𝐄𝐮𝐫𝐨𝐩𝐞:

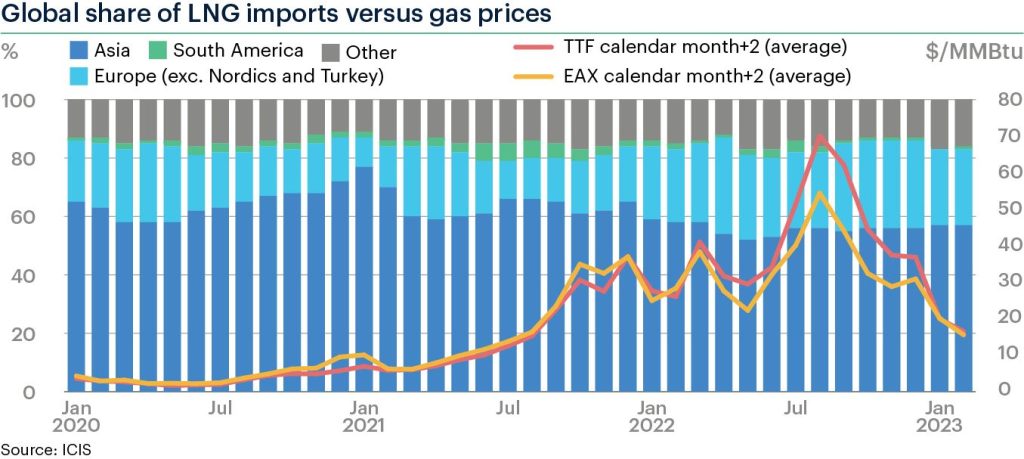

Imports totalled 𝟴.𝟴𝗺 metric tonnes in February, an 8.3% decrease month on month but a 10% jump year on year. The 2020-2022 average for the month is 6.4m tonnes.

France is the regional leader with 1.9m tonnes, followed by the UK (1.6m) and Spain (1.5m)

Europe accounted for a 𝟮𝟲% share of global LNG imports, unchanged month on month. Market share was 30% across the last quarter of 2022.

𝐀𝐬𝐢𝐚:

Imports for the top 5 buyers – China, Japan, South Korea, India and Taiwan – fell back to 𝟭𝟴.𝟰𝗺 tonnes in February, a monthly decline of 17%.

Global share of LNG imports amounts to 𝟱𝟳%, a 1 percentage point drop according to revised ICIS data.

𝗝𝗮𝗽𝗮𝗻 continues to be the leading Asian importer with the country taking in 6.5m tonnes.

𝗦𝗼𝘂𝘁𝗵 𝗞𝗼𝗿𝗲𝗮 𝘀𝘁𝗼𝗹𝗲 𝘀𝗲𝗰𝗼𝗻𝗱 𝗽𝗹𝗮𝗰𝗲 𝗳𝗿𝗼𝗺 𝗖𝗵𝗶𝗻𝗮 𝘄𝗶𝘁𝗵 𝟱.𝟭𝗺. Chinese imports were 5m.

China imported 11.2m tonnes of LNG across January and February, down 5% year on year. Volumes are also 18% below the 2021 equivalent, which was an all-time high for the period.

𝗦𝗼𝘂𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮:

South American imports – represented by Argentina, Brazil, Chile and Colombia – were 0.5m tonnes.

Global share was 𝟬.𝟳%.

𝗖𝗵𝗶𝗹𝗲 and 𝗖𝗼𝗹𝗼𝗺𝗯𝗶𝗮 were the only importers with February marking the first time in 3 months the latter has taken in cargoes.

𝐏𝐫𝐢𝐜𝐞𝐬:

Average ICIS TTF rolling month+2 values held a $𝟬.𝟵𝟮/𝗠𝗠𝗕𝘁𝘂 𝗽𝗿𝗲𝗺𝗶𝘂𝗺 to the ICIS EAX equivalent in February. The month before Europe held a $𝟬.𝟭𝟲/𝗠𝗠𝗕𝘁𝘂 𝗱𝗶𝘀𝗰𝗼𝘂𝗻𝘁.

Reclaiming a premium to Asia came as TTF prices averaged $15.71/MMBtu in February, 𝗮 𝟭𝟵-𝗺𝗼𝗻𝘁𝗵 𝗹𝗼𝘄.

Can we carry this downtrend into the summer?