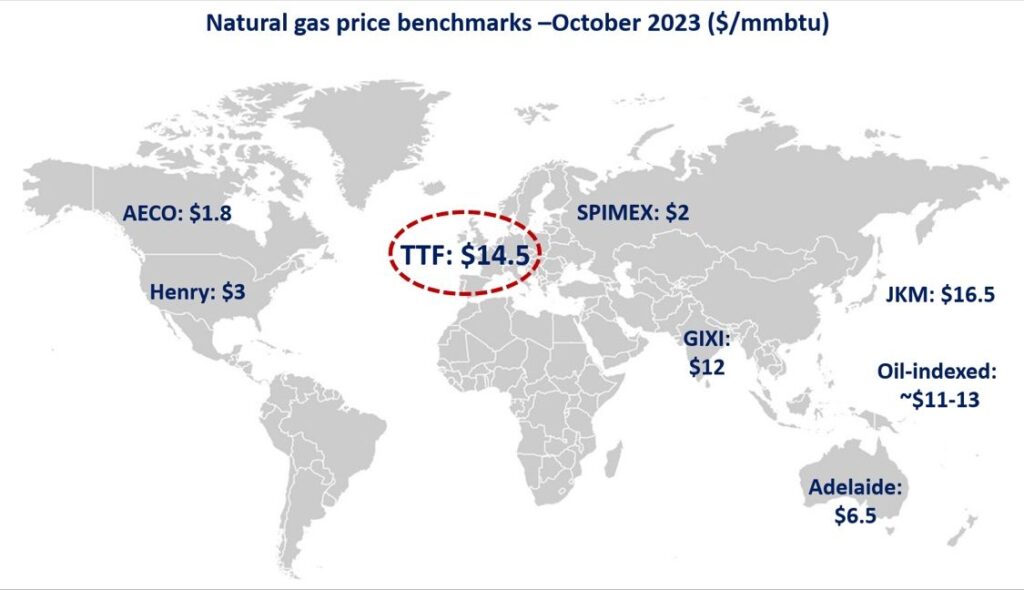

Gas prices continued to climb in October as we are slowly but surely heading into the winter season, while the tragic events in the Middle East fuel fears across oil and gas markets.

In Europe, TTF month-ahead prices rose by 25% month-on-month and averaged at $14.5/mmbtu. demand remained broadly flat compared to last year, as higher consumption in industry and space heating was offset by the continued decline in gas-fired powgen. lower Norwegian flows (-6% yoy) together with lower LNG inflows (-9% yoy) provided upward pressure on prices, despite storage sites hitting an all-time high 99% fill level.

In Asia, JKM prices rose by 17% compared to last month to average at $16.5/mmbtu. continued demand recovery in China together with Australian strike risks provided upward pressure on prices. China’s LNG imports rose by 14%, reinforcing its position as the world’s largest LNG importer.

In the US, Henry Hub prices rose by 13% month-on-month to an average of $3/mmbtu. strong gas-fired powgen (+7% yoy) and rapidly rising LNG exported supported higher gas price levels. in Canada, AECO fell by 10% to $1.8/mmbtu. strong production and high storage levels weighed on gas prices.

What is your view? how will gas prices evolve through the winter months? are we set for more volatility?

Source: Greg MOLNAR