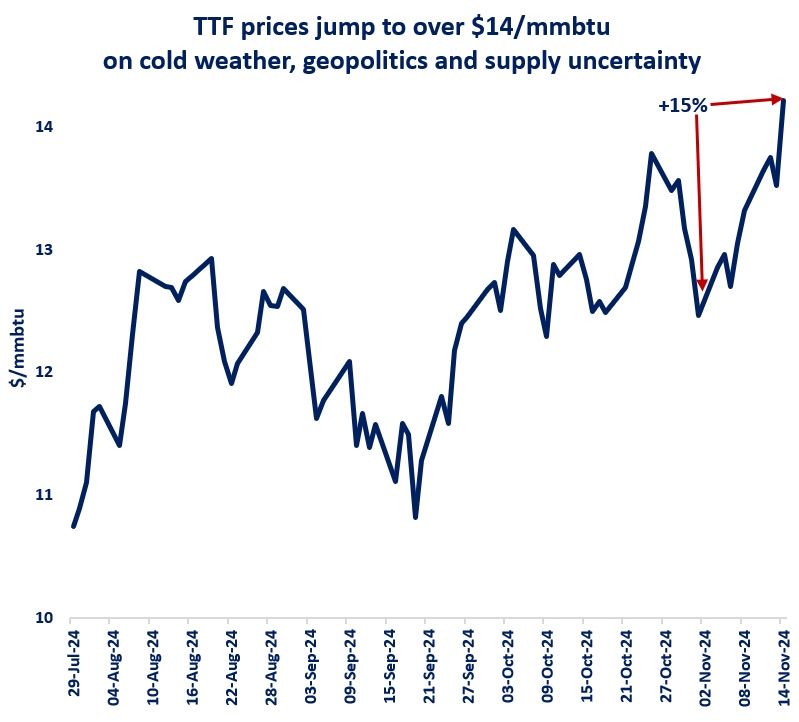

TTF prices jumped by 6% today to just above $14/mmbtu -their highest level year-to-date.

Several factors contributed to the TTF bull run since the start of November, with prices up now by more than 15%:

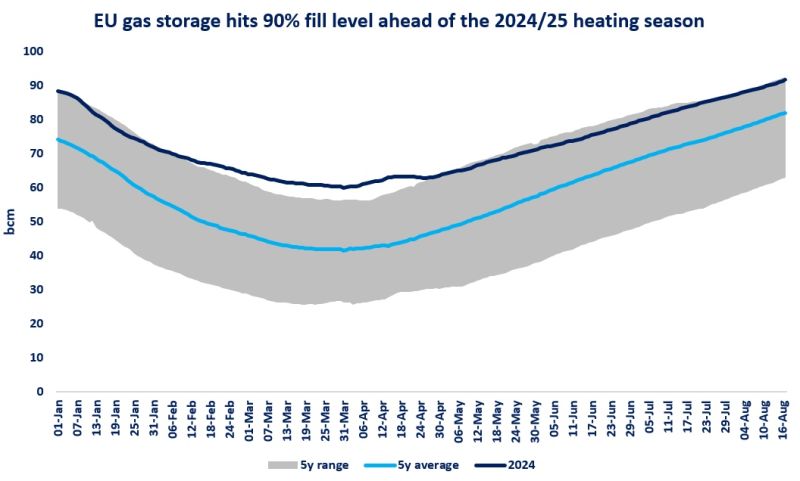

(1) weather: colder temperatures together with low wind speeds boosted European gas demand to well-above seasonal averages. around 3 bcm of gas was withdrawn from storage, with fill levels dropping from 95% to 92% in just two weeks;

(2) supply uncertainty: OMV won its arbitration case against Gazprom and is ready to enforce the arbitral award, but of course this could lead to a “potential halt of supplies”. the potential volume loss is around 5.5 bcm/y;

(3) LNG project delays: Tortue FLNG (3.6 bcm/y) has been again delayed from Q4 2024 to Q2 2025, further tightening the winter gas supply outlook and feeding the bulls;

(4) stronger dollar: the dollar gained over 3% against the euro since the election of President Trump, which supports euro-nominated TTF prices;

In contrast, JKM prices remained relatively stable in the last few days, amid relatively high storage levels and the return of MLNG Dua (13 bcm/y) in Malaysia.

What is your view? Are we set up for a new TTF bull run? Or it is just short lived volatility? How will the TTF-JKM spread evolve this winter?

Source: Greg MOLNAR