Getting intimate: Price correlation between TTF and Asian spot LNG hit a record high of 0.98 in the second half of 2020 to date.

And this is actually not too far from the typical 0.99 correlation rate we would have between TTF and NBP.

This clearly shows, that regional gas markets are becoming increasingly interconnected with Asian market dynamics influencing European prices and vice à versa.

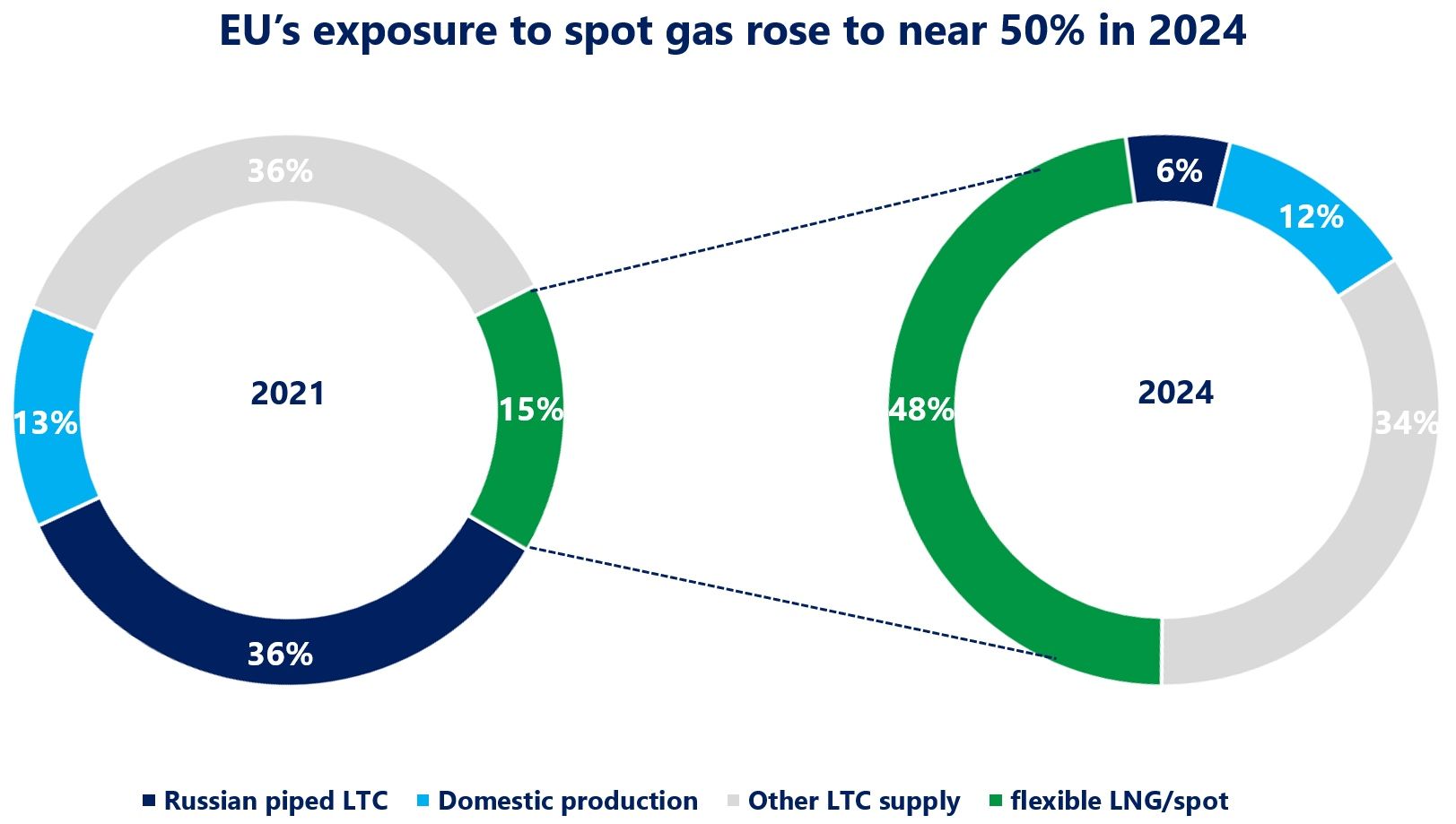

This is largely driven by the growing volumes of flexible LNG and marketing strategies valuing optionality vs the traditional point-to-point model.

During the same period, correlation between Henry Hub and Asian spot averaged at 0.9, up from statistically insignificant levels just two years ago… Of course since then US LNG exports more then tripled and the role of Henry expanded well beyond North America.

At the same time, the correlation with Brent broke and was actually negative through H2 2020, as oil and gas markets are facing different market dynamics these days… which might raise some questions regarding oil-indexation.

What is your view? Are we getting closer to a global gas market? While short-term supply/demand shocks can drive down correlation, the growing volumes of flexible LNG are here to stay.

Source: Greg Molnar

See original post by Greg on LinkedIn.